5 Greenblatt Magic Formula Biotech Stocks to Weather the Summer Coronavirus Storm

In light of Novavax Inc. (NASDAQ:NVAX) getting $1.6 billion in federal aid for its coronavirus vaccine candidate, investors might find opportunities in biotechnology stocks that have high financial strength, earnings yield and return on capital. The top five stocks according to the Joel Greenblatt Magic Formula Screen, a Premium value screen, are Alexion Pharmaceuticals Inc. (NASDAQ:ALXN), Novo Nordisk A/S (NYSE:NVO), Galapagos NV (NASDAQ:GLPG), Regeneron Pharmaceuticals Inc. (NASDAQ:REGN) and Vertex Pharmaceuticals Inc. (NASDAQ:VRTX).

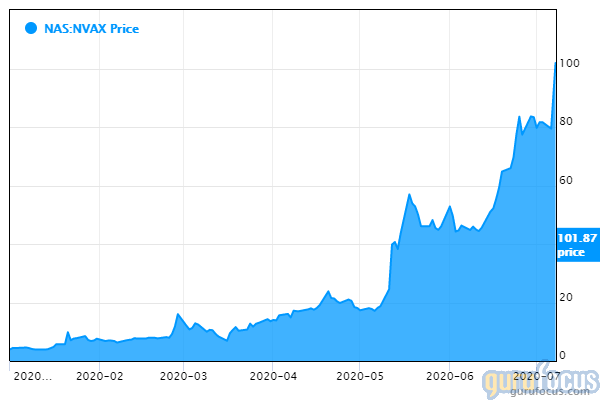

Novavax continues big surge on coronavirus vaccine federal aid

Shares of the Gaithersburg, Maryland-based company closed at $104.56, close to a 52-week high of $111.77 and up 31.62% from the previous close of $79.44, on its announcement that the company has been selected to participate in Operation Warp Speed, a U.S. program that aims to develop a coronavirus vaccine in 2021. The stock has climbed over 1,800% year to date, from a 52-week low of around $3.98.

Novavax President and CEO Stanley Erck said in an statement that the company plans to conduct Phase 3 clinical trials of NVX-Cov2373, its vaccine candidate, and deliver up to 100 million doses by the end of this year. U.S. Health and Human Services Secretary Alex Azar added that adding Novavax's vaccine candidate to Operation Warp Speed's portfolio increases the chance of having "a safe, effective vaccine" by the end of 2020.

As such, investors might seek opportunities among biotech companies that have high financial strength, strong earning yields and returns on capital. Greenblatt, manager of Gotham Asset Management, developed a magic formula where the top-ranked stocks have high Ebit-to-enterprise-value ratios and high Ebit-to-fixed-asset ratios.

Alexion

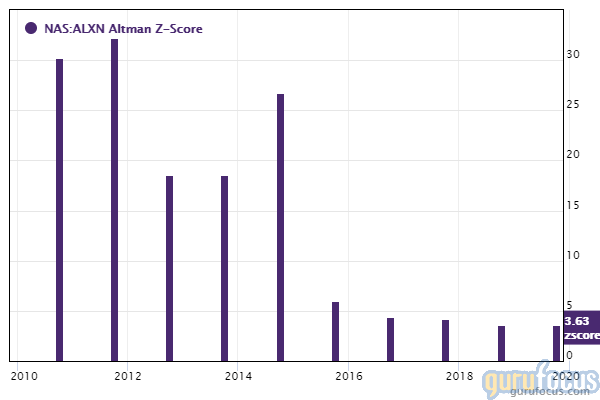

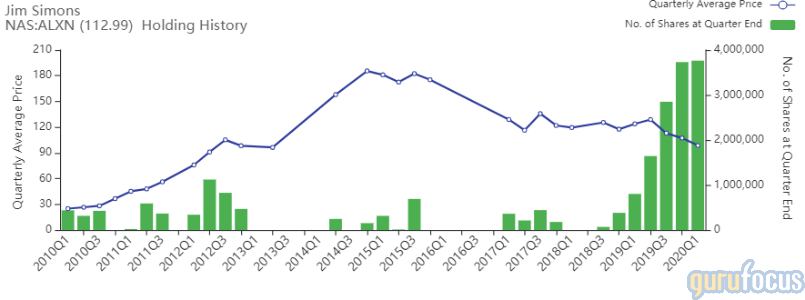

Boston-based Alexion develops and markets drugs for medical conditions like paroxysmal nocturnal hemoglobinuria, atypical hemolytic uremic syndrome and generalized myasthenia gravis. GuruFocus ranks the company's financial strength 7 out of 10, driven by a high Altman Z-score of 3.73 and Piotroski F-score of 8, suggesting strong business operations.

Alexion's Greenblatt earnings yield and return on capital are outperforming over 95% of global competitors. Such metrics, coupled with expanding operating margins and a three-star business predictability rank, contribute to a GuruFocus profitability rank of 9.

Gurus with holdings in Alexion include Jim Simons (Trades, Portfolio)' Renaissance Technologies, Pioneer Investments (Trades, Portfolio) and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management.

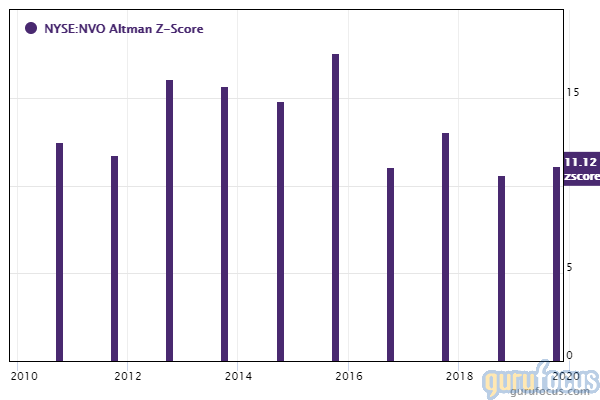

Novo Nordisk

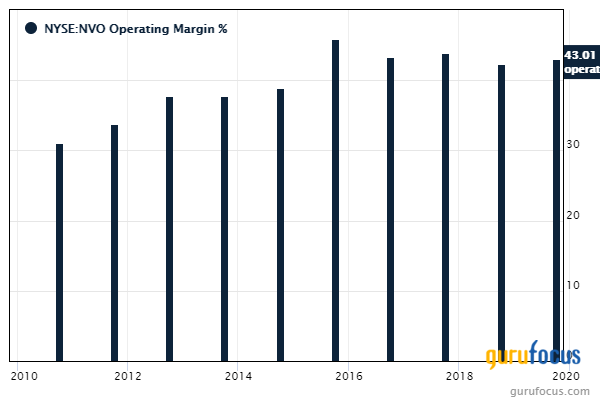

Danish biotech company Novo Nordisk manufactures and markets a wide range of insulins and other diabetes treatments. GuruFocus ranks the company's financial strength 8 out of 10, driven by strong interest coverage, a double-digit Altman Z-score and a debt-to-Ebitda ratio that outperforms over 90% of global competitors.

Novo Nordisk's profitability ranks 9 out of 10 on positive investing signs like expanding operating margins, a five-star business predictability rank, a Greenblatt earnings yield that outperforms 93.20% of global competitors and a Greenblatt return on capital that outperforms 95.54% of global peers.

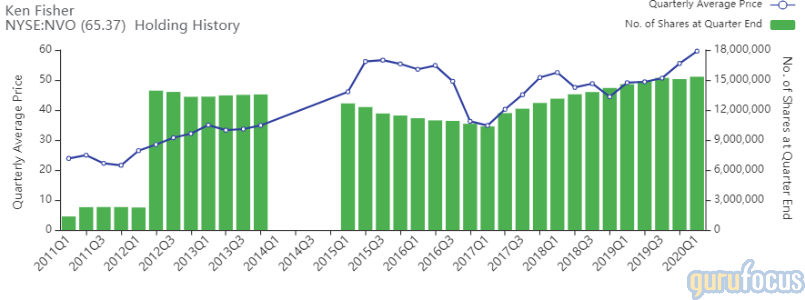

Gurus with holdings in Novo Nordisk include Ken Fisher (Trades, Portfolio) and Tom Gayner (Trades, Portfolio).

Galapagos NV

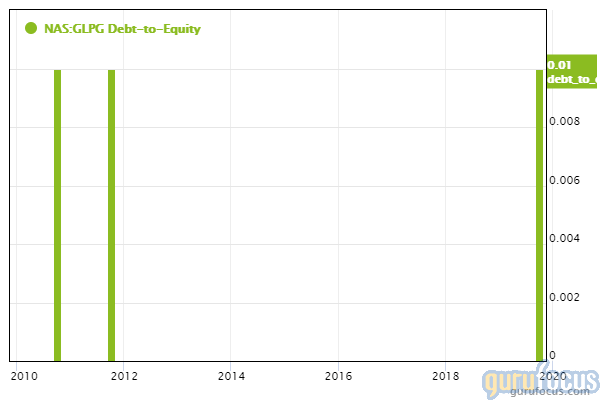

Galapagos discovers and develops small-molecule medicines for the treatment of rheumatoid arthritis, Crohn's disease, ulcerative colitis and cystic fibrosis. GuruFocus ranks the Belgian clinical-stage biotech company's financial strength 8 out of 10 on the back of cash-to-debt and debt-to-equity ratios outperforming over 81% of global competitors.

Galapagos' Greenblatt earnings yield and return on capital are outperforming 90.04% and 98.07% of global competitors.

Regeneron

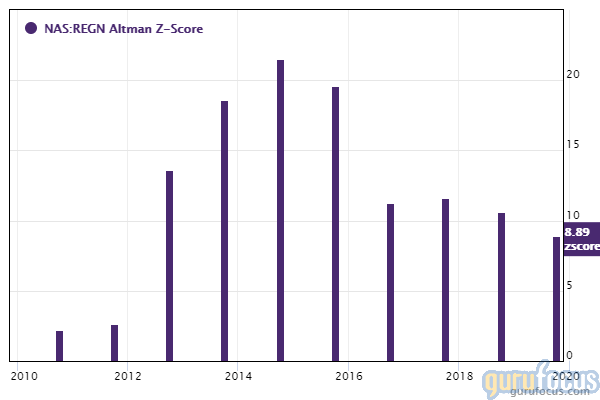

Regeneron develops and commercializes products for the treatment of eye diseases, cardiovascular disease, cancer and inflammation. GuruFocus ranks the Tarrytown, New York-based company's financial strength and profitability 8 out of 10 on several positive investing signs, which include robust interest coverage, a double-digit Altman Z-score and expanding operating margins.

Regeneron's Greenblatt earnings yield and return on capital are outperforming 92.39% and 93.61% of global competitors.

Regeneron announced on Tuesday that, as part of Operation Warp Speed, the Biomedical Advanced Research and Development Authority and the U.S. Department of Defense awarded the company a $450 million contract to manufacture Regeneron's investigational double antibody cocktail for the treatment of Covid-19. The company's shares closed at $640.88, up 2.17% from the previous close of $627.25.

Vertex

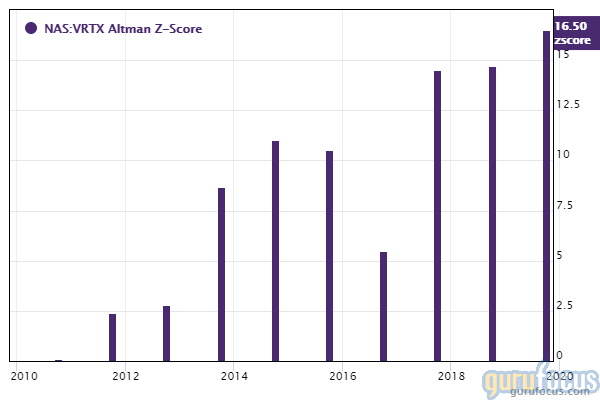

Boston-based Vertex discovers and develops small-molecule drugs for the treatment of cancer, pain, inflammatory diseases, influenza and other rare diseases. GuruFocus ranks the company's financial strength 8 out of 10 on the back of double-digit Altman Z-scores and debt ratios outperforming over 70% of global competitors.

Disclosure: No positions.

Read more here:

4 High-Quality Companies With Low Shiller Price-Earnings Ratios

5 Profitable Global Stocks to Consider for 2nd Half of Year

5 Metals and Mining Stocks With High Financial Strength

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance