5 Dividend Paying Growth Stocks to Buy for a Stable Portfolio

Wall Street ended last week on a positive note despite severe volatility. The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — were up 1.2%, 1.4% and 1.7%, respectively. U.S. stock markets moved northward, defying the banking sector turmoil across the globe and the threat of a recession.

Meanwhile, in its March FOMC meeting, the Fed raised the benchmark interest rate by 25 basis points to the range of 4.75% to 5%. This is the highest level of the Fed fund rate since late 2007. However, Fed Chairman Jerome Powell signaled that the rate hike cycle is approaching its end.

Fed’s latest projection shows that the terminal interest rate at the end of 2023 will be 5.125%. This implies that just one more 25 basis-point hike in the benchmark lending rate will complete this cycle. Although no rate cut is anticipated in 2023, Powell signaled that the Fed fund rate will be reduced by 0.8% in 2024 and another 1.2% cut is expected in 2025.

At this stage, it will be prudent to invest in growth stocks that pay regular dividend to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five growth stocks that have solid upside left for 2023. These stocks have also witnessed positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Growth Score A. You can see the complete list of today’s Zacks #1 Rank stocks here.

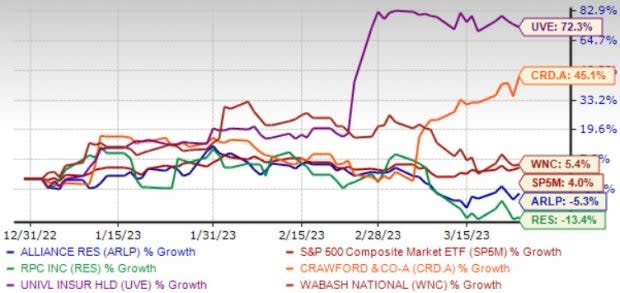

The chart below shows the p;rice performance of our five picks year to date.

Image Source: Zacks Investment Research

Alliance Resource Partners L.P. ARLP is a diversified natural resource company that produces and markets coal primarily to utilities and industrial users in the United States. ARLP operates through four segments: Illinois Basin Coal Operations, Appalachia Coal Operations, Oil & Gas Royalties, and Coal Royalties.

Alliance Resource produces a range of thermal and metallurgical coal with sulfur and heat contents. ARLP operates seven underground mining complexes in Illinois, Indiana, Kentucky, Maryland, Pennsylvania, and West Virginia. In addition, Alliance Resource leases land and operates a coal loading terminal on the Ohio River at Mt. Vernon, IN, and buys and resells coal.

ARLP has expected revenue and earnings growth rates of 20.2% and 38.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.4% over the last 30 days. Alliance Resource has a current dividend yield of 14.5%.

RPC Inc. RES provides a range of oilfield services and equipment for the oil and gas companies involved in the exploration, production, and development of oil and gas properties. RES operates through the Technical Services and Support Services segments. RES operates in the United States, Africa, Canada, Argentina, China, Mexico, Latin America, the Middle East, and internationally.

RPC has expected revenue and earnings growth rates of 26.9% and 67.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the last 60 days. RPC has a current dividend yield of 2.1%.

Crawford & Co. (CRD.A) is the world's largest independent provider of diversified services to insurance companies, self-insured corporations, and governmental entities. CRD.A provides claims management and outsourcing solutions for carriers, brokers, and corporations in the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America. Crawford operates through four segments: North America Loss Adjusting, International Operations, Broadspire, and Platform Solutions.

CRD.A has expected revenue and earnings growth rates of 4.2% and 24.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 13% over the last 30 days. Crawford has a current dividend yield of 3%.

Universal Insurance Holdings Inc. UVE operates as an integrated insurance holding company in the United States. UVE is engaged in insurance underwriting, distribution and claims settlement. Universal Insurance generates revenues from the collection and investment of premiums.

UVE’s agency operations which include Universal Florida Insurance Agency and U.S. Insurance Solutions Inc. generate income from policy fees, commissions, premium financing referral fees and the marketing of ancillary services.

Universal Insurance has expected revenue and earnings growth rates of 9% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 22.5% over the last 30 days. UVE has a current dividend yield of 3.5%.

Wabash National Corp. WNC is one of the leading manufacturers of semi-trailers in North America. WNC designs, manufactures, and distributes connected solutions for the transportation, logistics, and distribution industries primarily in the United States. WNC operates through two segments, Transportation Solutions and Parts & Services.

Wabash National specializes in the design and production of dry freight vans, refrigerated vans, flatbed trailers, drop deck trailers, and intermodal equipment. Its innovative core products are sold under the DuraPlate, ArcticLite, and Eagle brand names.

WNC has expected revenue and earnings growth rates of 13.1% and 28.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.9% over the last 30 days. WNC has a current dividend yield of 1.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alliance Resource Partners, L.P. (ARLP) : Free Stock Analysis Report

Wabash National Corporation (WNC) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

UNIVERSAL INSURANCE HOLDINGS INC (UVE) : Free Stock Analysis Report

Crawford & Company (CRD.A) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance