4 Ways Retailers Are ‘Robbing’ You, According to Rachel Cruze

Budget-conscious consumers know all the tricks to get around paying high costs, but sometimes even the most disciplined shoppers get stuck with hefty price tags due to dynamic pricing.

Trending Now: 9 Easiest Ways To Maximize Your Savings in 2024

For You: I Work at Home Depot — Here Are 4 Insider Secrets You Should Know

“Dynamic pricing enables digital platforms to rapidly adapt to changing market conditions,” per Harvard Business School. What does that mean for you? Prices that rise and fall on the fly, according to how much businesses determine you’re willing to pay at any given moment.

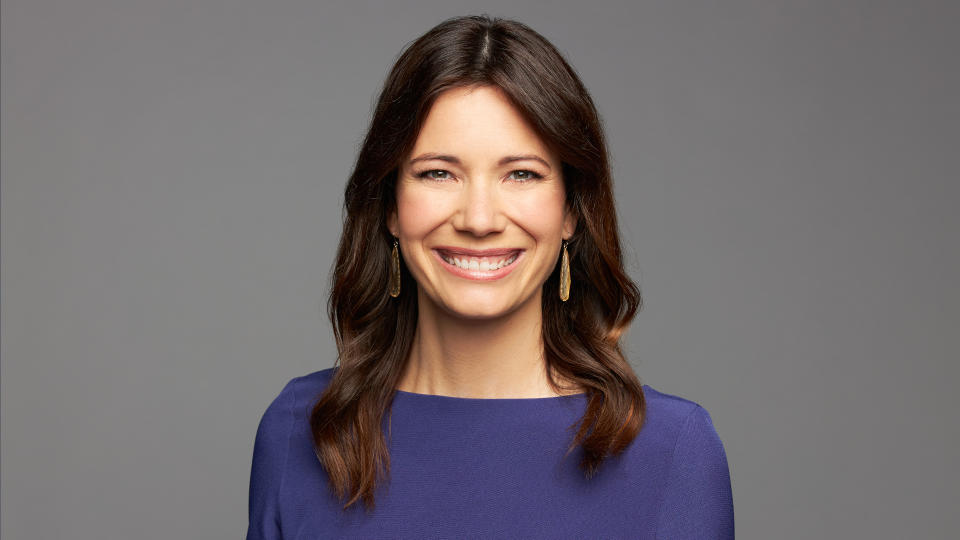

In a recent video on her namesake YouTube channel, personal finance expert Rachel Cruze shared four ways consumers are being robbed. GOBankingRates has listed them below, along with a couple of shopping hacks to keep you from getting ripped off.

Earning passive income doesn't need to be difficult. You can start this week.

Wedding Vendors

The average wedding is about $33,000, according to Zola. That figure is likely much higher than the price for a non-wedding event of similar size and scope.

“Just putting the word wedding in front of something, people can kind of start taking advantage,” Cruze said. “Venue, flowers, catering, music, photographers, hair, makeup, drinks, you name it, if you’ve got wedding in front of it, it’s going to be more.”

One way around it is to purchase products and services without specifying that they’re for a wedding.

Check Out: Warren Buffett — 10 Things Poor People Waste Money On

Entertainment Tickets

According to StubHub, prices for Taylor Swift’s October 18th show in Miami ranged from $1364 to $6,277 at the moment GOBankingRates checked prices. But it’s not just the “Fortnight” singer with outrageous prices. Almost every concert ticket price has skyrocketed.

“It’s Ticketmaster who we should have beef with,” Cruz said. “Monopolies never play fair because they know they can jack up prices, and it is what it is … And then third parties are selling for [even] higher.”

Ride Share Services

Another example of dynamic pricing Cruze noted is ride-sharing apps like Uber or Lyft. During peak times, rates are increased, and riders pay the price. However, Cruz said she understands the added pressure on the driver during certain events and times of the day and gives the price surge a pass in some situations, like airport and concert pickups.

“I get it, it’s annoying, you know, if you’re the person using the app, You’re like, ‘dang it, why was it so expensive to get home?’ But I do think the more inconvenient a situation is for someone, the more they can charge for it, and I think I’m okay with that,” she stated.

Internet Tracking

Ever notice how you mention a product, and then an ad for that item shows up on your social media feeds? According to Cruze, “people are saying,” websites know your data and will increase the price of an item you’re interested in.

“I’ve seen people on the internet claim that they … will check a flight price on the same website three times in one week and it’s different every single time. Sometimes, if you’re looking for the same flight, it actually ends up going up and up and up and it doesn’t give you a lower price ‘cuz they know that you’re looking at it.”

She added, “I don’t know if this is just coincidence, or if this is a bargaining tactic, or if this is the internet’s doing what the internet does with all the algorithms, but it is happening.”

You might be able to limit tracking by using a private browser window — Incognito, for Chrome users. Just be sure you’re not logged in to a site when you shop, and close out all private tabs after each shopping session.

More From GOBankingRates

6 Subtly Genius Moves All Wealthy People Make With Their Money

I'm a Debt Expert: Here's How Social Media Warps Our Perceptions of Debt

This article originally appeared on GOBankingRates.com: 4 Ways Retailers Are ‘Robbing’ You, According to Rachel Cruze