4 Undervalued Tech Stocks to Bet on Amid Market Uncertainties

The year so far has been highly volatile for the U.S. stock market. The ongoing Russia-Ukraine war has increased worries for investors who were already concerned about global economic recovery due to increasing crude oil prices, rising inflation and a hawkish policy adopted by the Fed, leading to high volatility in the equity market.

Year to date, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 have plunged 16.9%, 31.8% and 22.8%, respectively. The global economy has been going through a massive slowdown due to the macroeconomic and geopolitical environment.

In the current highly volatile market scenario, one should look for stocks that are undervalued but have bright growth prospects. On the other hand, if the market shoots up, these stocks have increased chances of registering higher gains. This implies that undervalued stocks cushion investors from market jitters, while companies’ robust fundamentals ensure solid portfolio returns.

However, it is difficult to pick such multi-faceted stocks from a plethora of investment opportunities.

Here the Zacks Style Score comes in handy. The Value Style Score will help us filter stocks that are undervalued, while our Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

With the help of Zacks Stock Screener, we have zeroed in on four tech stocks — Jabil JBL, Amdocs DOX LG Display LPL and Perion Network PERI — which look promising based on their encouraging Zacks Rank, and favorable Value and Growth style scores.

These stocks have a favorable combination of a Growth and Value Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy). Stocks with such a favorable combination offer solid investment opportunities.

Our Picks

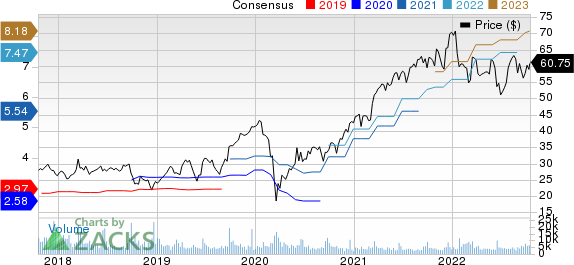

Jabil – The company currently sports a Zacks Rank #1 and has a Growth as well as Value Score of A. The Zacks Consensus Estimate for fiscal 2023 earnings has been revised upward by 30 cents to $8.18 per share over the past 30 days, indicating a year-over-year increase of 6.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Jabil is benefiting from strong demand in key end markets, courtesy of its operational execution and skillful management of supply chain dynamics. It is likely to witness healthy top-line growth owing to secular tailwinds in healthcare, automotive, industrial, 5G and cloud businesses.

Jabil’s focus on end-market and product diversification is a key catalyst. Its Photonics business unit and EFFECT Photonics have joined forces to develop next-generation coherent optical modules, which will likely drive top-line expansion.

Jabil, Inc. Price and Consensus

Jabil, Inc. price-consensus-chart | Jabil, Inc. Quote

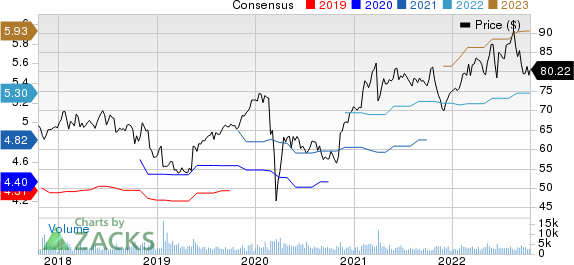

Amdocs – It has a Growth and Value Score of B. The Zacks Consensus Estimate for this Zacks Rank #2 company’s fiscal 2023 earnings has been revised a penny northward to $5.93 per share over the past 30 days, indicating a year-over-year increase of 11.9%.

Amdocs is benefiting from its recurring revenue business model. Customer additions and solid demand for managed services are primary growth drivers. The company’s growth momentum is expected to continue due to its initiatives to aid digital, media, network and cloud transformations of its clients. The acquisition of Openet has rapidly expanded its footprint in 5G cellular networks. Its solutions have been selected by the likes of AT&T and T-Mobile to bolster their 5G footprint.

Amdocs Limited Price and Consensus

Amdocs Limited price-consensus-chart | Amdocs Limited Quote

LG Display – It has a Value Score of A and a Growth Score of B. The company carries a Zacks Rank #2. The Zacks Consensus Estimate for 2022 is pegged at a loss of $1.05 per share, having narrowed from $1.12 60 days ago.

LG Display is riding on the healthy demand for its display panels from PC vendors. The PC vendors are witnessing heightened demand for commercial notebooks and desktops as economies around the world are reopening and enterprises are investing in building a hybrid work environment. The solid sales of smartphones are also likely to spur demand for the company’s display panels.

LG Display Co., Ltd. Price and Consensus

LG Display Co., Ltd. price-consensus-chart | LG Display Co., Ltd. Quote

Perion Network – The company carries a Zacks Rank #2 and has a Growth as well as Value Score of A. The Zacks Consensus Estimate for 2022 earnings has been revised upward by 13 cents to $2.00 per share over the past 30 days, indicating a year-over-year increase of 96.1%.

This Israel-based global technology company delivers online advertising solutions and search monetization to brands and publishers in North America, Europe and internationally. Perion is riding on strong advertising revenue growth. Perion is expected to benefit from the robust performance of its Search business, driven by strong advertiser demand.

Perion Network Ltd Price and Consensus

Perion Network Ltd price-consensus-chart | Perion Network Ltd Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amdocs Limited (DOX) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

LG Display Co., Ltd. (LPL) : Free Stock Analysis Report

Perion Network Ltd (PERI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance