4 Steps For Investors To Prepare For The Next Bear Market

Bear market is the number one concern on investors’ mind. This is especially true in the current investing climate where investors are constantly questioning whether the next drop would materialise into the next bear market.

So, are we in a bear market? According to UBS, we are not, yet. With the last ten years of bull market, the risk of a bear market in the horizon is building up. So, what should investors do to prepare for the next bear market?

Investors Takeaway: 4 Steps For Investors To Prepare For The Next Bear Market By UBS

Step 1: Recognizing A Bear Market

The most important step in preparing for the next bear market is to first recognize and acknowledge that a bear market has arrived. By traditional definition, a bear market is when the market falls by 20 percent (or more) from its peak. Besides the peak-to-trough drop period, investors should also look out for how long it took for the market to hit its peak.

Using the US market as a gauge, UBS summarized the statistics for equity bear markets since World War II to help investors evaluate how a bear market looks like.

Source: UBS

Step 2: Build Up Your War Chest

Heard of the cliché saying that ‘Cash Is King’? Well, it is true in a bear market. The reasoning is simple. With more cash, you have a bigger war chest to hunt for opportunities in the bear market. It also gives you more room to maneuver around. Additionally, it gives you the financial foothold to hold on to your risks to avoid selling in a fire sale.

Step 3: Adopting The 3L Framework Prior To Bear Market

While it is easy to pinpoint bear markets with perfect hindsight, it is much more difficult to pinpoint an imminent bear market with such accuracy. Thus, before the bear market strikes, it is important for investors to seek strategies that provide the most potent protection against equity downside risk.

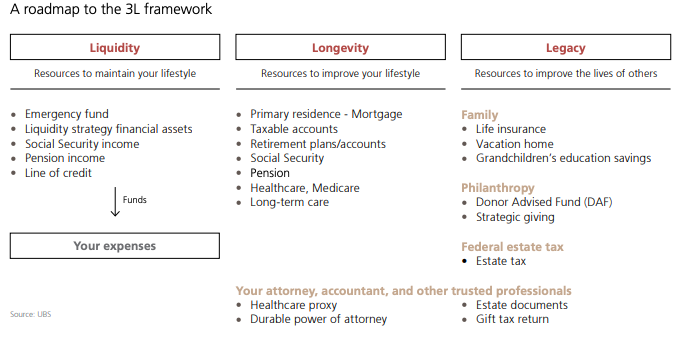

UBS recommends prioritizing cost-effective protection before moving on to less-reliable or costlier hedging strategies. One of UBS’ top strategies is to leverage on the 3L framework (Liquidity, Longevity, Legacy). Liquidity means that your portfolio needs to be designed to provide needed cash flow over the next 2-5 years, securing your ability to hold risk assets during a downturn. The Longevity aspect is constructed to include all assets and resources needed for the rest of your life for basic living. The Legacy aspect comprises of assets in excess of what you require to meet your own lifetime objectives to raise your standard of living. A portfolio that is able to fulfill this 3L framework will help you meet both short and long term goals, even during a bear market.

Source: UBS

Step 4: Don’t Panic And Harvest For Opportunities When Bear Market Strikes

IF the bear market strikes today, what should you do? Perhaps, the most counterintuitive thing to do is to stop panicking. Bear markets, while painful, are temporary. Sticking to your plan is key. Thus, resist the urge to change the risk profile of your portfolio or make sizable shifts out of stocks into cash.

Rather than viewing a bear market as apocalypse, investors should be using the sell off as an opportunity to harvest for tactical opportunities. There are always market gaps that can provide opportunities to enhance returns. UBS recommends leaning towards risk assets where their market price is out of sync with their fundamentals. Unwinding hedges to take on more risks will generate higher return opportunity after a downturn.

Yahoo Finance

Yahoo Finance