4 Metal Fabrication Stocks to Watch in a Promising Industry

The Zacks Metal Products - Procurement and Fabrication industry is poised well to gain on the growth in end-use sectors, such as manufacturing, aerospace and automotive. Recent indications of easing supply-chain disruptions instill optimism.

Companies like The Timken Company TKR, ESAB Corporation ESAB, Century Aluminum CENX and CIRCOR International CIR have witnessed order growth and delivered improved results despite the inflationary scenario and supply-chain woes. Solid demand in end markets, efforts to gain market share and investment in automation should aid growth. Their focus on cost management and improving efficiency would boost margins.

About the Industry

The Zacks Metal Products - Procurement and Fabrication industry primarily comprises metal processing and fabrication services providers that transform metal into metal parts, machinery or components used across various other industries. Their processes include forging, stamping, bending, forming and machining, which are used in shaping individual pieces of metal, and welding and assembling to join parts. The companies either use one of these processes or a combination of all. The most common raw materials utilized by metal fabrication companies include plate metal, formed or expanded metal, tube stock, welding wire or rod and casting. The industry players serve an array of markets, including construction, mining, aerospace and defense, automotive, agriculture, oil and gas, electronics/electrical components, industrial equipment and general consumer.

What's Shaping the Future of Metal Products - Procurement and Fabrication Industry

Easing Supply Chain Snarls to Bring Relief: Per the Fed’s latest industrial production report, the aggregate production of fabricated metal products in the United States dipped 1.3% in December 2022. Nevertheless, over the 12-month period ended September 2022, production of fabricated metal products was up 1.7%. Overall, industrial production gained 1.6% over the same time period. In December, the Institute for Supply Management’s (ISM) manufacturing index touched 48.9%, contracting for the second month in a row. Nevertheless. the average for the 12 months ended December 2022) came in at 53.5. Amid the ongoing uncertainty in the global economy and persisting inflationary trends, customers have been curbing spending. The industry has also been bearing the brunt of supply-chain issues. On a positive note, some of the industry players recently noted that supply-chain issues are easing. The delivery performance of suppliers to manufacturing organizations was reported to be faster for the third straight month in December. Once the situation normalizes, strong demand in the metal Products - Procurement and Fabrication industry’s diverse end markets will drive its growth.

Pricing Actions to Combat High Costs: The industry has been experiencing significant levels of inflation, including higher prices for labor, freight and fuel. The companies are currently witnessing labor shortages for some positions and incurring steep labor costs to meet demand. The industry players are focusing on pricing actions, cost-cutting measures, efforts to improve productivity and efficiency, and diversification of the supplier base to mitigate some of these headwinds.

Automation & End-Market Growth to Act as Catalysts: The industry’s customer-focused approach to providing cost-effective technical solutions and automation to increase efficiency and lowering labor costs, as well as development of the latest and innovative products should drive growth in the days ahead. Growth in end-use sectors, such as manufacturing, aerospace and automotive is anticipated to benefit the metal fabrication market over the next few years. Developing countries hold promise owing to rapid industrialization. This, in turn, is likely to create demand.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates upbeat prospects in the near term. The Zacks Metal Products - Procurement and Fabrication industry, which is a 10-stock group within the broader Industrial Products sector, currently carries a Zacks Industry Rank #42, which places it in the top 17% of the 249 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock-market performance and the valuation picture.

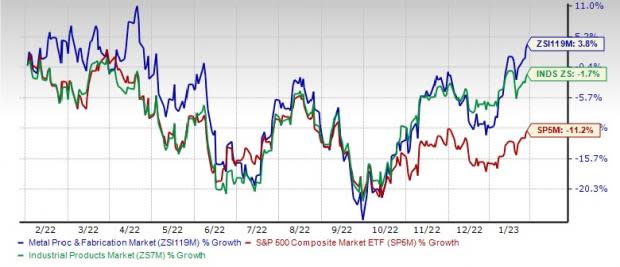

Industry Versus Broader Market

The Zacks Metal Products - Procurement and Fabrication industry has outperformed its sector and the Zacks S&P 500 composite over the past year.

Over this period, the industry has gained 3.8% compared with the sector’s decline of 1.7% and the Zacks S&P 500 composite’s decrease of 11.2%.

One-Year Price Performance

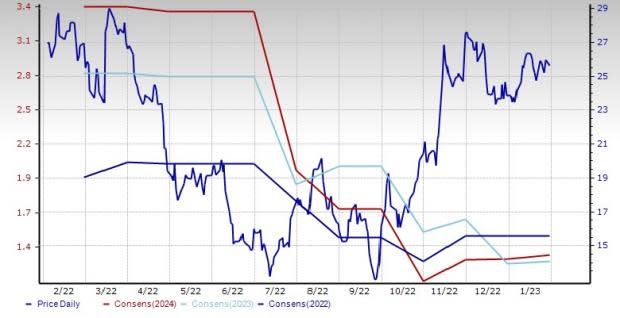

Industry's Current Valuation

Based on the trailing 12-month EV/EBITDA ratio, a commonly used multiple for valuing the Metal Products - Procurement and Fabrication companies, the industry is currently trading at 7.10 compared with the S&P 500’s 12.32 and the Industrial Products sector’s trailing 12-month EV/EBITDA of 19.34. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) TTM Ratio

Enterprise Value/EBITDA (EV/EBITDA) TTM Ratio

Over the last five years, the industry traded as high as 19.17 and as low as 5.24, with the median at 8.41.

4 Metal Products - Procurement and Fabrication Stocks to Keep Tabs on

Century Aluminum: The company is seeing an improvement in demand across various intermediate and end markets and is poised to gain from the rise in global aluminum demand. Its volumes have also returned to pre-pandemic levels. Strong manufacturing activities, especially in the United States, are expected to drive demand. CENX is taking actions to increase production to capitalize on the surge in demand. It is executing an expansion project at Mt. Holly and is also taking actions to return to targeted production levels at Hawesville through an optimization project. Both projects are expected to provide additional units to the tight U.S. market and additional exposure to pricing. Backed by these tailwinds, the company’s shares have gained 46.3% over the past three months. The company’s effective management of controllable costs are expected to boost its bottom line in the forthcoming quarters.

The Zacks Consensus Estimate for Chicago, IL-based Century Aluminum’s current-year earnings has remained stable over the past 30 days. The consensus mark indicates year-over-year growth of 375%. The company produces standard-grade and value-added primary aluminum products in the United States and Iceland. CENX has a trailing four-quarter earnings surprise of 123%, on average and currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: CENX

CIRCOR International: In the third quarter of 2022, the company’s total order levels were up 26% organically, with Aerospace and Defense up a solid 74% and Industrial orders gaining 8%. This has been instrumental in the stock’s 20.3% price gain over the past three months. A strong backlog of $497 million, which marked a 14% increase driven by strong demand in both Aerospace & Defense and Industrial segments would support its top-line performance in the forthcoming quarters. New products for missiles fusing devices and space application, growth in medical products and the sustained momentum in commercial aerospace aided by the ongoing recovery in the market, bode well for the Aerospace & Defense segment. In the Industrial segment, higher pricing has helped the company counter the inflationary pressures and deliver solid margin expansion. Power generation, midstream O&G, new business activities for lithium batteries manufacturing, aftermarket are expected to drive growth for the segment.

The Zacks Consensus Estimate for CIRCOR International earnings for this year has moved up 2% over the past 30 days. The company has a trailing four-quarter earnings surprise of 40.3%, on average. Burlington, MA-based CIRCOR is one of the world’s leading providers of mission critical flow control products and services for the Industrial and Aerospace & Defense markets. The stock carries a Zacks Rank #2.

Price and Consensus: CIR

ESAB Corporation: In October 2022, the company completed the acquisition of Ohio Medical, a global leader in oxygen regulators and central gas systems. The buyout is expected to be accretive to ESAB’s adjusted earnings in the first full year of ownership. Ohio Medical provides it with strong brands and distribution in the large and attractive North American market and significant cross-selling opportunities globally with its existing GCE business. The company continues its track record of innovation and new product introductions with the upcoming global launch of the game-changing Renegade VOLT battery-powered welder in partnership with DEWALT. This offering strengthens ESAB’s equipment portfolio and fills a key customer need of improved transportability and is expected to improve ESAB’s margins. The company is progressing toward its goal of creating a faster growing, higher-margin, and less-cyclical business. Backed by these developments, the company’s shares have surged 50% over the past three months.

North Bethesda, MD-based ESAB Corporation engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, and automated welding, as well as gas control equipment. The Zacks Consensus Estimate for ESAB’s current-year earnings has moved north by 2% over the past 30 days. The Zacks Ranked #2 stock has a trailing four-quarter earnings surprise of 10.6%.

Price and Consensus: ESAB

Timken: The company continues to witness new business wins in new markets and regions. Its diversity in terms of end market, customer and geography, product innovation and engineering expertise provides it with a competitive edge. Underlying customer demand and end-market momentum remain strong across most of its sectors. Apart from strong demand, earnings growth will be supported by benefits from price realization, growth initiatives and operational excellence initiatives. The stock has appreciated 11.9% over the past three months. Timken continues to pursue strategic acquisitions to broaden its portfolio and capabilities across diverse markets, focusing on bearings, adjacent power transmission products, and related services. Its acquisition of GGB Bearing in November 2022 provides strong synergies and expands Timken’s business by adding products with a solid growth outlook. TKR’s efforts to grow its wind and solar businesses are a key catalyst considering the growing demand for renewable energy.

Timken is based in North Canton, OH and designs, manufactures, and manages engineered bearings and power transmission products worldwide. The Zacks Consensus Estimate for TKR’s current-year earnings has moved up 1% over the past 30 days. The figure indicates year-over-year growth of 13%. TKR has a trailing four-quarter earnings surprise of 15.7%, on average. The stock has an estimated long-term earnings growth rate of 12% and a Zacks Rank #3 (Hold).

Price and Consensus: TKR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Timken Company (The) (TKR) : Free Stock Analysis Report

CIRCOR International, Inc. (CIR) : Free Stock Analysis Report

Century Aluminum Company (CENX) : Free Stock Analysis Report

ESAB Corporation (ESAB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance