4 Blue-Chip Stocks to Buy From Tech Sector Amid Market Swings

The U.S. equity market has been highly volatile so far this year, owing to uncertainties associated with the coronavirus pandemic, geopolitical tensions and supply-chain challenges. These factors have been taking a toll on various sectors, including technology, retail, automotive and industrial, in the form of rising inflationary pressure, resulting in a huge decline in the major U.S. indexes.

This is evident from year-to-date declines of 16.9%, 20.5% and 28.3% in the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite, respectively.

The consumer price index rose to 8.3% in August 2022 on a year-over-year basis, which was well above the Federal Reserve’s target of 2%. The figure was more than analysts’ expectation of 8.1%.

To counter inflation woes, the Federal Reserve has implemented four interest rate hikes so far this year. It may announce another steep hike in the days ahead to achieve its target. This has turned the market jittery.

Soaring interest rates will continue to increase the cost of borrowing, which, in turn, will affect consumer spending.

Given the downturn, we advise investors, who are looking for good investment opportunities, to park their money in high fliers, with strong growth potential, such as blue-chip stocks.

We recommend four blue-chip stocks from the Zacks Computer and Technology sector, namely Cadence Design Systems CDNS, STMicroelectronics STM, Fortinet FTNT and Synopsys SNPS.

Why Invest in These Stocks?

Amid market volatility, it is a prudent idea to pick the above-mentioned stocks, as these are highly reputed, fundamentally strong, and financially resilient, and they belong to the widely-diversified tech sector, which holds the potential to defy recessionary woes. The underlined stocks are likely to outshine once the current macro headwinds subside and market sentiments improve.

Strong 5G prospects, the growing proliferation of cloud services, cybersecurity solutions, IoT, AI, and Machine Learning, and the increasing trend of hybrid work are likely to be the major tailwinds for the technology sector.

Apart from having solid fundamentals, the aforementioned stocks have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy), with a market capitalization greater than $30 billion.

Per Zacks’ proprietary methodology, stocks with such a favorable combination offer solid investment opportunities.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Cadence Design Systems offers products and tools that help customers design electronic equipment. The company’s performance is gaining from healthy demand for its diversified product offerings.

Frequent product launches and synergies from acquisitions are expected to help Cadence Design Systems sustain top-line growth. CDNS recently acquired OpenEye Scientific Software, which is expected to improve revenues by $40 million in fiscal 2023 and expand the company’s reach in pharmaceutical and biotechnology markets. CDNS’s Palladium and Protium platforms are gaining traction among the hyperscale, AI/ML and server customers.

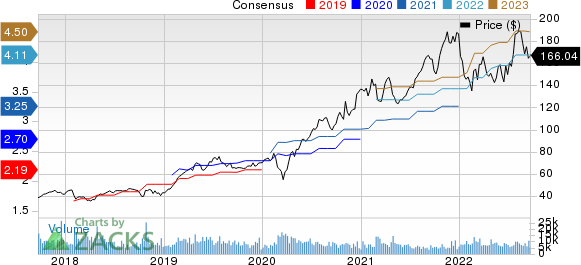

CDNS currently sports a Zacks Rank #1 and has a Growth Score of B. It has a market capitalization of $45.73 billion. The Zacks Consensus Estimate for Cadence Design Systems’ 2022 earnings has improved 5.7% to $4.11 per share over the past 60 days. The long-term earnings growth rate for the stock is pegged at 17.7%. The stock has a trailing four-quarter earnings surprise of 9.7%, on average.

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

STMicroelectronics is a global semiconductor company benefitting from solid demand for its robust microcontrollers, sensors, power, analog and other connectivity products. The growing uptake of motion and environmental sensors, time-of-flight ranging sensors, wireless charging products, touch display controllers, and secure solutions in smartphones is anticipated to aid its performance in the personal electronics market in the near term. The strong momentum in design wins of smartwatches and other wearables is another positive.

Growing electrification and digitalization of the automotive industry are expected to remain tailwinds. Strong design wins, with ST power modules in electronic vehicle applications, are likely to drive its growth in the automotive market in the near term. The strengthening of customer engagements in cellular and satellite communication infrastructure is driving STM’s performance in the communications equipment, computer and peripherals market.

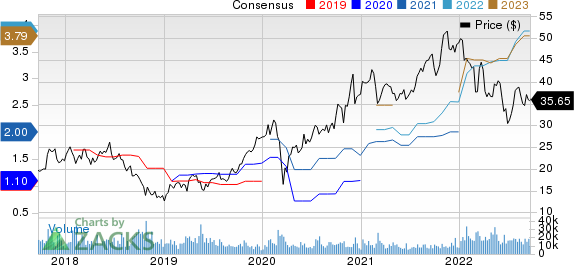

STM currently flaunts a Zacks Rank #1 and has a Growth Score of B. The company has a market capitalization of $32.31 billion. The Zacks Consensus Estimate for STMicroelectronics’ 2022 earnings has improved 16.5% to $3.88 per share over the past 60 days. The long-term earnings growth rate for the stock is pegged at 5%. The stock has a trailing four-quarter earnings surprise of 9.6%, on average.

STMicroelectronics N.V. Price and Consensus

STMicroelectronics N.V. price-consensus-chart | STMicroelectronics N.V. Quote

Fortinet is a provider of network security appliances and Unified Threat Management (“UTM”) network security solutions to enterprises, service providers and government entities worldwide. The company is benefiting from the rising demand for security and networking products amid the growing hybrid working trend. It is also gaining from robust growth in Fortinet Security Fabric, cloud and Software-defined Wide Area Network offerings.

Increasing IT spending on cybersecurity is expected to aid Fortinet in growing faster than the security market. Its focus on enhancing the UTM portfolio through product development and acquisitions remains another tailwind. Strong deal wins remain the company’s key growth drivers.

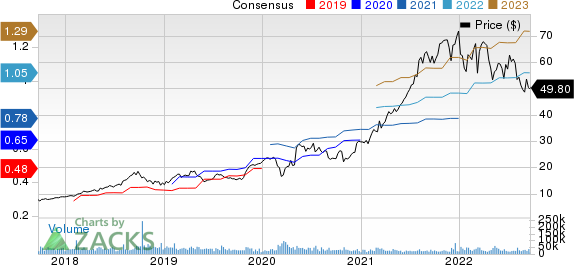

FTNT currently has a Zacks Rank #2 and a Growth Score of A. It has a market capitalization of $39.27 billion. The Zacks Consensus Estimate for Fortinet’s 2022 earnings has improved 2.9% to $1.05 per share over the past 60 days. The long-term earnings growth rate for the stock is pegged at 18%. The stock has a trailing four-quarter earnings surprise of 10.3%, on average.

Fortinet, Inc. Price and Consensus

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

Synopsys is a vendor of electronic design automation software for the semiconductor and electronics industries. The company is benefiting from strong design wins, owing to a robust product portfolio. Growth in the work and learn-from-home trends is driving bandwidth demand. Strong traction for Synopsys’ Fusion Compiler product is contributing well. The growing demand for advanced technology, design, IP and security solutions is creating solid prospects.

The growing adoption of the company’s Verification Continuum platform is another positive. The rising demand for ZeBu Server 4 products among customers for designing storage, networking and AI chips is a tailwind.

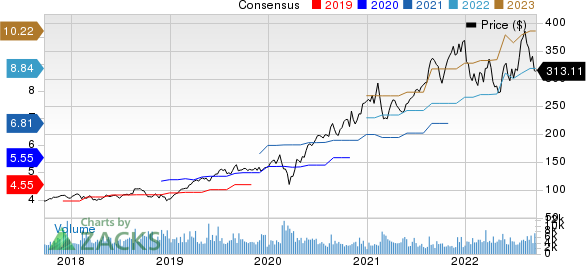

SNPS currently has a Zacks Rank #2 and a Growth Score of B. It has a market capitalization of $48.36 billion. The Zacks Consensus Estimate for Synopsis’ fiscal 2022 earnings has improved 4.4% to $8.84 per share over the past 60 days. The long-term earnings growth rate for the stock is pegged at 16.2%. The stock has a trailing four-quarter earnings surprise of 2.9%, on average.

Synopsys, Inc. Price and Consensus

Synopsys, Inc. price-consensus-chart | Synopsys, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance