3D Systems (DDD) Launches Startup, Boosts Drug Discovery

3D Systems DDD recently announced the formation of a wholly-owned bioprinting startup — Systemic Bio — to accelerate the development of new drugs that will aid in reducing or eliminating the need for animal testing.

Initially, the 3D printing company is investing $15 million in seeds to offer its support to Systemic Bio. The new formation is likely to expand 3D Systems’ growth opportunities in the domain of pharmaceuticals and create a new revenue stream that could reach $100 million annually over the next five years.

Leveraging 3D Systems’ advanced bioprinting technologies, Systemic Bio intends to accurately produce vascularized organ models with the application of biomaterials and human cells. The new firm has created a unique organ-on-a-chip platform, h-VIOS (human vascularized integrated organ systems), by using hydrogels to produce complex vasculature. This organs-on-chip technology, when perfused with any desired drug compound, aids in studying drug metabolism and its effects on healthy or diseased tissue at the earliest stages of new pharmaceutical drug development.

Further, Systemic Bio will integrate its bioprinting solutions with 3D Systems’ Print to Perfusion process to bioprint highly complex, custom-designed, vascularized tissues for h-VIOS. This combination will enable DDD in 3D printing high-resolution scaffolds that perfectly imitate human tissues. This innovative approach might significantly reduce the high costs and time required for new drug discovery.

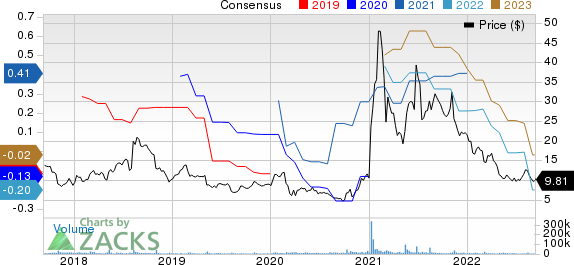

3D Systems Corporation Price and Consensus

3D Systems Corporation price-consensus-chart | 3D Systems Corporation Quote

Systemic Bio will be headed by Taci Pereira.

Shares of DDD have plunged 69.4% in the past year.

Zacks Rank & Stocks to Consider

3D Systems currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader Computer and Technology sector are Clearfield CLFD, Silicon Laboratories SLAB and Taiwan Semiconductor TSM. While Clearfield and Silicon Laboratories flaunt a Zacks Rank #1 (Strong Buy), Taiwan Semiconductor carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Clearfield's fourth-quarter fiscal 2022 earnings has been revised 10 cents north to 80 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved 36 cents north to $3.13 per share in the past 60 days.

Clearfield’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 33.9%. Shares of CLFD have increased 123.7% in the past year.

The Zacks Consensus Estimate for Silicon Laboratories’ third-quarter 2022 earnings has increased 36% to $1.13 per share over the past 60 days. For 2022, earnings estimates have moved 25% up to $1.05 per share in the past 60 days.

Silicon Laboratories’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 63.6%. Shares of SLAB have decreased 12.7% in the past year.

The Zacks Consensus Estimate for Taiwan Semiconductor's third-quarter 2022 earnings has been revised a penny southward to $1.69 per share over the past 30 days. For 2022, earnings estimates have moved 41 cents north to $6.30 per share in the past 60 days.

TSM's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 3.9%. Shares of the company have decreased 34.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

3D Systems Corporation (DDD) : Free Stock Analysis Report

Silicon Laboratories, Inc. (SLAB) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance