3 Wireless Stocks Set to Ride on 5G Rollout, Cloud Transition

The Zacks Wireless Equipment industry appears well poised to gain from healthy demand trends with the gradual revival in post-pandemic market conditions and a faster 5G rollout. However, large-scale investments to support the 5G transition, margin erosion due to price wars and inflated raw material costs amid a challenging macroeconomic environment and supply chain adversities might erode profitability.

Nevertheless, Motorola Solutions, Inc. MSI, Juniper Networks, Inc. JNPR and Comtech Telecommunications Corp. CMTL are likely to benefit from the increasing demand for state-of-the-art wireless products with a vast proliferation of IoT, fiber densification and a gradual shift to cloud services.

Industry Description

The Zacks Wireless Equipment industry primarily comprises companies that provide various networking solutions, wireless telecom products and related services for wireless voice and data communications through scalable modular platforms. Their product portfolio encompasses integrated circuit devices (chips) and system software for wireless voice and data communications, analog and digital two-way radio, satellite telecommunications, wireless networking and signal processing, and end-to-end enterprise mobility solutions. The firms also provide a broad range of routing, switching and security products, video surveillance and machine-to-machine communication components that secure VPN appliances, enable intrusion detection and thwart data theft. Some firms even provide electronic warfare, avionics, robotics, advanced communications and maritime systems to the defense industry.

What's Shaping the Future of the Wireless Equipment Industry?

Continuous Infrastructure Upgrade: With the exponential growth of mobile broadband traffic and home Internet solutions, demand for advanced networking architecture has increased manifold. This has forced service providers to spend more on routers and switches to upgrade their networks and support the surge in home data traffic. To maintain superior performance standards, there is a continuous need for network tuning and optimization, which creates demand for state-of-the-art wireless products and services. Moreover, a faster pace of 5G deployment is expected to augment the scalability, security and universal mobility of the telecommunications industry and propel the wide proliferation of IoT. The fiber-optic cable network is vital for backhaul and the last mile local loop, which are required by wireless service providers for 5G deployment. Fiber networks are also essential for the growing deployment of small cells that bring the network closer to the user and supplement macro networks to provide extensive coverage. The industry participants are facilitating its customers to move away from an economy-of-scale network operating model to demand-driven operations and seamlessly migrate to 5G by offering easy programmability and flexible automation through steady infrastructure investments.

Profitability Woes Persist: Although higher infrastructure investments will eventually help minimize service delivery costs to support broadband competition and wireless densification, short-term profitability has largely been compromised. Margins are likely to be affected by the high cost of first-generation 5G products, profitability challenges in China, the Russian invasion of Ukraine and pricing pressure in early 5G deals. Uncertainty regarding chip shortage and supply-chain disruptions leading to a dearth of essential fiber materials, shipping delays and shortages of other raw materials are likely to affect the expansion and rollout of new broadband networks. Extended lead times for basic components are also likely to affect the delivery schedule and escalate production costs. High technological obsolescence of most products and a challenging macroeconomic environment have also escalated operating costs with steady investments in R&D.

Transition to Cloud Networking Solutions: The majority of the industry participants offer mission-critical communication infrastructure, devices, accessories, software and services that enable its customers to run businesses with increased efficiency and safety for their mobile workforce. These systems drive demand for additional device sales, software upgrades, infrastructure overhaul and expansion, as well as additional services to maintain, monitor and manage these complex networks and solutions. The comprehensive suite of services ensures continuity and reduces risks for constant critical communication operations. The wide proliferation of cloud networking solutions is further resulting in increased storage and computing on a virtual plane. As both consumers and enterprises use the network, there is tremendous demand for quality networking equipment.

Zacks Industry Rank Indicates Bearish Prospects

The Zacks Wireless Equipment industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #146, which places it in the bottom 42% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few wireless equipment stocks that are well-positioned to outperform the market based on a strong earnings outlook, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms Sector, Lags S&P 500

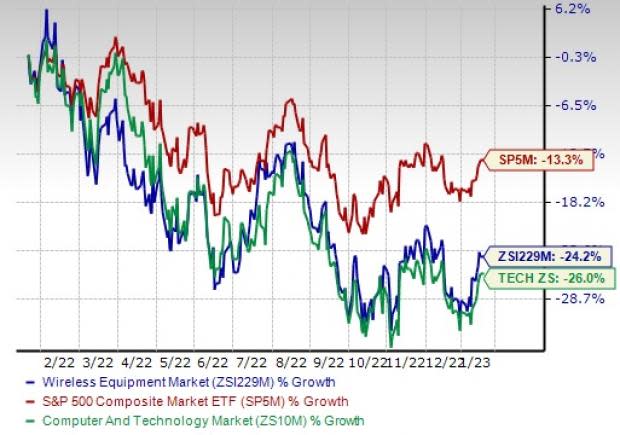

The Zacks Wireless Equipment industry has outperformed the broader Zacks Computer and Technology sector but lagged the S&P 500 composite over the past year.

The industry has lost 24.2% over this period compared with the S&P 500 and sector’s decline of 13.3% and 26%, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of trailing 12-month enterprise value-to EBITDA (EV/EBITDA), which is the most appropriate multiple for valuing telecom stocks, the industry is currently trading at 17.91X compared with the S&P 500’s 12.09X. It is also trading above the sector’s trailing-12-month EV/EBITDA of 8.96X.

Over the past five years, the industry has traded as high as 37.22X and as low as 11.6X and at the median of 18.83X, as the chart below shows.

Trailing 12-Month enterprise value-to EBITDA (EV/EBITDA) Ratio

3 Wireless Equipment Stocks to Keep a Close Eye on

Motorola: Based in Chicago, IL, Motorola is a leading communications equipment manufacturer and has strong market positions in bar code scanning, wireless infrastructure gear and government communications. This Zacks Rank #2 (Buy) stock has a long-term earnings growth expectation of 9%. Motorola intends to boost its position in the public safety domain by entering into strategic alliances with other players in the ecosystem. It expects to record strong demand across video security and services, land mobile radio products and related software while benefiting from a solid foundation driven by the strength of its business model and the value of its mission-critical integrated ecosystem. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: MSI

Comtech: Headquartered in Melville, NY, Comtech offers terrestrial and wireless network solutions, next-generation 9-1-1 emergency services, satellite and space communications technologies and clouded native solutions to commercial and government customers across the globe. This Zacks Rank #2 stock has a long-term earnings growth expectation of 8%. Comtech is likely to benefit from a healthy demand trajectory in the Satellite Earth Station business, accentuated by the new Heights product, potential new deals, the UHB acquisition and rising demand for bandwidth. Continuous infrastructure upgrade by carriers further offers an upside potential for the company.

Price and Consensus: CMTL

Juniper: Based in Sunnyvale, CA, Juniper is a leading provider of networking solutions and communication devices. The company develops, designs and sells products that help to build network infrastructure used for services and applications based on a single Internet protocol network worldwide. This Zacks Rank #3 (Hold) stock has a long-term earnings growth expectation of 7.7%. It is witnessing encouraging trends across various areas of its business, including solid momentum in Mist Systems and strength in the services organization. Juniper has made significant changes to the go-to-market structure to better align sales strategies with each of its core customer verticals. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence.

Price and Consensus: JNPR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance