3 Top-Ranked Beverage Stocks with Epic Returns

From refreshing carbonated soft drinks to healthy alternatives, the thirst-quenching market captivates investors seeking potential opportunities, and rightfully so. Soft Drink and Beverage companies have demonstrated that they can be some of the highest performing stocks in the market.

While Coca-Cola KO and Pepsi PEP have shaped the industry for decades, several newer companies have proven that there is plenty of room for beverage innovation.

Monster Beverage MNST, Celsius CELH, and Vita Coco COCO are all high-ranking stocks that have put up some incredible returns. COCO, the newest company, went public just 18 months ago and is already up 92% since its IPO.

However, the returns of Celsius, and Monster Beverage are in a league of their own. Over the last 10 years CELH stock is up a mind boggling 51,800%, or 85% annualized. Over the last 20 years MNST stock is up an unbelievable 128,500%, or 42.5% annualized.

The fresh new offerings from these companies haven’t gone unnoticed by the industry’s incumbents. In 2015, Coca Cola acquired a 16.7% equity stake in Monster Beverage and placed two directors on its board. Additionally, KO transferred its energy drink business to MNST, and MNST transferred its non-energy drink business to KO. The partnership has likely been beneficial to both companies.

The beverage industry more broadly has been experiencing strong returns over the last year as well. It currently ranks in the top 10% of the Zacks Industry Rank, and has outperformed the market Indexes.

Image Source: Zacks Investment Research

Celsius

Celsius is an innovative beverage company that has gained significant attention for its unique line of fitness drinks. Focused on providing functional and healthy beverages, Celsius has positioned itself as a leader in the growing wellness industry.

The company's flagship product, Celsius Fitness Drink, stands out for its thermogenic properties and ability to enhance metabolism and energy levels. With a commitment to science-backed formulations and quality ingredients, CELH has built a loyal customer base among fitness enthusiasts and health-conscious consumers.

The brand's success can be attributed to its targeted marketing strategies, extensive distribution network, and strategic partnerships with athletes and fitness influencers.

CELH has seen its earnings estimates revised significantly higher, giving it a Zacks Rank #1 (Strong Buy). Current quarter earnings have been revised higher by 14.8% are expected to grow 158% YoY and FY23 earnings have been upgraded by 32.7% and are expected to grow 154% YoY.

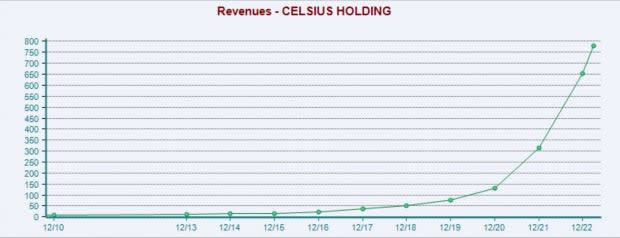

Image Source: Zacks Investment Research

Sales over the last decade at CELH have gone absolutely parabolic. In just the last four years revenue has 10x’d from $75 million to $780 million. That pace looks like it is going to keep up, as the current quarter sales are projected to grow 75% YoY and FY23 sales are expected to climb 68% YoY.

Image Source: Zacks Investment Research

Celsius has an admittedly lofty valuation. Trading at a TTM price to sales ratio of 13.8x it is well above the industry average of 4.9x, and its 10-year median of 5.7x. It is worth noting that MNST is trading at a 9.4x multiple, which is high compared to any standard. However, its 10-year median is 8.8x, so it is just about in line with its historical average.

This shows just how high the market is willing value these successful beverage companies. While CELH may not be the next MNST, it likely has a few more years of exponential revenue growth, making the sky-high valuation a bit more palatable.

Image Source: Zacks Investment Research

Vita Coco

Vita Coco is a leading beverage company that has made a significant impact in the coconut water market. Recognizing the growing demand for natural and healthier hydration options, Vita Coco has successfully established itself as a trusted brand offering premium coconut water products.

COCO sources its coconuts from carefully selected regions to ensure the highest quality and taste. Vita Coco's beverages are known for their refreshing flavor, natural electrolytes, and hydrating properties, making them a popular choice among fitness enthusiasts and health-conscious consumers.

With a strong commitment to sustainability and ethical sourcing practices, Vita Coco has not only captured a significant market share but also earned a reputation as a socially responsible brand. As the demand for healthier beverages continues to rise, COCO is well-positioned to capitalize on this trend and maintain its position as a leading player in the coconut water market.

Vita Coco currently has a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. FY23 earnings have been revised higher by nearly 5% and are expected to see growth of 191% YoY. Additionally, FY23 sales are projected to grow 11.7% YoY.

Image Source: Zacks Investment Research

COCO is trading at a TTM price to sales ratio of 3.4x, which is well below the industry average of 4.9x, and above its two-year median of 1.8x. Considering how rapidly the drink has become one of the most popular coconut water drinks in the market this may be a compelling valuation, especially when compared to MNST and CELH.

Image Source: Zacks Investment Research

Monster Beverage

Monster Beverage is a powerhouse in the global beverage industry, known for its iconic energy drink brand. With a strong presence in over 90 countries, MNST has cemented its position as a market leader. The company's flagship product, Monster Energy, has gained widespread popularity for its bold flavors, potent caffeine content, and association with extreme sports and lifestyle.

Leveraging a successful marketing strategy that targets a youthful demographic, Monster Beverage has effectively built a strong brand image and cultivated a dedicated following. Despite facing fierce competition in the energy drink space, Monster Beverage's relentless commitment to product innovation, strategic partnerships, and expanding product portfolio continues to drive its growth and reinforce its position as a dominant player in the ever-energetic beverage market.

MNST boasts a Zacks Rank #1 (Strong Buy), reflecting its upward trending earnings revisions. FY23 earnings have been revised higher by 9.2% and are expected to grow 38.4% YoY, an incredible growth rate for a mature company. Additionally, FY23 sales are expected to grow 12.5% YoY.

Image Source: Zacks Investment Research

Almost as impressive as its stock returns are the growth in earnings per share. From 2004 to 2022 EPS have grown from $0.02 to $1.22, which is a CAGR of 23%. Also interesting is that net income has been ~20% revenue almost every single year, showing incredibly stability of the company’s financial management.

Image Source: Zacks Investment Research

MNST offers an insight into what a powerful return on equity looks like. Monster Beverage has $8.8 billion in total assets, and just $1.5 billion in liabilities, leaving shareholder equity at ~$7.4 billion. With that equity it produces $1.3 billion in net income, an 18% return on equity, which MNST will likely be able to produce for decades to come. That is an enviable position for any company.

Bottom Line

Beverage companies enjoy strong fundamental factors when the business is executed properly. Drinks are easily and regularly consumed, sometimes multiple times per day. Especially when brands get into something like the health niche, consumers can identify with brand making customers consumption even stickier. Additionally, there are massive, readily available networks for drinks to be distributed, from supermarkets to convenience stores and direct to consumers among others. Lastly, beverages have great margins, allowing them the potential to be extremely profitable.

Investors have a few options when it comes to investing in drink companies; buy shares in the leaders like Coca-Cola or Pepsi, who often absorb smaller and fast-growing start-up brands. Buy shares in the newcomers like those listed above or find an even newer brand that fits into some trending niche with high risk, but high reward potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance