3 Top Housing Stocks to Consider Buying Now -- and 1 to Avoid

Everyone needs a place to call home. That may be a house, an apartment, or even a mobile home. However, with more than 125 million U.S. households, this is a big market that touches many different industries and has a huge influence on the domestic economy. Although housing stocks took a big hit after the deep 2007 to 2009 housing led recession, they've largely been recovering ever since. Here are a few names, like giant lumber producer Weyerhaeuser Co (NYSE: WY) and niche homebuilder LGI Homes Inc (NASDAQ: LGIH), that you might want to put on your buy list. And one that you should avoid all costs.

A big market

Housing is a simple product, but it often gets taken for granted. There's a huge and complex ecosystem built around the sector. For example, a home can't be built without wood. Timber real estate investment trusts (REITs) like Weyerhaeuser, Rayonier Inc., and Potlatch Corporation are a few of the key players that provide this vital housing building block.

Image source: Getty Images.

The companies buying that lumber are companies like LGI Homes, NVR, Inc., and Hovnanian Enterprises Inc. (NYSE: HOV), which specialize in building the houses people live in. But they don't just buy wood, which means they are also buying from companies like Owens Corning, which makes roofing, Masco Corp., which makes plumbing supplies, and A.O. Smith (NYSE: AOS), which makes water heaters.

Some of the buildings that get erected, meanwhile, end up in institutional hands. Traditionally that meant apartment REITs like AvalonBay Communities, Inc. or UDR, Inc. But there's also a new breed of landlord that owns single family homes at an institutional level. The list here includes American Home 4 Rent and Invitation Homes Inc, two companies that stepped into the massive home foreclosure mess following the recession to buy up houses in large enough numbers to create economies of scale.

There's even more to consider on the housing front, too. For example, Home Depot Inc and Lowe's Companies Inc are hardware stores, but they supply just about everything one might need to repair (or even build) a home. And then there's Sherwin-Williams Co that focuses on selling paints and supplies to professional and amateur painters. Housing is a truly massive sector with tentacles that reach far and wide.

A few top stocks to consider

With that scope in mind, you could probably find any number of great companies in the housing space. However, here are three that look interesting right now, and one that you should definitely avoid.

Weyerhaeuser is one of the largest publicly traded owners of timberland in the world, with roughly 13 million acres. It has property spread across key U.S. timber markets, with notable exposure to the southern states that are seeing relatively robust population growth. That said, it also has nearly 3 million acres in the northwest, a region that extends Weyerhaeuser's reach into the global exports market. But it doesn't just own land with trees on it, the REIT also owns and operates the facilities that turn trees into lumber. And Weyerhaeuser has a division that sells land so it can be used to build housing, among other things.

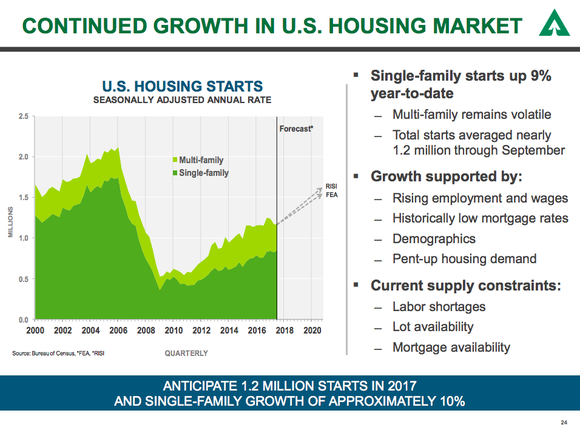

The housing market has been in a multi-year upturn since getting hit hard during the deep 2007 to 2009 housing-led recession. Image source: Weyerhaeuser Co.

Timber is a commodity, so Weyerhaeuser's top and bottom lines are driven by commodity prices. However, its main product, trees, is a renewable resource unlike gold or iron ore, which deplete over time. So while results will fluctuate, the core of the business is pretty consistent.

The REIT's shares, which yield around 3.4%, have had a nice price run since early 2016, when commodity prices started to move broadly higher. It's definitely not cheap today, but the renewable nature of its business and the fact that the huge millennial generation appears to be ready to start buying their first homes, make it worth a deep dive. It looks like there could still be more upside.

That huge millennial generation shifting into home buying mode is also why investors might want to take a look at LGI Homes. LGI is a relatively small homebuilder, with a modest $1.4 billion market cap, but it has a unique niche. The company focuses on getting renters to buy so-called starter homes, with an advertising push that specifically compares the costs of renting to the costs of owning.

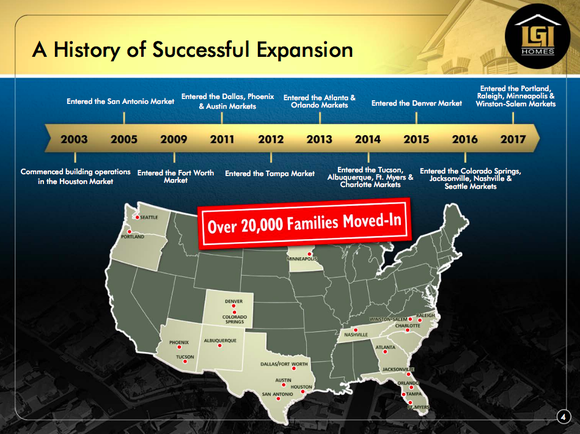

LGI has expanded its business well beyond the one market it started in around 15 years ago. Image source: LGI Homes Inc.

LGI went public in 2013, after the housing crash, and has done an impressive job of growing its business. Revenues and earnings have both roughly tripled over the last four years. Although LGI may not be able to keep that pace of growth up, a new generation starting to buy their first homes suggests that growth will continue. The homebuilder's unique business approach of targeting first-time homebuyers is also the right place to be. It's currently building 77 communities (a 30% year-over-year increase), but thinks it can expand that number over time -- just like it has over the past few years.

On the other end of the spectrum is Hovnanian, a homebuilder that investors are best off avoiding right now. The company has lost money in seven of the last 10 years, with red ink in each of the last three years. The big problem here is leverage -- the company's interest expense in 2017 was larger than its operating income. And with negative shareholder equity, long-term debt made up more than 100% of its capital structure. Hovnanian is working with lenders to manage through this situation, but it's not worth buying a struggling company in a recovering industry.

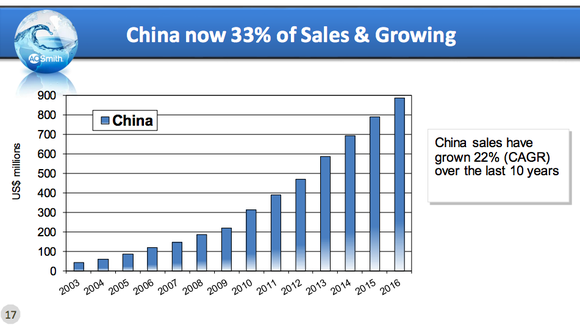

Another stock you might want to consider is a play on homes outside of the United States. A.O. Smith is a key global supplier of water heaters and water filtration systems. It has a large presence in North America, which makes up around two-thirds of its business. However, the region is mature and slow growth is the norm. That said, the rest of A.O. Smith's business is largely driven by China. Sales in that giant, developing nation have grown at an incredible 22% annualized over the past decade.

China has been a huge growth story for A.O. Smith. Image source: A.O. Smith.

While some poeple take hot water for granted, in developing countries it is a luxury that more and more people can afford as they move up the socioeconomic ladder. A.O. Smith expects solid results to continue in China, but the really exciting story here is that it is now focusing on taking its water heaters into India. The game plan for this new market is essentially the same as the one that played out so well China.

Investors are well aware of the company's success, which is highlighted by A.O. Smith's incredible 24-year streak of annual dividend increases. However, if growth in India proves as robust as the growth in China, this water heater manufacture could still have years of growth.

A huge and important market

The term "housing stocks" is really a wide net that catches a lot of fish. Although I think timber REIT Weyerhaeuser, home builder LGI Homes, and water heater maker A.O. Smith have strong outlooks, they are just a drop in the bucket when it comes to the opportunities for investment in the housing space. If you do a deep dive in the broad sector, be careful of risky companies like Hovnanian. Don't just stop at homebuilders, though, because there are so many more facets to the housing market to consider.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of LGI Homes and NVR and has the following options: short May 2018 $175 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot, Lowe's, and Sherwin-Williams. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance