3 Top Growth Stocks to Buy in September

If you are looking for growth stocks, lululemon athletica (NASDAQ: LULU), Moody's Corporation (NYSE: MCO), and A.O. Smith Corporation (NYSE: AOS) are all top picks for September. Mind you, they are very different, spanning the retail, financial, and industrial spaces. But they all have one key thing in common: growth. Here's why these Motley Fool contributors think they are three of the top growth stocks to buy this month.

Stretching for higher profits

Demitri Kalogeropoulos (lululemon athletica): This stock has roughly doubled so far in 2018, but investors shouldn't let that rally keep Lululemon off their watchlists. The athletic apparel retailer has earned its premium, after all, with sales gains blowing past management's targets in both the first and second quarters. And while many retailers are seeing improved operating results lately, two metrics illustrate just how much stronger Lululemon's growth is today.

First, consider its rising profitability, as both gross and operating margins are jumping. Lululemon's pricing trends are strong thanks to a packed pipeline of innovative product releases that support its premium branding. Its operating margin jumped to 16% of sales from 12% last quarter, too, which combined with a lower tax rate to send net income higher by 96%.

Image source: Getty Images.

Next, there's Lululemon's booming online business, which grew at a 48% rate in the most recent quarter. But rather than pinch profitability, as it has for Lululemon's peers, that shift toward e-commerce is lifting the retailer's margins today.

Those impressive trends mean it's very likely the company will pass $3 billion in sales this year. And if the positive momentum holds for much longer, Lululemon executives might need to raise their long-term outlook, which targets $4 billion of annual revenue by fiscal 2020.

This growth stock enjoys little competition

Jordan Wathen (Moody's): When companies want to borrow money, there is no better way to do it than to tap the bond market. But before issuing a bond, companies have to get the nod from one of the credit rating agencies, like Moody's, S&P, or Fitch.

A bond rating is the corporate equivalent of your credit score. For a fee, a credit rating agency ascribes a letter grade to a bond. That letter grade reflects the likelihood that a bond is repaid in full. Less risky companies get a higher grade. Riskier companies get a lower grade.

Getting a rating is almost a prerequisite for a company to borrow money. Many bond funds can only buy bonds with certain ratings. Bank regulations require institutions to hold a certain amount of capital based on the ratings assigned to bonds they hold. To be able to sell a bond to the greatest number of buyers, corporate issuers have to get a rating.

Moody's and S&P have an effective duopoly in the business of ratings. Of the roughly 2.3 million ratings outstanding at the end of 2016, S&P issued roughly 49% of them. Moody's was responsible for 34% of all ratings issued. Fitch came in third at 13%. The seven remaining credit rating agencies made up less than 4% of all ratings outstanding.

Limited competition gives Moody's pricing power that should allow it to grow its earnings at a rate faster than the underlying growth in corporate debt issuance. With shares trading at about 24 times the midpoint of its earnings guidance for 2018, investors are getting a company that could grow earnings at a high-single-digit clip for years to come, at a very attractive price.

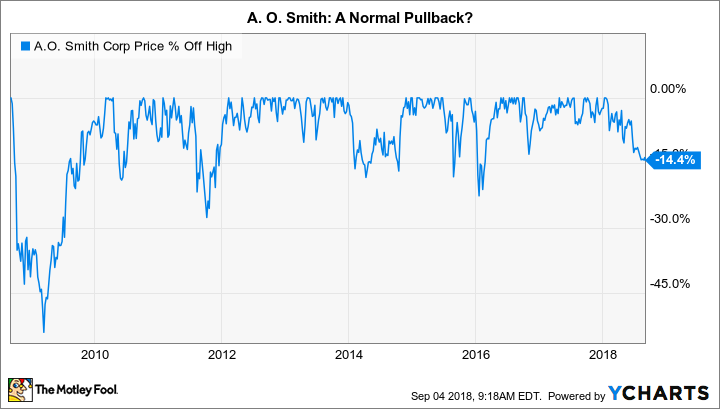

This pullback could be your opportunity to buy

Reuben Gregg Brewer (A.O. Smith Corporation): A.O. Smith's share price has fallen nearly 15% from a peak in early 2018. Looking back over the company's history, a pullback of around that much is normal and, in fact, could be a sign that now is a good time to buy this growth stock.

Part of the pullback is likely related to the tense global trade environment. A.O. Smith's recent growth has been driven by the water-heater maker's expanding presence in China. That country accounts for almost all of its foreign sales (around 36% of the total) and has grown at a compound annual rate of 21% over the past decade. Smith has big plans to continue its expansion in China by entering the water- and air-purification sectors. It also intends to ramp up its growth in India.

Success so far has been impressive, with its slow-growth core developed markets supporting high-growth emerging markets. The end result has been annualized earnings growth of 26% since 2010. It also has 25 years of dividend hikes behind it, with 17% compound annual growth over the past decade.

Sure, the tense global atmosphere increases uncertainty, but the long-term story here really hasn't changed all that much: Asia is still a big opportunity. And when the trade spat eventually subsides, A.O. Smith's stock will likely be rewarded with a higher price.

A diverse trio

Lululemon's strong sales show it still has a leading position in the athletic apparel space. Moody's market position in the bond rating business gives it a leg up over the long term. And Smith's water heater business is still executing well and has great prospects, even though investors appear to be taking a conservative stance because of increasing global trade tensions. If you take the time to dig into these three growth stocks, I'm confident you'll agree that one or more could make a good addition to your portfolio.

More From The Motley Fool

Demitri Kalogeropoulos has no position in any of the stocks mentioned. Jordan Wathen has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Lululemon Athletica. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance