3 Things You Should Know About Your CPF When Planning Your 2018 Finances

When the New Year arrives and you’re making a list of resolutions to take steps towards your financial goals, your CPF account is probably one of the last things to cross your mind.

But understanding what you can and cannot do with your CPF actually goes a long way in helping you plan for your future finances.

If you’ve been passive about knowing how CPF works and how it affects you, here are 3 things you should take note of to get savvier with your CPF savings from now on:

1. Your CPF allocation rates change depending on your age

For those of us under the age of 55, our CPF contribution rate will not change. Most of us will contribute 20% of our monthly salary to our CPF accounts, with our employers contributing another 17%, for a total of 37% of our income going into our CPF.

But how that 37% is allocated to our various CPF accounts may change, depending on our age. And this may affect you if you are moving on to a different age group this year.

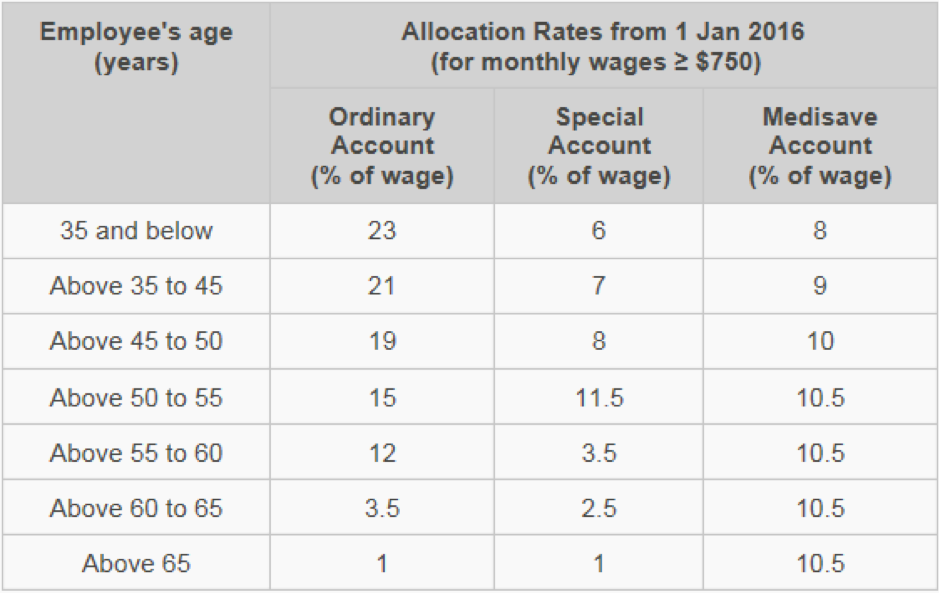

Table above shows CPF allocation rates from 1 January 2016 for private sector and public sector non-pensionable employees (Source: CPF)

The older we get, the less goes into our CPF Ordinary Account (OA), and the more goes into our Special Account (SA) and Medisave Account (MA).

If you’re financing your mortgage fully with your OA savings, do note that the amount of CPF contributions allocated to your OA decreases from 23% to 21% after you turn 36 years old (refer to chart above). If your salary hasn’t changed in a few years, this may affect your ability to pay your mortgage.

Say you turn 36 in June 2018, for example, and your monthly salary (before CPF) is $4,000.

In June 2018, your contribution to your OA will be 23%, or about $920. From July 2018 onwards, since you’re now above 35, the contribution to your OA will drop to about $840. If you were paying $900 a month for your mortgage, you will now need to set aside $60 in cash each month to make up the shortfall.

If you’re not planning to buy a house, the change in allocation rates could still affect you. Say if you are planning to transfer money from your OA to your SA to take advantage of the higher interest rate, or invest some of your OA savings under the CPF Investment Scheme. You will need to take note of your new allocation rate before you make a decision, since you’ll potentially have less in your OA to play around with.

2. You could grow your savings faster if you transfer funds from your Ordinary Account to your Special Account

Your OA savings currently earn interest of up to 3.5% per year~, while your SA savings earn interest of up to 5% per year~. To optimise your CPF savings, you can transfer funds from your OA to your SA to earn the higher interest.

If you are planning to grow your CPF savings by transferring your OA savings to SA, just remember that such transfers are irreversible. Before making a transfer, you should also consider if you want to use your OA savings for any other needs (e.g. buying your own property).

To leverage on the attractive interest rates, you can also consider topping up your SA with cash. Besides growing your retirement savings, you will also enjoy dollar-for-dollar tax relief of up to $7,000 per year for top-ups in cash. (The overall personal income tax relief cap of $80,000 applies for cash top-ups to CPF accounts.)

If you want to maximise the interest earned, January’s actually the best month to top up your SA via a CPF transfer or cash because you will be able to earn interest over 12 months, as opposed to doing it at the end of the year. Here’s an example showing how much more you can earn assuming you top up $7,000 every January:

3. Your CPF monies are earning risk-free interests in your OA and SA accounts

It is commonly known, and as already mentioned earlier, your CPF accounts offer attractive interest rates of up to 3.5% per year~ on your OA savings, and up to 5% per year~ on your SA savings.

But keeping this in mind is important especially if you are looking at the option to invest your OA and/or SA savings under the CPF Investment Scheme (CPFIS).

Planning and managing your investments carefully is very important because at the end of the day, the last thing you want is to lose money, especially when your OA and SA savings already enjoy risk-free interest rates that help grow your retirement nest egg.

So if you are not confident of investing on your own or beating the CPF interest rates, leaving your money in your CPF accounts could be the best step to take.

What are your financial resolutions this New Year? Share your thoughts with us.

~Inclusive of an extra 1% interest paid on the first $60,000 of a member’s combined balances, of which up to $20,000 comes from your Ordinary Account (OA).

The post 3 Things You Should Know About Your CPF When Planning Your 2018 Finances appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance