3 Swiss Dividend Stocks On SIX Swiss Exchange Yielding Up To 5%

The Swiss market recently experienced a volatile session, with the SMI index initially recovering but ultimately closing in negative territory, reflecting broader uncertainties and mixed performances among major companies. In such fluctuating conditions, dividend stocks can offer investors a measure of stability and income potential; here we explore three notable Swiss dividend stocks listed on the SIX Swiss Exchange that yield up to 5%.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Cembra Money Bank (SWX:CMBN) | 5.07% | ★★★★★★ |

Vaudoise Assurances Holding (SWX:VAHN) | 4.68% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.43% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

EFG International (SWX:EFGN) | 4.58% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 4.71% | ★★★★★☆ |

Luzerner Kantonalbank (SWX:LUKN) | 3.81% | ★★★★★☆ |

Holcim (SWX:HOLN) | 3.33% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.72% | ★★★★★☆ |

DKSH Holding (SWX:DKSH) | 3.54% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Holcim

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Holcim AG, along with its subsidiaries, operates as a global building materials and solutions company with a market cap of CHF47.22 billion.

Operations: Holcim AG generates revenue from several segments, including Cement (CHF13.39 billion), Aggregates (CHF4.31 billion), Ready-Mix Concrete (CHF5.84 billion), and Solutions & Products (CHF5.91 billion).

Dividend Yield: 3.3%

Holcim's dividends have shown stability and growth over the past decade, supported by a sustainable payout ratio of 52.3% from earnings and 39.7% from cash flows. Although its dividend yield of 3.33% is lower than the Swiss market's top quartile, it remains reliable with minimal volatility. Recent strategic moves include a potential dual listing for its North American unit, which could impact shareholder dynamics but also reflects Holcim’s efforts to optimize its business structure and investor base.

Unlock comprehensive insights into our analysis of Holcim stock in this dividend report.

Upon reviewing our latest valuation report, Holcim's share price might be too pessimistic.

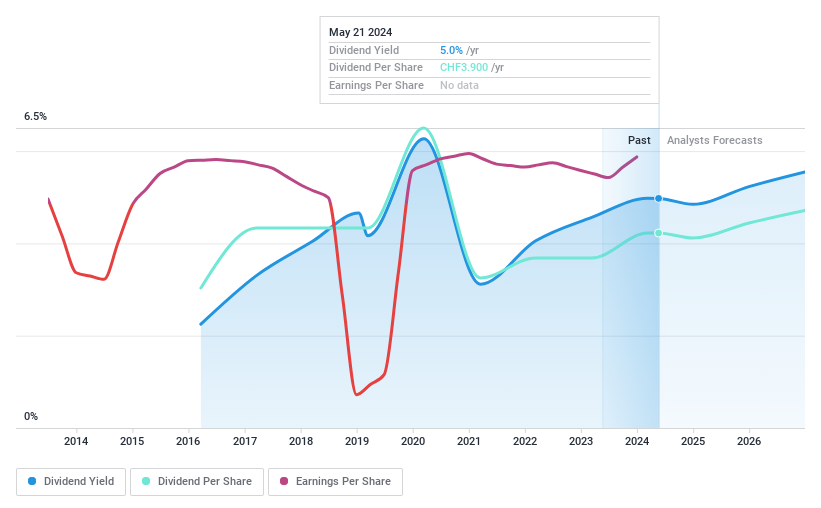

Orell Füssli

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG, with a market cap of CHF150.92 million, operates in security solutions and book retailing both in Switzerland and internationally.

Operations: Orell Füssli's revenue is primarily derived from its Book Trade segment, contributing CHF118.52 million, followed by Security Printing at CHF75.94 million and Industrial Systems at CHF21.24 million.

Dividend Yield: 5.1%

Orell Füssli's dividend yield of 5.06% ranks in the top quartile among Swiss stocks, though its payout ratio is high at 86.9%, indicating dividends are covered by earnings but with less margin for safety. The cash payout ratio stands at a more sustainable 33%. Despite recent earnings volatility—net income dropped to CHF 1.59 million from CHF 4.83 million—the company has increased dividends over nine years, albeit with an unstable track record.

Get an in-depth perspective on Orell Füssli's performance by reading our dividend report here.

Our expertly prepared valuation report Orell Füssli implies its share price may be too high.

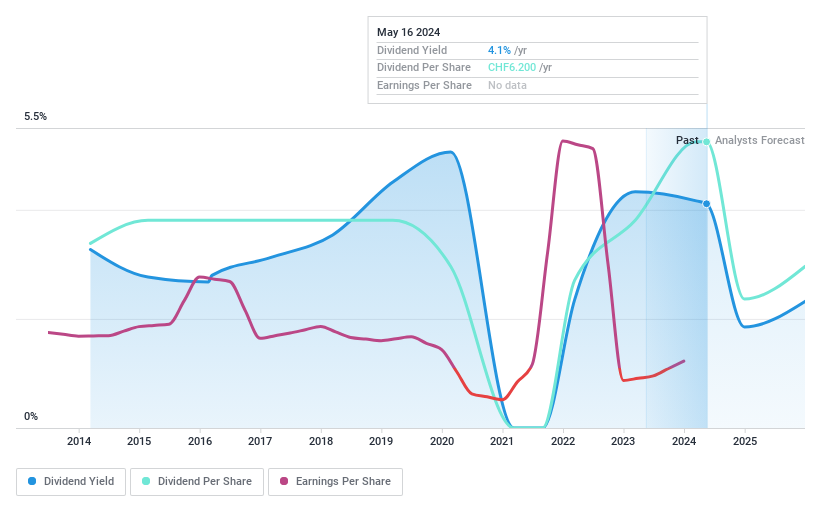

TX Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms offering information, orientation, entertainment, and support services in Switzerland with a market cap of CHF1.56 billion.

Operations: TX Group AG's revenue segments include Tamedia (CHF427 million), Goldbach (CHF299.10 million), 20 Minutes (CHF115.60 million), TX Markets (CHF126.40 million), and Groups & Ventures (CHF159.40 million).

Dividend Yield: 4.2%

TX Group's dividend yield of 4.2% falls short of the top tier in Switzerland, and its historical dividend payments have been unreliable and volatile. However, the dividends are sustainably covered by both earnings (payout ratio at 59.6%) and cash flows (cash payout ratio at 43.4%). The company recently turned profitable with a net income of CHF 9.6 million for the first half of 2024, showing improved financial stability despite past volatility in share price and dividends.

Seize The Opportunity

Take a closer look at our Top SIX Swiss Exchange Dividend Stocks list of 27 companies by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:HOLN SWX:OFN and SWX:TXGN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com