3 Swedish Dividend Stocks With Yields Ranging From 3.2% To 7.8%

In recent trading sessions, the Swedish market has echoed the positive sentiment seen across major global indices, buoyed by easing inflation concerns and anticipatory adjustments in monetary policies. As investors seek stable returns amidst fluctuating market conditions, dividend stocks in Sweden present an appealing avenue for those looking to balance yield with potential growth.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.15% | ★★★★★★ |

Betsson (OM:BETS B) | 5.63% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.56% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.37% | ★★★★★☆ |

Duni (OM:DUNI) | 4.73% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.34% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.34% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.25% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.64% | ★★★★★☆ |

Bahnhof (OM:BAHN B) | 3.75% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

We'll examine a selection from our screener results.

Bulten

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) specializes in manufacturing and distributing fasteners, offering related services and solutions to various industries including automotive and consumer electronics, across multiple global regions with a market cap of SEK 1.60 billion.

Operations: Bulten AB generates its revenue primarily from the fasteners segment, which amounted to SEK 5.95 billion.

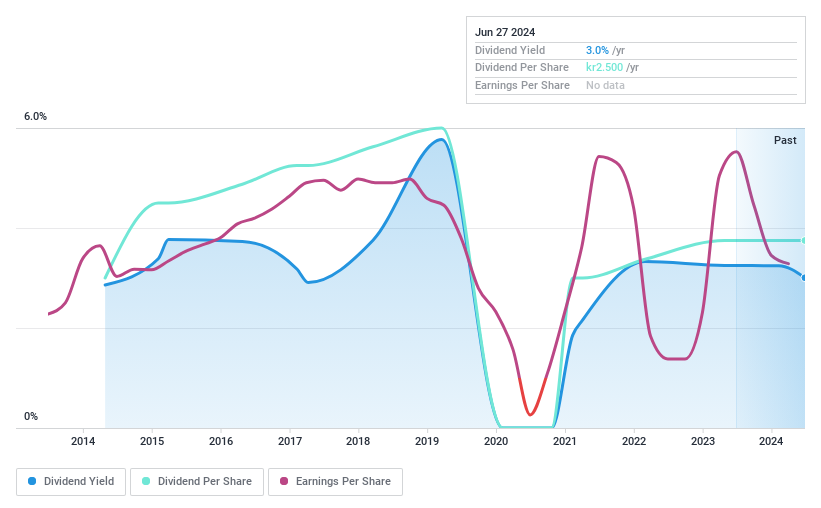

Dividend Yield: 3.3%

Bulten's dividend history reveals inconsistency, with payments showing volatility over the past decade, including annual drops over 20%. Despite this, dividends are sustainably supported by earnings and cash flows, with a payout ratio of 57% and a cash payout ratio of 30.9%. However, Bulten's current dividend yield of 3.29% is below the top quartile in Sweden. Recent financials indicate a slight decline in profitability with net margins falling from last year’s 3.6% to 1.5%.

Navigate through the intricacies of Bulten with our comprehensive dividend report here.

Our valuation report here indicates Bulten may be overvalued.

Husqvarna

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 52.65 billion.

Operations: Husqvarna AB generates revenue through its diverse segments, with SEK 29.38 billion from Forest & Garden, SEK 13.06 billion from Gardena, and SEK 8.23 billion from Construction.

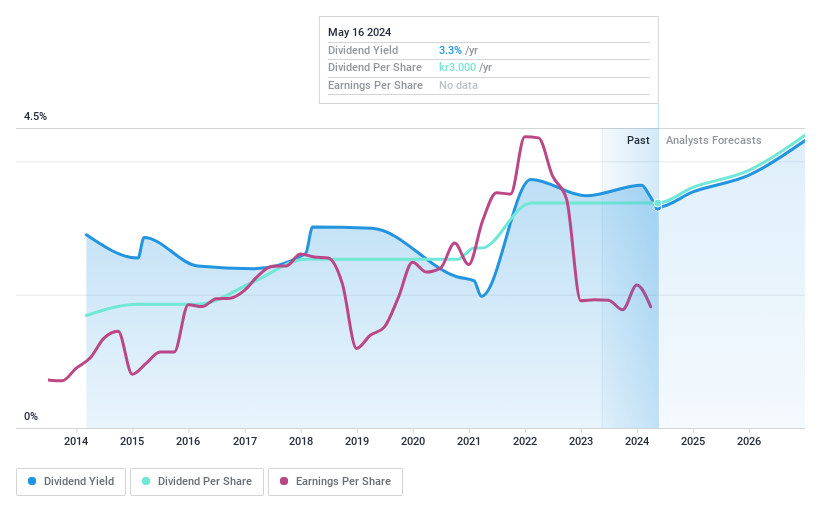

Dividend Yield: 3.3%

Husqvarna's recent partnership with Liverpool FC enhances its global brand visibility, potentially impacting investor perception positively. However, its dividend yield of 3.26% lags behind Sweden's top dividend payers. The company maintains a stable decade-long history of dividend payments but struggles with high debt levels and a payout ratio of 92.8%, indicating dividends are not well-covered by earnings despite being supported by cash flows (58.6% cash payout ratio). Recent financials show a decline in sales and net income, suggesting challenges ahead in sustaining profitability and dividends.

Click here to discover the nuances of Husqvarna with our detailed analytical dividend report.

Our expertly prepared valuation report Husqvarna implies its share price may be lower than expected.

Nordic Paper Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Paper Holding AB operates in the production and sale of natural greaseproof and kraft paper, serving markets in Sweden, Italy, Germany, Europe broadly, the United States, and internationally with a market capitalization of SEK 3.42 billion.

Operations: Nordic Paper Holding AB generates revenue primarily through two segments: Kraft Paper, which brought in SEK 2.23 billion, and Natural Greaseproof paper with SEK 2.19 billion in sales.

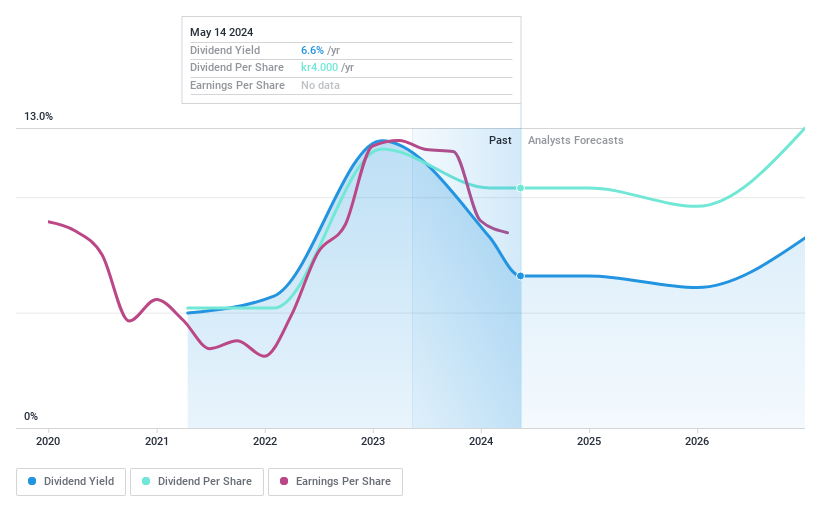

Dividend Yield: 7.8%

Nordic Paper Holding's dividend history is short, having initiated payments only three years ago with a recent payout of SEK 4 per share. Despite this brevity, dividends have shown growth and stability, supported by a solid earnings coverage with a payout ratio of 68.3% and cash flows covering 78%. However, the company faces challenges, evidenced by a recent decrease in dividends and declining quarterly sales from SEK 1.305 billion to SEK 1.209 billion alongside a drop in net income from SEK 173 million to SEK 149 million.

Dive into the specifics of Nordic Paper Holding here with our thorough dividend report.

Our valuation report here indicates Nordic Paper Holding may be undervalued.

Make It Happen

Discover the full array of 22 Top Swedish Dividend Stocks right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BULTEN OM:HUSQ B and OM:NPAPER.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com