3 Stocks for Warren Buffett Fans

Just about everyone wants to know what famed investor Warren Buffett, the so-called Oracle of Omaha, owns and whether or not they should own those stocks, too. The answer, as with every investment decision, isn't usually a simple yes or no. Which is why these three Motley Fool investors have looked at the stocks that Buffett owns in his own portfolio or as CEO of Berkshire Hathaway to see which ones are most interesting today. Technology giant Apple Inc. (NASDAQ: AAPL), food maker The Kraft Heinz Company (NASDAQ: KHC), and tiny real estate investment trust Seritage Growth Properties (NYSE: SRG) all caught our attention -- but only for the right types of investors.

The company Buffett wishes he owned 100%

Chris Neiger (Apple Inc.): There are plenty of reasons to consider owning Apple stock. The company's popular iPhone generates massive profits, it's the current leader in the wearable-tech space, it has a growing services business, CEO Tim Cook consistently takes a long-term view with the company, and Apple has been generous with its buybacks and continues to raise its dividend.

But why is Apple specifically a stock for Buffett fans? To answer that, let's look at what the famed investor thinks about the company. Back in May, Buffett said:

We bought about 5% of the company. I'd love to own 100% of it. ... We like very much the economics of their activities. We like very much the management and the way they think.

Deciphering the oracle requires more than just looking at the list of what Warren Buffett owns.

Buffett famously shunned tech stocks for years, but he began purchasing Apple through Berkshire Hathaway back in 2016. In the first quarter of this year, Buffett bought another 75 million shares of the tech company, bringing Berkshire's total holdings to 240 million shares.

Aside from Buffett's confidence in Apple's management, he also believes that Apple's business will continue to be successful year after year, despite some of the focus of Apple bears on short-term issues.

"The idea that spending loads of time trying to guess how many iPhone X or whatever are going to be sold in a given three-month period, to me, it totally misses the point ... [W]hat really counts is what's going to happen over the next 10 years," Buffett recently said.

This advice can be directly applied to any negative sentiment about Apple's second-quarter iPhone sales, which grew just 3% year over year.

For investors considering following Buffett and buying Apple stock, there's one more bit of the billionaire's advice that applies: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

With Apple trading at just 14 times the company's forward earnings right now, compared to the tech industry average of about 36, Apple's shares are certainly at a fair price.

It all means that Buffett fans should have no problem adding this tech giant to their list of potential investments.

Buffett's bet in the condiment aisle

Travis Hoium (The Kraft Heinz Company): There may not be a holding in Buffett's top 10 that seems as obviously "Buffett-like" as Kraft Heinz. The company makes condiments like ketchup and mustard that are standards in households around the world and have been powerful brands for decades. Buffett likes Kraft Heinz's business so much, he owns 26.7% of it, valued at $20.5 billion.

While Kraft has been a great business in the past, it's begun to see disruption from smaller craft-food providers and private-label brands, which have led to a 2% decline in revenue over the past two years. This is forcing changes beyond cost-cutting and efficiency measures that have traditionally led to growing profits in the commodity food business. The company is starting to innovate itself, rather than assume customers will continue buying ketchup and Mac and Cheese at the same rate they have in years past. Artificial ingredients are being taken out of products, new marketing plans are being developed, and innovative new products like Just Crack an Egg are hitting the market.

What remains true, no matter if Kraft Heinz is growing or not, is that the company owns a tremendous amount of shelf space around the world and has distribution muscle that few companies can match. That gives it a leg up on the competition operationally as long as it can position brands that are working to exploit market trends. I think in 2018, we're going to see the innovation start catching up to the distribution muscle, which should be positive for financial results.

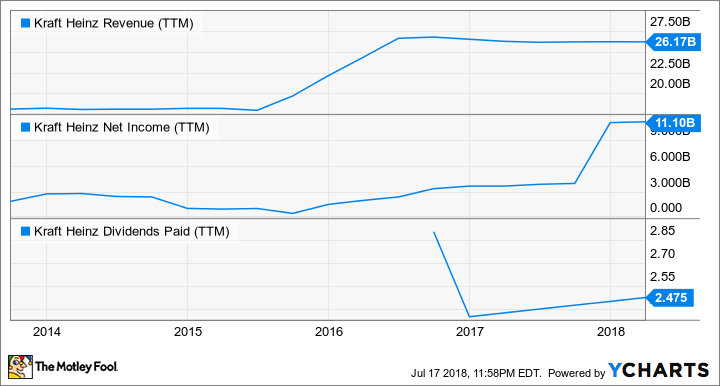

KHC revenue data by YCharts. TTM = trailing 12 months.

The struggles I highlighted above have actually given investors buying Kraft Heinz today a nice discount, considering that shares are down 26.4% over that time. But you can see that even in a down year, revenue is fairly steady and adjusted earnings per share were actually up 6% in the first quarter of the year, reaching $0.89, showing there's some bottom-line improvement.

I wouldn't expect Kraft Heinz to be a growth machine going forward, but it's a rock-solid company in the food business, and Warren Buffett is confident enough on its future to bet over $20 billion on the stock.

Not for the faint of heart

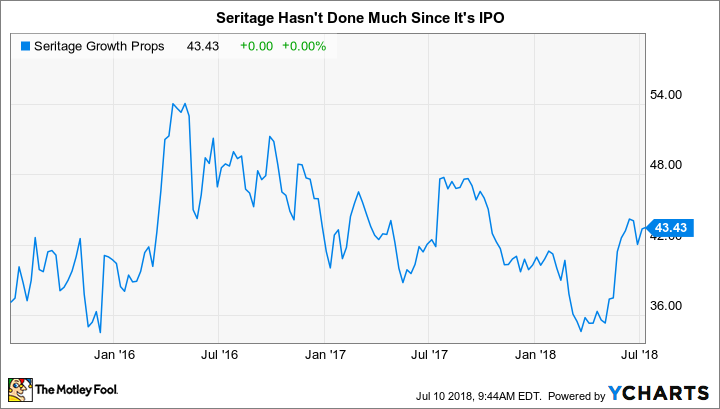

Reuben Gregg Brewer (Seritage Growth Properties): Seritage is an interesting story built on the idea that investors often miss the long-term value of a company by focusing too much on near-term results. It's so perfectly "Buffett" that he owns around 5.7% of the stock in his personal investment portfolio. So what are investors missing here and why?

The why is easy. Seritage was broken out of Sears Holdings in mid-2015 with a portfolio of 235 retail properties as a way for the troubled retailer to raise much-needed cash. So, not only does Seritage own retail properties, but Sears and Kmart are its largest tenants. It's no wonder, then, that investors are leery of Seritage, particularly since Sears' results continue to disappoint. In fact, it's a completely reasonable expectation that Seritage's largest tenant could go out of business.

Before you run for the hills, however, you need to dig a little. Year over year in the first quarter, Seritage reduced its exposure to Sears Holdings from around 60% of base rents to 46%. It's moving that number in the right direction. Every closure of a troubled Sears and Kmart location is an opportunity for Seritage to upgrade and lease it to a new tenant. The real benefit shows up in the new rent it can charge: Sears Holdings pays roughly $5 per square foot, with replacement tenants paying around $20.

There's no question that Seritage has been dealt a tough hand. But it is taking the right steps to unlock value for shareholders. If you can handle the uncertainty around its affiliation with Sears Holdings, which will likely take a long time to meaningfully reduce, the rent increases Seritage has been able to get from vacated Sears and Kmart locations is a huge indication of the value that Buffett sees in this real estate investment trust (REIT).

Three Buffett stocks you need to examine today

Apple, Kraft Heinz, and Seritage are all Buffett stocks because they are either owned by Berkshire Hathaway or Buffett himself. That said, they each fit a different investor profile. Apple is most appropriate for growth-minded investors. The sell-off at Kraft Heinz makes it a good choice for value investors. And Seritage is something of a special-situation play, with the slow demise of the REIT's largest tenant actually the key long-term opportunity. If you take the time to do a deep dive on this trio, I'm certain that one or more of these Buffett stocks could find their way into your portfolio today.

More From The Motley Fool

Chris Neiger has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. Travis Hoium owns shares of Apple and Berkshire Hathaway (B shares). The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool recommends Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance