These 3 Stocks Have Led The Nasdaq's Rebound

The tech-heavy Nasdaq has come roaring out of the gate in 2023, undoubtedly a welcomed development among investors following a less-than-ideal 2022.

In fact, January reflected the Nasdaq’s best performance since 2001.

So far, better-than-expected inflationary data and earnings have helped keep the market afloat, with the Federal Reserve also giving the market some much-needed juice in yesterday’s session.

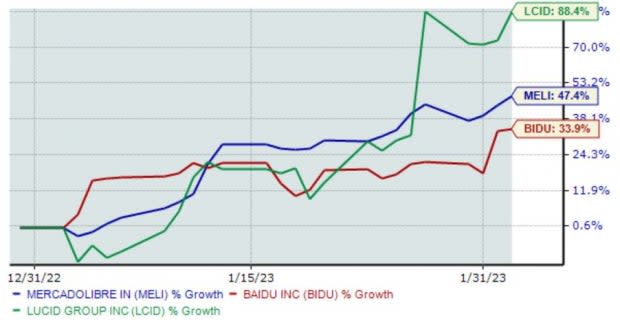

Three stocks – Mercado Libre MELI, Baidu BIDU, and Lucid Group LCID – have all helped lead the Nasdaq’s rebound, residing well in the green year-to-date. This is shown in the chart below.

Image Source: Zacks Investment Research

How does each company stack up? Let’s take a closer look.

Mercado Libre

Mercado Libre is one of the largest e-commerce platforms in Latin America, offering a total of six integrated e-commerce services. Currently, the company sports the highly-coveted Zacks Rank #1 (Strong Buy).

Investors will undoubtedly appreciate MELI’s growth trajectory; the Zacks Consensus EPS Estimate of $8.20 for its current fiscal year indicates a sizable 390% Y/Y uptick in earnings.

And in FY23, estimates suggest a further 80% of bottom line growth.

Image Source: Zacks Investment Research

Further, Mercado Libre has posted strong quarterly results as of late, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in back-to-back releases.

Just in the company’s latest quarter, MELI posted an 11% EPS beat paired with a marginal revenue surprise.

Image Source: Zacks Investment Research

Baidu

Baidu offers a Chinese language search platform with a network of third-party websites and software applications. Presently, the company boasts a Zacks Rank #1 (Strong Buy).

Baidu shares have been scorching hot over the last three months, nearly doubling in value and indicating that buyers have taken control.

Image Source: Zacks Investment Research

In addition, the company does have a sizable cash pile, with cash and equivalents reported at roughly $26 billion in its latest quarter.

Image Source: Zacks Investment Research

Keep an eye out for Baidu’s upcoming quarterly release on March 7th, 2023; the Zacks Consensus EPS Estimate of $2.14 indicates a climb of roughly 18% Y/Y.

Lucid Group

Formerly known as Churchill Capital Corp. IV, Lucid Group Inc. is an automotive company specializing in the EV industry. LCID is currently a Zacks Rank #2 (Buy).

Despite a short history, the company has witnessed significant revenue growth, sequentially growing sales by at least 60% across its last three quarters.

Image Source: Zacks Investment Research

Challenging business conditions have impacted the company significantly, as evidenced in its latest release; Lucid fell short of the Zacks Consensus EPS Estimate by more than 20% and reported revenue roughly 16% under expectations.

Bottom Line

January was a fantastic start to 2023, with stocks finally showing signs of life after a rough performance in 2022.

And all three stocks above – Mercado Libre MELI, Baidu BIDU, and Lucid Group LCID – have helped lead the Nasdaq’s rebound, rewarding shareholders with considerable gains year-to-date.

In addition, all three sport a favorable Zacks Rank, providing the cherry on top.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance