These 3 Stocks Doubled in 2017 -- Are They Still Buys?

Sir Isaac Newton may be best known for his first law of motion, which states in part that "an object in motion tends to stay in motion unless acted upon by an outside force." The same can be said for certain stocks. Each of the companies discussed here gained more than 100% last year, and investors will rightly be asking themselves if they will continue to gain ground, given their massive outperformance last year, or if they're headed for a fall.

To help with that task, we asked three Motley Fool investors to choose companies that doubled in 2017 and evaluate their potential for future growth. They offered up their assessments of Micron Technology, Inc. (NASDAQ: MU), Weight Watchers International, Inc. (NYSE: WTW), and IPG Photonics Corporation (NASDAQ: IPGP).

Image source: Getty Images.

Blockbuster growth

Tim Green (Micron Technology): Micron, a manufacturer of memory chips for PCs, mobile devices, servers, and other products, is currently enjoying a period of robust demand and sky-high prices. In its last reported quarter, Micron's revenue soared 58% year over year and its adjusted earnings per share more than tripled. The stock more than doubled at its highest point in 2017, closing the year up about 88%.

Can shares of Micron keep moving higher? It depends. The memory chip business is cyclical, sometimes brutally so. Periods of strong demand and high prices in the past have always eventually given way to oversupply and plunging prices. While Micron is wildly profitable today, it lost money in four of the past 10 years.

Image source: Micron.

Micron stock trades for around 6.5 times trailing-12-month earnings because the market doesn't believe that this time will be different. The stock just can't shake that lingering feeling that the company's blockbuster results won't last. Management is optimistic, expecting a "healthy demand environment" for DRAM, which accounts for the bulk of its sales. But Micron has a poor forecasting record, just like everyone else.

Whether Micron is a buy depends on whether you believe the company is suddenly immune from the brutal cyclical swings of the past. Personally, I wouldn't bet on it.

Getting down to its fighting weight

Rich Duprey (Weight Watchers): Once you hit your stride in dieting, the weight seems to melt off. It's starting a new way of eating -- and sticking with it after a few weeks or even months -- that's the hard part. After a while, it becomes almost a lifestyle.

That's rather how it went with Weight Watchers, which struggled at first as competitors like NutriSystem and other dieting programs nibbled away potential customers who were turned off by the strict regiment imposed by Weight Watchers diets. But like any good meal plan, it was able to evolve and has since become a phenomenal growth vehicle that more than doubled in 2017 -- it was up 268%. It's not doing too shabbily in 2018, either, and is up another 75% year to date.

Image source: Getty Images.

The success has been due to the star power it brought on board, first when Oprah Winfrey took a stake in the business, and then when it convinced social media star DJ Khaled to be its social media spokesman.

Perhaps more important, though, have been the improvements it made to its diets, which now don't limit what a person can eat, but rather give the individual the power to choose what foods best fit their lifestyle. Its Freestyle program introduced in December made certain foods "point-free," meaning dieters would no longer need to count them.

It was an instant hit and has helped drive subscriptions 29% higher in the first quarter, allowing it to end the period with a record 4.6 million people. With the potential to reach all new demographics now before it, Weight Watchers has the opportunity to continue its incredible run higher well into the foreseeable future.

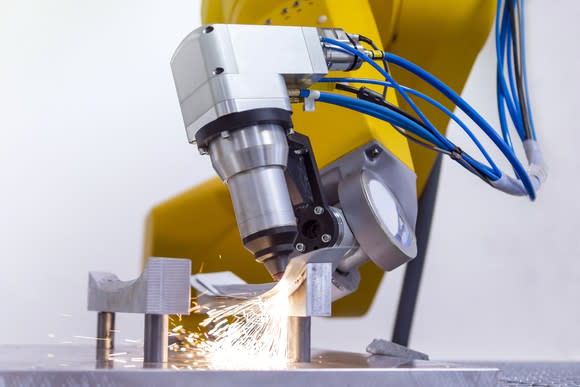

Laser-focused on the future

Danny Vena (IPG Photonics): IPG Photonics may be the best-performing stock of 2017 you've never heard of. The company, which manufactures high-performance lasers, produced record results last year, growing revenue 40% year over year, while operating income soared 51% compared to 2016.

Analysts expect the company to generate $1.61 billion in revenue for 2018, an increase of 14.2%, which would represent a significant deceleration from the 40% growth achieved last year. IPG's management forecast isn't much different, expecting revenue growth in a range of 10% and 15% for the year.

Image source: Getty Images.

Based on these projections, investors shouldn't expect anything near last year's stellar performance.

That said, IPG may be providing conservative guidance and erring on the side of caution. When the company initially provided its full-year forecast for 2017, it targeted revenue growth of between 10% and 14%. If that sounds familiar, it should: It's much the same as the company estimated for this year.

Unfortunately, IPG is anticipating softer demand for consumer electronics -- like smartphone production -- in 2018, which will offset some of the other growth. Additionally, the company has previously identified a biannual cycle to its business that will likely result in slower growth this year.

In spite of last year's record-setting performance and the potential for slower growth, IPG's results in the first quarter were better than expected, with revenue up 26% year over year, higher than the 20% growth the company forecast. Earnings per share also exceeded expectations, up 40% compared to the prior-year quarter and exceeding the high end of its guidance.

Taking all those factors into account, while I don't expect the outstanding results the company produced last year, I still believe IPG Photonics is a buy.

More From The Motley Fool

Danny Vena owns shares of IPG Photonics. Rich Duprey has no position in any of the stocks mentioned. Timothy Green has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends IPG Photonics. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance