3 Reasons Plug Power's Stock Could Rise

For investors who have recently added Plug Power (NASDAQ: PLUG) to their portfolios, the stock has been a delight, rising more than 96% year to date. Longer-term investors, however, have suffered: Over the past 10 years, shares have plummeted 94%.

But the stock's long-term performance doesn't come as much of a surprise to those familiar with the renewable-energy sector, for its landscape is replete with stocks that have provided negative returns. Over the past 10 years, two leading clean-energy ETFs, the Guggenheim Solar ETF (NYSEMKT: TAN) and the PowerShares WilderHill Clean Energy ETF (NYSEMKT: PBW) are down 90% and 77%, respectively.

Although Plug Power faces many challenges in proving that hydrogen-based solutions can be a lucrative enterprise, there are several catalysts that could certainly drive the stock higher. Should any of the following events happen, however, it's incumbent upon investors to investigate much further before considering a position.

Image source: Getty Images.

What's in a name?

Since the fuel-cell industry hasn't achieved the same degree of notoriety as its clean-energy brethren, like solar and wind power, investors are looking for signs from the marketplace that validate fuel-cell solutions as viable options. Consequently, the announcement of a large deal with an industry leader -- such as the deal it announced with Amazon.com (NASDAQ: AMZN) last April -- is certain to drive shares higher, for they're often interpreted as encouraging and possible harbingers of similar deals. In April, for example, the month during which Plug Power announced the Amazon.com deal, the company's shares soared more than 60%.

Besides an indication that Plug Power is gaining notoriety, the signing of a major deal has the obvious benefit of helping the company to grow its top line. A long-term partnership with Walmart (NYSE: WMT), for example, has been a major factor in Plug Power's impressive 18% compound annual growth rate of the top line over the past 10 years. Currently, management estimates that the Amazon.com deal will add $70 million to Plug Power's revenue in fiscal 2017 -- a sizable contribution considering Plug Power reported sales of $86 million in fiscal 2016.

Counting the largest retailers in the U.S. as its customers, Plug Power could also very well add leading retailers from abroad to its customer base. After all, the company is no stranger to this strategy. It recently demonstrated this in 2016, when it formed a partnership with leading French retailer Carrefour SA, for example. To this end, MercadoLibre, a dominant player in e-commerce in Latin America markets, or China's e-commerce leader, Alibaba, could be possibilities.

Profits would provide a pop

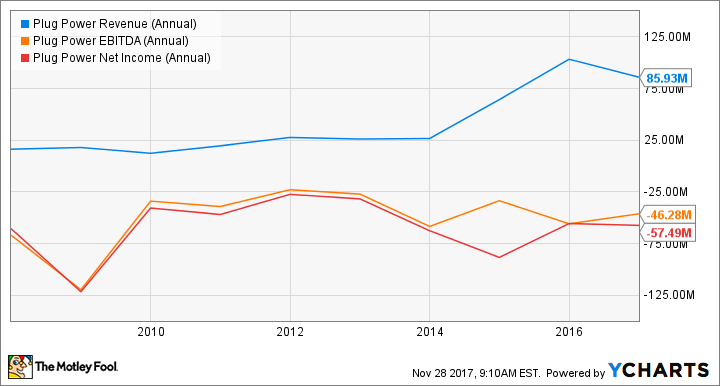

Although Plug Power has deftly grown the top line, bottom-line growth has remained elusive. In fact, the company has never achieved profitability. And there's certainly no guarantee that it ever will, which represents one of the greatest risks for potential investors.

PLUG Revenue (Annual) data by YCharts.

Looking ahead, though, management offered signs that the company is moving closer to profitability. In fiscal 2016, Plug Power reported a positive annual gross margin -- 4.6% -- for the first time, and management forecasts this expansion to be between 5% and 6% for fiscal 2017. Moreover, management anticipates expanding the gross margin even further in 2018.

In all likelihood, Plug Power wouldn't have to report net income in order to see its shares pop. Either achieving breakeven on an operating income or earnings before interest, taxes, depreciation, and amortization (EBITDA) basis would suffice. But investors shouldn't hold their breath. Considering the difficulties that the company has faced in simply generating a gross profit, reaching breakeven in terms of operating income and EBITDA are two feats that remain far off -- if at all -- in the company's future.

More than the bottom line

Whereas profits are unlikely in the near term, achieving positive cash flow represents a more reasonable catalyst for the stock to rise, since the company's current financial position is rather tenuous. Primarily, management has relied on raising equity to keep the lights on. From fiscal 2007 to 2016, the share count, according to Morningstar, has risen from 9 million to 181 million. Recently, however, management has eschewed further dilution and chosen to tap the debt market.

Carrying zero debt on its balance sheet from 2013 through 2015, Plug Power ended 2016 with $24 million in debt, thanks to a loan from NY Green Bank.

Image source: Getty Images.

The company weighed down its balance sheet, amending the agreement with NY Green Bank, even further in July, increasing the size of the loan, to $45 million. And it's not as if Plug Power is benefiting from the current low-interest-rate environment: The loan comes with a shocking sticker price -- an interest rate equal to the three-month LIBOR rate plus 9.5%.

Assuaging investors' fears of further dilution and debt, management claims the company is nearing positive cash flow. In fact, in the third-quarter earnings report, management suggested that the company -- thanks, in large part, to the deal with Amazon.com -- will be cash flow positive for the second half of 2017, and it will be cash flow positive on a quarterly basis beginning in the second half of 2018.

Investor takeaway

Whether Plug Power is announcing a new deal, reporting a profit, or generating positive cash flow, there are obvious reasons why its shares could shoot higher. And although any one of these items would be an auspicious sign for Plug Power's future, the company's future success relies on numerous factors -- not solely one. Consequently, before considering Plug Power as an addition to a portfolio, a more comprehensive examination of the company is required.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Scott Levine has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and MercadoLibre. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance