3 Non Ferrous Metal Mining Stocks to Watch in a Challenging Industry

The prospects of the Zacks Mining - Non Ferrous industry look bleak, as apprehensions about slowing demand in China and economic activity have been weighing down commodity prices. Additionally, the industry players are grappling with inflated input costs, particularly energy, and labor shortages and supply-chain issues.

Against this backdrop, we suggest keeping a close eye on companies like Freeport-McMoRan Inc. FCX, Southern Copper Corporation SCCO and Coeur Mining CDE. These companies are poised to gain from their endeavors to build reserves and control costs, while investing in technology and improving production efficiency.

About the Industry

The Zacks Mining - Non Ferrous industry comprises companies that produce non-ferrous metals, including copper, gold, silver, cobalt, molybdenum, zinc, aluminum and uranium. These metals are utilized by various industries, including aerospace, automotive, packaging, construction, machinery, electronics, transportation, jewelry, chemical and nuclear energy. Mining is a long, complex and capital-intensive process. Significant exploration and development to evaluate the size of the deposit, followed by the assessment of ways to extract and process the ore efficiently, safely and responsibly, precede actual mining. The miners continually search for opportunities to grow their reserves and resources through targeted near-mine exploration and business development. They strive to upgrade and improve the quality of their existing assets, internally, as well as through acquisitions.

What's Shaping the Future of the Mining-Non Ferrous Industry?

Fears of Rate Hikes, Weak Demand in China Hurt Prices: Copper prices have declined for the major part of 2022 due to varied reasons — the uncertainties surrounding the global economy, resurgent COVID-19 outbreaks in top consumer China, the Russia-Ukraine situation, the spike in energy costs and low global inventories. Zinc and nickel prices were also weighed down by worries about weak demand as COVID-19 lockdowns in China stoked concerns over a global recession. Gold and silver prices had also been negatively impacted, owing to a stronger U.S. dollar, rising interest rates and sluggish growth. Recently, stronger-than-expected U.S. economic data has fueled expectations of further monetary tightening from the Federal Reserve, which, in turn, has impacted commodity prices. Also, demand has been lower than expected in China, which is impacting prices. Slower-than-expected demand recovery following the Lunar New Year holiday in China has been impacting metal prices.

Cost Control & Innovation to Increase Efficiency: The industry has been facing a shortage of skilled workforce to date, which hiked wages. Labor-related disputes can be damaging to production and revenues. The industry players are grappling with escalating production costs, including electricity, water and materials, as well as higher freight expenses and supply-chain issues. Since the industry cannot control the prices of its products, it focuses on improving sales volume, increasing operating cash flow and lowering unit net cash costs. The industry participants are opting for alternate energy sources to minimize fuel-price volatility and secure supply. Miners are now committed to cost-reduction strategies and digital innovation to drive operating efficiencies.

Demand and Supply Imbalance to Eventually Support Prices: The industry players are dealing with depleting resources, declining supply in old mines and a lack of new mines. Development projects are inherently risky and capital-intensive. Demand for non-ferrous metals will remain high in the future, given their wide use in primary sectors, including transportation, electricity, construction, telecommunication, energy, information technology and materials. The demand for electric vehicles and renewable energy is expected to be a significant growth driver for metals like copper and nickel in the years to come. The plan to overhaul and upgrade the nation’s infrastructure and promote green policies per the U.S. Infrastructure Investment and Jobs Act will require a huge amount of non-ferrous metals. While demand remains strong, there will be an eventual deficit in metal supply, leading to a situation that will bolster metal prices. This, in turn, would favor the industry in the long haul.

Zacks Industry Rank Indicates Weak Prospects

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates a gloomy near term. The Zacks Mining - Non Ferrous industry, a 12-stock group within the broader Zacks Basic Materials Sector, currently carries a Zacks Industry Rank #189, which places it in the bottom 24% of 251 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. Since the beginning of this year, the industry’s earnings estimates for the current year have moved down 27%.

Before we present a few stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock-market performance and its valuation picture.

Industry Versus Broader Market

The Zacks Mining- Non Ferrous Industry has outperformed its sector and the Zacks S&P 500 composite over the past 12 months. The stocks in this industry have collectively gained 6% in the past year compared with the Zacks Basic Materials sector’s decline of 6.1%. The S&P 500 has dipped 10.9% in the said time frame.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month EV/EBITDA ratio, a commonly used multiple for valuing Mining- Non Ferrous stocks, we see that the industry is currently trading at 8.14X compared with the S&P 500’s 19.71X. The Basic Materials sector’s trailing 12-month EV/EBITDA is at 6.88X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Over the last five years, the industry traded as high as 8.88X and as low as 4.80X, with the median being at 5.95X.

3 Mining-Non Ferrous Stocks to Keep an Eye on

Coeur Mining: Over the past five years, CDE has invested around $245 million in exploration investment, which has resulted in peer-leading reserve and resource growth, and longer mine lives. Backed by these efforts, on a gold-equivalent basis, reserves have increased 34% net of depletion, measured and indicated resources have grown by 80%, and inferred resources have expanded 26% since 2017. CDE’s exploration investments remain focused on generating attractive returns from near-term priorities, including mine life extensions at Kensington, which was achieved in 2022. Resource growth at the high-grade Silvertip project in British Columbia, and additional enhancements to Rochester’s reserve and resource pipeline will also aid growth. Construction at Rochester is scheduled to be completed by mid-year 2023. The sale of Crown Sterling holdings completed last year is consistent with Coeur Mining’s strategy of monetizing non-core assets and prioritizing high-return growth from its North American asset portfolio. CDE shares have gained 3.1% over the past six months.

This Chicago, IL-based company explores, develops, and produces gold, silver, zinc and lead properties with five operations in the United States, Mexico and Canada. The Zacks Consensus Estimate for the company’s fiscal 2023 earnings indicates year-over-year growth of 50%. The estimate has been unchanged over the past 60 days. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price & Consensus: CDE

Freeport-McMoRan: FCX’s exploration activities near existing mines, which are focused on expanding reserves, will drive growth. It is expected to benefit from the ongoing large-scale concentrator expansion project at Cerro Verde that will likely result in incremental annual productions of 600 million pounds of copper and 15 million pounds of molybdenum. Cerro Verde's expanded operations will also offer cost efficiencies, and large-scale and long-lived reserves. It is assessing a large-scale milling operation at El Abra to process additional sulfide material. The expansion at Morenci increased milling rates. The Lone Star project in eastern Arizona has been completed and is on track to produce more than 200 million pounds of copper annually. The company is looking to advance studies for potential expansions and long-term development options for its large-scale sulfide resources at Lone Star. It is also ramping up underground production at Grasberg in Indonesia, resulting in a spike in milling rates. The focus on cost management and reduction of debt levels is commendable. Shares of FCX have gained 27% over the past six months.

Based in Phoenix, AZ, Freeport-McMoRan is engaged in mineral exploration and development; mining and milling of copper, gold, molybdenum and silver; and smelting and refining copper concentrates. The Zacks Consensus Estimate for FCX’s earnings for 2023 has moved up 18% over the past 90 days. FCX has a trailing four-quarter earnings surprise of 1.1%, on average. The company currently carries a Zacks Rank #3 (Hold).

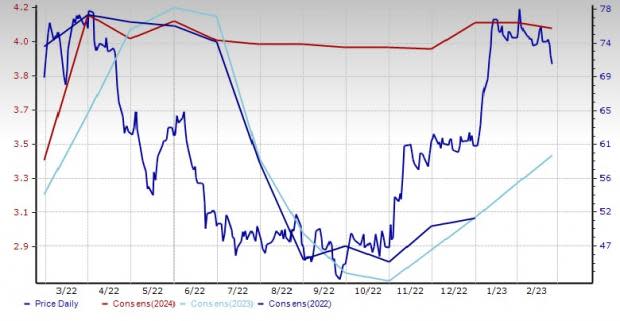

Price & Consensus: FCX

Southern Copper: The company has the largest copper reserves in the industry and operates world-class assets in investment-grade countries, such as Mexico and Peru. Its constant focus on increasing low-cost production is commendable. SCCO expects copper production in 2023 to reach 926,000 tons, with the Peruvian production coming back on track, and new production at Pilares, El Pilar and Buenavista. The company’s capital investment program for this decade exceeds $15 billion and includes investments at the Buenavista Zinc, Pilares, El Pilar and El Arco projects in Mexico and at the Tia Maria, Los Chancas and Michiquillay projects in Peru. It will gain from its efforts to grow in Peru, given that the country is currently the second-largest producer of copper globally and holds 13% of the world’s copper reserves. The company's shares have gained 43% in the past six months.

The Zacks Consensus Estimate for the Phoenix, AZ-based company’s fiscal 2023 earnings has been revised upward by 11.8% over the past 60 days. SCCO has a trailing four-quarter earnings surprise of 7%, on average. The company, which engages in mining, exploring, smelting, and refining copper and other minerals, currently carries a Zacks Rank #3.

Price & Consensus: SCCO

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Freeport-McMoRan Inc. (FCX) : Free Stock Analysis Report

Southern Copper Corporation (SCCO) : Free Stock Analysis Report

Coeur Mining, Inc. (CDE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance