3 Leading Dividend Stocks With Yields Up To 3.5%

As global markets exhibit resilience with major U.S. indexes like the Dow Jones and S&P 500 reaching record highs, investors are witnessing a period of moderated inflation and easing interest rate concerns. In this context, dividend stocks become particularly attractive, offering potential for steady income in a landscape where long-term treasury yields are falling and market volatility persists.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Wuliangye YibinLtd (SZSE:000858) | 3.01% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.49% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 8.12% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.63% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.16% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.50% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.40% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.14% | ★★★★★★ |

Innotech (TSE:9880) | 4.02% | ★★★★★★ |

Click here to see the full list of 1889 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Ternium Argentina

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ternium Argentina S.A., along with its subsidiaries, specializes in manufacturing and processing a range of steel products in Argentina, boasting a market capitalization of approximately ARS 4.36 trillion.

Operations: Ternium Argentina S.A. generates its revenue primarily through two segments: Coated steel products, contributing ARS 551.20 million, and Uncoated steel products, accounting for ARS 647.51 million.

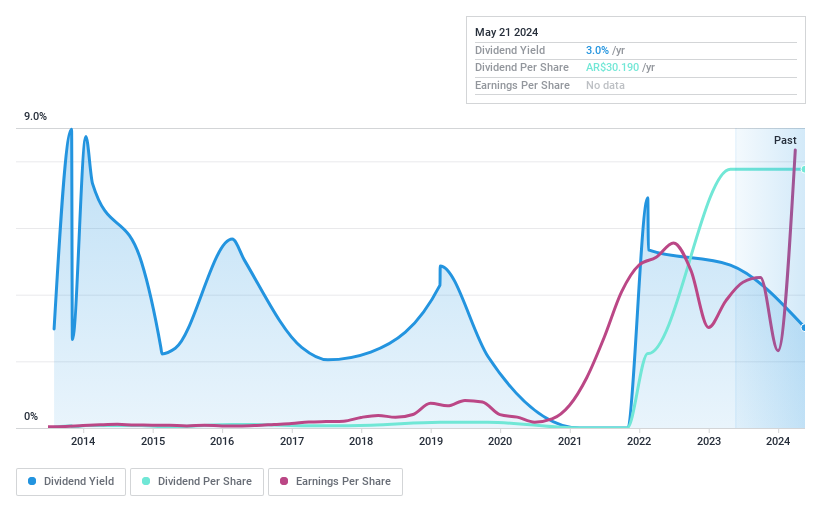

Dividend Yield: 3%

Ternium Argentina has demonstrated significant earnings growth, with a recent report showing first-quarter sales of AR$436.39 billion, up from AR$165.53 billion the previous year, and net income rising to AR$216.61 billion from AR$50.35 billion. Despite this performance, the company's dividends present challenges; its payout ratio of 109.5% indicates that dividends are not well covered by earnings, reflecting a potential risk for sustainability. Moreover, Ternium's dividend yield stands at 3.01%, higher than the market average but is compromised by past volatility and unreliable payouts over the last decade.

Unlock comprehensive insights into our analysis of Ternium Argentina stock in this dividend report.

Upon reviewing our latest valuation report, Ternium Argentina's share price might be too optimistic.

Yapi ve Kredi Bankasi

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers a range of banking products and services both in Turkey and globally, with a market capitalization of approximately TRY 320.65 billion.

Operations: Yapi ve Kredi Bankasi A.S. generates its revenue primarily from Retail Banking (including Private Banking and Wealth Management) with TRY 69.08 billion, followed by Commercial and SME Banking at TRY 48.89 billion, Treasury, Asset Liability Management and Other at TRY 20.86 billion, Corporate Banking at TRY 13.39 billion, Other Domestic Operations at TRY 10.41 billion, and Other Foreign Operations contributing TRY 3.95 billion.

Dividend Yield: 3.2%

Yapi ve Kredi Bankasi (YKBNK) maintains a low payout ratio of 15.6%, ensuring dividends are well-covered by earnings, with expectations to remain so over the next three years. Despite trading below fair value, the bank's dividend history is marked by instability and unreliability over the past decade. Additionally, YKBNK faces challenges with a high bad loans ratio at 2.6%. Recent M&A rumors involving First Abu Dhabi Bank potentially acquiring a significant stake could influence future performance and stability.

LX International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX International Corp. operates a global trading business based in Korea, with a market capitalization of approximately ₩1.24 trillion.

Operations: LX International Corp.'s revenue is primarily generated through three segments: the Resource Sector (₩1.08 billion), Trading/New Business (₩6.75 billion), and the Logistics Division (₩6.79 billion).

Dividend Yield: 3.6%

LX International has shown a growth in dividends, albeit with a short history of only 7 years and some volatility, including significant annual drops. Despite this instability, both earnings and cash flow adequately cover the dividend payments, with payout ratios at 60% and 11.9% respectively. The company's recent financials indicate a decrease in net income despite higher sales. Analysts predict the stock price could rise by 21.3%, trading at 46.1% below estimated fair value.

Navigate through the intricacies of LX International with our comprehensive dividend report here.

Upon reviewing our latest valuation report, LX International's share price might be too pessimistic.

Make It Happen

Unlock more gems! Our Top Dividend Stocks screener has unearthed 1886 more companies for you to explore.Click here to unveil our expertly curated list of 1889 Top Dividend Stocks.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BASE:TXARIBSE:YKBNKKOSE:A001120 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com