3 Intriguing Top-Rated Stocks to Buy After Earnings

When popular companies’ top earnings expectations they often receive an abundance of attention but strong quarterly results from lesser-known names can really get the ball rolling in regard to their stock performance.

Here are three top-rated stocks that investors shouldn’t overlook as they could start to rally after impressive earnings beats.

Danaos (DAC)

More known than the other names on the list, Danaos Corporation is standing out with a Zacks Rank #1 (Strong Buy) after easily surpassing first-quarter EPS estimates on Monday.

Danaos is a leading international owner of containerships, chartering vessels to many of the world’s largest liner companies. Notably, Danaos’ Transportation-Shipping Industry is in the top 37% of over 250 Zacks industries.

First-quarter earnings of $7.14 per share came in 21% above EPS expectations of $5.90. Annual earnings are now forecasted to dip -21% in fiscal 2023 at $27.33 per share after a tough year to follow and EPS of $34.68 in 2022. With that being said, FY24 earnings are forecasted to stabilize and rise 4% at $28.52 per share.

Plus, earnings estimate revisions have trended higher over the last 30 days with Danaos' robust bottom line starting to look more stable than other shipping companies.

Image Source: Zacks Investment Research

Danaos stock also trades at $61 a share and just 2.2X forward earnings which is nicely beneath the industry average of 5.6X and a considerable discount to the S&P 500’s 19X.

Image Source: Zacks Investment Research

Pioneer Power Solutions (PPSI)

Among industrial products stocks, Pioneer Power Solutions looks intriguing and lands a Zacks Rank #2 (Buy) with the company posting a surprise profit on Monday.

The business environment is favorable for Pioneer Power with its Manufacturing-Services Industry in the top 14% of all Zacks industries. As a specialty manufacturer of electrical transmission and distribution equipment, Pioneer Power posted Q1 earnings of $0.01 per share compared to estimates of -$0.03 a share.

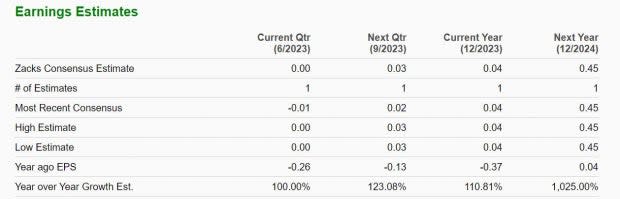

With shares of PPSI trading at $5, earnings are forecasted to climb swing to $0.04 per share in FY23 compared to an adjusted loss of -$0.37 a share in 2022. More intriguing, FY24 earnings are projected to skyrocket another 1,025% at $0.45 per share.

Image Source: Zacks Investment Research

VirTra (VTSI)

Sporting a Zacks Rank #1 (Strong Buy) Virtra Systems is a stock investors will not want to overlook after its strong Q1 results on Monday.

Virtra belongs to the Zacks Aerospace sector and is a provider of personal computer and non-personal computer-based products for training/simulation and advertising/promotion markets. Specifically, Vritra’s product lines include firearms training simulators for military and law enforcement.

To that note, the Electronics-Military Industry is in the top 1% of all Zacks industries at the moment. Indicative of its strong industry, Virtra blasted first-quarter earnings expectations by 440% with EPS at $0.27 compared to estimates of $0.05 per share.

Shares of VTSI trade at $7, with earnings now forecasted to jump 28% this year and soar another 126% in FY24 at $0.52 per share.

Image Source: Zacks Investment Research

Bottom Line

These companies are starting to stand out with their bottom lines expanding far more than expected during the first quarter. This is very promising with economic uncertainty still hindering many companies. Furthermore, the earnings potential of Danaos, Pioneer Power, and Virtra shouldn’t be overlooked as it could lead to a nice amount of upside in their stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaos Corporation (DAC) : Free Stock Analysis Report

Pioneer Power Solutions, Inc. (PPSI) : Free Stock Analysis Report

VirTra, Inc. (VTSI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance