3 High Yield Dividend Stocks In India With Yields Up To 4.1%

The Indian market has shown robust growth, rising 1.5% in the last week and an impressive 46% over the past year, with earnings expected to grow by 16% annually. In this buoyant environment, high-yield dividend stocks can be particularly attractive for investors looking for steady income combined with potential capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 3.94% | ★★★★★★ |

Gulf Oil Lubricants India (NSEI:GULFOILLUB) | 3.36% | ★★★★★☆ |

D. B (NSEI:DBCORP) | 3.52% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.16% | ★★★★★☆ |

Bharat Petroleum (NSEI:BPCL) | 7.00% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.04% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.39% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.67% | ★★★★★☆ |

Oil and Natural Gas (NSEI:ONGC) | 4.12% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.56% | ★★★★★☆ |

Click here to see the full list of 15 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

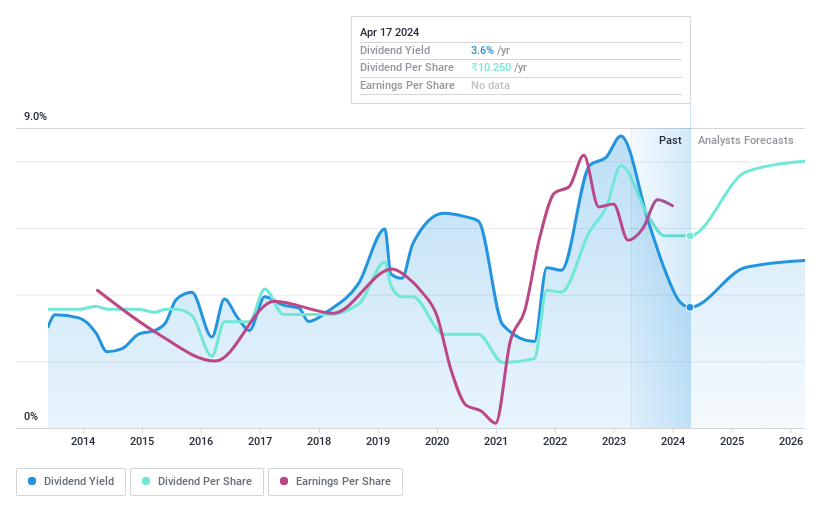

D. B

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms, with a market capitalization of approximately ₹65.79 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing business, which earned ₹22.43 billion, and its radio segment, which contributed ₹1.59 billion.

Dividend Yield: 3.5%

D. B. Corp Limited, with a P/E ratio of 15.5x, stands below the Indian market average of 34.4x, indicating a potentially attractive valuation for dividend investors. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 54.4% and 43.6% respectively, suggesting sustainability despite its historically volatile dividend track record over the past decade. Recent financials show a substantial increase in net income to INR 4,255.23 million from INR 1,690.85 million year-over-year and an interim dividend announcement of INR 8 per share aligns with its ongoing commitment to shareholder returns.

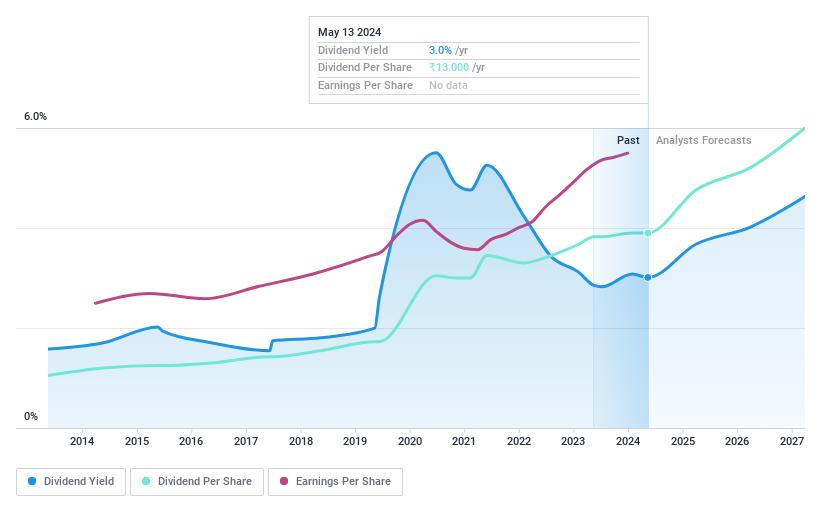

ITC

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITC Limited operates in diverse sectors including fast-moving consumer goods, hotels, paperboards, paper and packaging, agriculture, and information technology across India and globally, with a market capitalization of approximately ₹5.65 trillion.

Operations: ITC Limited generates revenue from several segments: FMCG - Cigarettes (₹336.68 billion), FMCG - Others (₹210.02 billion), Agri Business (₹161.24 billion), Paperboards, Paper & Packaging (₹83.44 billion), and Hotels (₈31.03 billion).

Dividend Yield: 3%

ITC Limited reported a revenue increase to INR 795.68 billion for FY 2024, up from INR 784.99 billion the previous year, with net income also rising to INR 204.59 billion from INR 191.92 billion. Despite these gains, the dividend payout ratio stands high at 83.7%, raising concerns about sustainability given a cash payout ratio of 126.1%. The company's dividends have shown stability over the past decade and are in the top quartile of Indian dividend payers with a yield of 3.04%. However, this is tempered by earnings forecasts predicting modest growth and ongoing high payout ratios which may challenge future dividend reliability without improved cash flow coverage.

Click to explore a detailed breakdown of our findings in ITC's dividend report.

Our valuation report unveils the possibility ITC's shares may be trading at a premium.

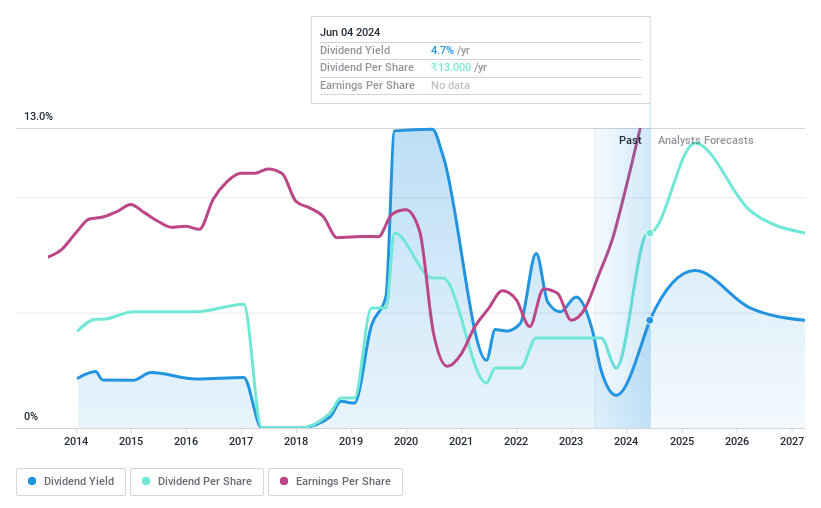

Oil and Natural Gas

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited (ONGC) is engaged in the exploration, development, and production of crude oil and natural gas both domestically in India and internationally, with a market capitalization of approximately ₹3.74 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through its refining and marketing segment in India at ₹56.75 billion, followed by offshore exploration and production at ₹9.43 billion, onshore exploration and production at ₹4.39 billion, and international operations contributing ₹0.96 billion.

Dividend Yield: 4.1%

ONGC has demonstrated a mixed track record in dividend reliability, with payments showing volatility over the last decade, including annual drops exceeding 20%. Despite this, the dividends are well supported financially, evidenced by a low payout ratio of 31.3% and a cash payout ratio of 32.5%, suggesting that current dividends are sustainable from earnings and cash flow perspectives. Additionally, ONGC's dividend yield stands at 4.12%, placing it in the top quartile of Indian dividend stocks. However, investors should be cautious due to past fluctuations in dividend distributions.

Navigate through the intricacies of Oil and Natural Gas with our comprehensive dividend report here.

Where To Now?

Click through to start exploring the rest of the 12 Top Dividend Stocks now.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:DBCORP NSEI:ITC and NSEI:ONGC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com