3 Energy Stocks to Buy at a Discount Before Earnings

After the recent rebound in crude oil prices, several energy stocks are starting to stand out going into their first-quarter earnings reports.

Among the Zacks Oil and Gas-Field Services Industry a few companies looked geared for solid growth with their valuations standing out as well.

Here are three of these stocks investors should consider buying at the moment.

Schlumberger (SLB)

Set to report its first-quarter earnings on Friday, April 21, Schlumberger will be drawing Wall Streets’ attention with many analysts recently boosting their price targets for shares of SLB.

Schlumberger sports a Zacks Rank #2 (Buy) with the oilfield services leaders’ top and bottom line growth very attractive at the moment. There is much optomism about Schlumberger’s expansion as the company offers critical services to upstream energy that includes locating oil and gas along with assistance in drilling and evaluating hydrocarbon wells.

Schlumberger’s earnings are projected to soar 39% this year to $3.03 per share compared to EPS of $2.18 in 2022. Better still, fiscal 2024 earnings are expected to climb another 25% to $3.79 per share. On the top line, sales are forecasted to jump 16% in FY23 and rise another 12% in FY24 to $36.63 billion.

Furthermore, Schlumberger also trades attractively relative to its past from a price-to-earnings perspective. Shares of SLB trade at $52 a share and 17.2X forward earnings. This is 88% below its decade high of 152.5X while offering a 30% discount to the median of 24.9X.

Image Source: Zacks Investment Research

NexTier Oilfield Solutions (NEX)

Another energy stock investors may want to consider buying ahead of earnings is NexTier which will report its quarterly results on Tuesday, April 25.

NextTier offers diverse services for the completion and production of wells and currently lands a Zack Rank #2 (Buy) with the company’s price-to-earnings valuation standing out right now.

Fiscal 2023 earnings are expected to soar 66% this year at $2.62 per share compared to EPS of $1.58 in 2022. Earnings are forecasted to drop -12% in FY24 after what would be an exceptional and very tough year to follow.

With that being said NexTier stock trades at $8 per share and just 3.1X forward earnings. Considering NexTier’s anticipated growth this year, shares of NEX still trade well below the industry average of 11.7X and the S&P 500’s 19.2X.

Image Source: Zacks Investment Research

Ranger Energy Services (RNGR)

Also worthy of consideration is Ranger Energy Services which reports its Q1 earnings next Thursday on April 27. Sporting a Zacks Rank #2 (Buy) Ranger provides well-service rigs and services primarily in the United States.

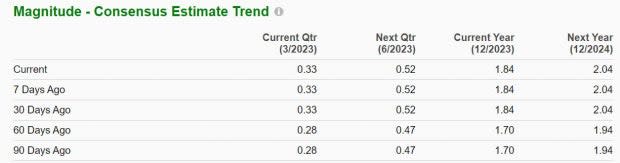

Ranger focuses on unconventional horizontal well completion and production operations. With earnings estimate revisions trending higher over the last 60 days, Ranger’s unique service appears to be paying off.

Earnings are now forecasted to skyrocket 192% this year at $1.84 per share compared to EPS of $0.63 in 2022. Fiscal 2024 earnings are expected to jump another 11%.

Even better, Ranger stock trades around $11 per share and just 6.3X forward earnings which is nicely beneath the industry average of 11.7X and the benchmark.

Image Source: Zacks Investment Research

Bottom Line

These energy stocks appear to be trading at nice discounts considering their growth prospects and now may be a good time to buy with crude oil prices rebounding over the last month. Furthermore, oil prices should be supported by the warmer summer months with peak travel season ahead and this could lead to strong guidance in their first quarter reports.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Ranger Energy Services, Inc. (RNGR) : Free Stock Analysis Report

NexTier Oilfield Solutions Inc. (NEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance