3 Dividend Growth Stocks to Buy and Never Sell

One of the best ways to find strong long-term investments is to look for stocks that have increased dividends consistently. Stocks known as dividend aristocrats are those that have raised their dividend payments every year consecutively for at least 25 years. The stocks I share below have a high Zacks Rank and have raised dividends for more than 50 years running.

If the economic picture were to become significantly more uncertain, dividend stocks like these will play a critical role in providing a sense of certainty for investors. Alternatively, even if the economy stays strong, these are still great companies to invest in.

3M

3M MMM is an international conglomerate producing a diverse range of products that span across multiple industries. It operates through four segments: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer. MMM was founded in 1902 and has annual revenues of $35 billion.

3M has raised its dividend 64 years in a row. 3M’s dividend currently yields 5.9%. This continuous growth is reflected by equally consistent growth in sales and earnings over that time and indicates how important and widely used MMM products are. Additionally, it shows management’s commitment to redistributing profits to shareholders, while also continuing to reinvest in the company to innovate new products and grow sales.

Image Source: Zacks Investment Research

MMM is a Zacks Rank #2 (Buy) stock, indicating upward trending earnings revisions. While sales and earnings estimates were lowered because of the expectations of a slowing economy, analysts recently began to upgrade those estimates. Current year sales growth is expected to slow -7% YoY to $31.8 billion, but next year sales are projected to resume growth of 1.9% to $32.55 billion. Additionally, next year earnings are expected to grow 6.8% to $9.23 per share.

Image Source: Zacks Investment Research

MMM is trading at a one-year forward earnings multiple of 12x, which is near its five-year low of 10x, and well below its five-year median of 19x.

Image Source: Zacks Investment Research

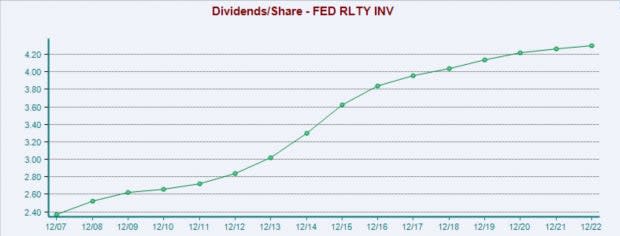

Federal Realty Investment Trust

Federal Realty Investment Trust FRT is a real estate investment trust (REIT) that owns, manages, and develops premium retail and mixed-use properties in the US. Federal Realty Investment Trust’s retail properties are anchored by supermarkets, drug stores or high-volume, value-oriented retailers, which provide consumer necessities. FRT has 103 properties that are reported as 93% occupied.

FRT has been raising dividends for 55 years, and the stock currently boasts a 4.4% dividend yield.

Image Source: Zacks Investment Research

Federal Realty Investment trust earns a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Sales growth is also expected across time frames, with the current quarter projecting 8% YoY growth to $277 million.

Image Source: Zacks Investment Research

FRT is trading at a one-year forward earnings multiple of 15x, which is below its five-year median of 20x, and below the broad market average 19x.

Image Source: Zacks Investment Research

While the current economic environment seems quite uncertain, particularly for the commercial real estate market, FRT still has some encouraging tailwinds. Many of its assets sit in upscale locations, with favorable demographics, which should considerably blunt the effects of an economic slowdown. Additionally, an improving retail real estate environment has been aiding leasing activity in recent quarters.

With a robust business model, and strong prospects, investors can expect continued growth of dividend payments for years to come.

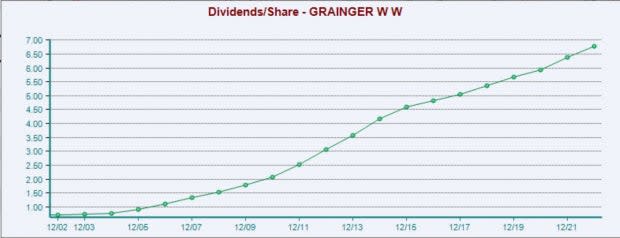

W.W. Grainger

W.W. Grainger GWW is a business-to-business distributor of maintenance, repair and operating products and services. WGG customers represent a wide array of industries including government, manufacturing, transportation, commercial and contractors. W.W. Grainger’s products include material-handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, and metalworking tools.

W.W. Grainger has raised dividends for 51 consecutive years, and the stock currently offers a dividend yield of 1.1%.

Image Source: Zacks Investment Research

Over the last 20 years GWW stock has performed as strongly as any investor can hope. Over that period the stock has appreciated 1900%, which is an extremely impressive 16% annualized. Even more impressive is that this return was achieved with considerably lower volatility than the broad market.

W.W. Grainger is a great example of a less well-known stock quietly making its investors rich over many decades.

Image Source: Zacks Investment Research

GWW currently has a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Sales and earnings expectations were already extremely sound, with current quarter sales expected to grow 11.6% YoY to $4.1 billion, and current year earnings expected to climb 21% YoY to $8.55 per share.

Even with those strong projections, analysts are still upgrading earnings expectations. Analysts have unanimously upgraded earnings estimates across timeframes.

Image Source: Zacks Investment Research

W.W. Grainger currently trades at a one-year forward earnings multiple of 19x, which is right in line with its 20-year median of 19x and below the industry average 21x.

Image Source: Zacks Investment Research

Bottom Line

Dividend growth stocks almost always make for a compelling addition to investors portfolios. With a single indicator of dividend growth, these companies display many of the characteristics a strong long-term investment should have. Even better is that these stocks have near term catalysts because of their upward trending earnings revisions, and high Zacks Ranks.

For dividend growers like these, consistently raising dividends has become a critical pitch to investors. This is a very good thing for the stock holders, because management will always be focused on raising the dividend payments and won’t get side tracked by any other poor capital allocation projects.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3M Company (MMM) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance