3 Companies That Are Changing How Business Gets Done

Tectonic shifts in how business is done can happen seemingly overnight, driven by companies willing to bet that the status quo isn't good enough. The companies responsible for these changes don't always end up winners in the long run, but investors can give themselves a chance to reap market-beating returns by betting on these forward-looking companies.

Three of our Foolish investors think Square (NYSE: SQ), International Business Machines (NYSE: IBM), and IPG Photonics (NASDAQ: IPGP) fit the mold as paradigm-shattering innovators. Here's what investors need to know about how these companies are changing the way business gets done.

Image source: Getty Images.

Making small businesses work

Travis Hoium (Square): There may not be a company that has made it easier to start a small business than Square. Its credit card processors have become commonplace at food trucks and breweries, but it's more than a service for niche businesses.

As Square has grown, it has added solutions for customers like accounting, payroll, and even loans for small businesses, just to name a few. As it's expanded into these services, it has created more value for small businesses and been able to use that to grow itself.

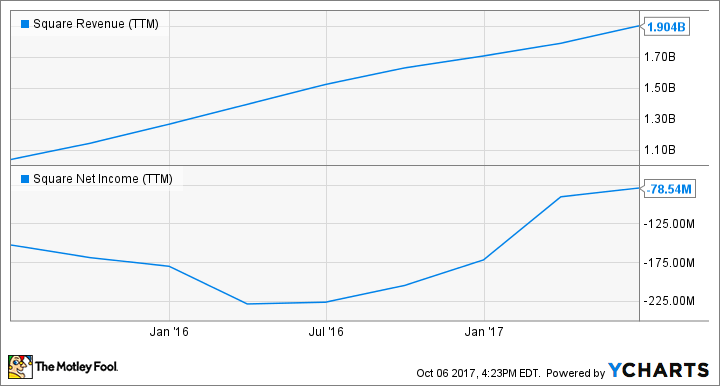

Square still isn't profitable, but you can see in the chart below that it's growing rapidly and has improved the bottom line over the last year, something that should continue as it reaches scale.

SQ Revenue (TTM). Data by YCharts.

What's impressive about Square's business is that it's become a platform on top of which all kinds of new businesses can be formed. New businesses don't need to sign up for a dozen systems and get all kinds of hardware to open up shop. Square handles most of their needs right from a phone or tablet, and all they require is an inexpensive credit card reader. It's not only changing the way business gets done, but also changing how new businesses start and that's a truly revolutionary concept.

Artificial intelligence and blockchain

Tim Green (International Business Machines): IBM has long been in the business of helping other businesses. Its global services arm, which includes consulting and a wide variety of other services, generated more than $17 billion of revenue last year.

With the technological landscape shifting underneath it, IBM has been transforming itself in recent years, shedding some legacy businesses and investing in areas like cloud computing and artificial intelligence. What hasn't changed, though, is IBM's role as a provider of solutions for its enterprise customers.

Watson, IBM's cognitive computing system, is being used in various industries to gain insights from mountains of data. During Hurricane Irma, for example, airlines interacted with Watson half a trillion times, with the system using weather data to reroute planes and minimize turbulence. Artificial intelligence has the potential to upend how business is done, and IBM is one of the companies leading the way.

Blockchain is another technology that could transform business. A distributed ledger that underlies cryptocurrencies, blockchain could prove useful in any industry where complicated transactions involving many parties and reams of paperwork take place. IBM is working with a handful of banks, for example, to build a blockchain-based platform for trade finance. This platform has the potential to cut down on errors, reduce paperwork, and increase transparency.

Century-old IBM may not seem like a disruptive force in the tech industry, but the company is placing bets on two technologies that could transform whole industries in the coming years.

Shine a light on this forward-looking company

Dan Caplinger (IPG Photonics): When most people think about lasers, science fiction movies first come to mind. Yet lasers have become extremely practical tools for industrial use, and IPG Photonics has turned the development of high-end lasers into a highly focused business that has produced amazing growth. As the world's leader in high-performance fiber lasers, IPG Photonics has developed products with a wide range of applications that extend into a large number of industries. IPG products are used in factory operations for materials processing, but you'll also find lasers involved in the communications and entertainment industries as well as for medical, biotechnology, and scientific applications.

IPG Photonics has competitors, but what sets it apart is its highly vertically integrated development and manufacturing process. This internal structure lets the company meet very specific customer needs effectively without having to rely on third-party suppliers to make good on its promises to clients. IPG Photonics' reputation for excellence has led to a hefty backlog of orders, and with strong demand from its core customer base, the laser maker has high expectations both for the immediate future and in the years to come. As the global economy's expansion strengthens, more companies will see the benefit of turning to IPG Photonics for the help that lasers can give them in their businesses.

Dan Caplinger has no position in any of the stocks mentioned. Timothy Green owns shares of IBM. Travis Hoium has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends IPG Photonics. The Motley Fool owns shares of Square. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance