3 Auto Stocks That Should Thrive Despite Peaking Vehicle Sales

After years of steady, healthy, and even exciting growth, the U.S. light-vehicle market is stalling due to worries about tariff wars, rising new-vehicle prices, more compelling used-vehicle options, and less certainty with interest rates and economic growth. That makes owning shares of car dealership groups, auto parts suppliers, and major automakers such as Ford and General Motors less appealing. But that doesn't mean there aren't great auto investments out there. Here are three compelling stocks poised for success despite a slowing light-vehicle market.

The future is now

There's little doubt that the future of transportation will revolve around driverless vehicles. That may be far down the road, but it's not too early to own shares of companies poised to thrive during this evolution. There is a list of companies betting on autonomous vehicles, but none seem as safe as Aptiv (NYSE: APTV).

Many investors are forced to invest in a company that must come out on top to turn into a great investment, such as General Motors and its GM Cruise brand, or Alphabet and its self-driving vehicle company Waymo, to name a couple. But Aptiv doesn't have to bet only on itself; it's developing technology that a slew of companies can use to improve their own driverless vehicles. It doesn't matter which company comes out on top; Aptiv can sell its products to whichever long-term winner emerges.

Image source: Getty Images.

Aptiv might not be a household name just yet, but the company has long been positioning itself to thrive as the self-driving vehicle megatrend gains traction. Its spinoff from Delphi Automotive roughly two years ago separated its legacy powertrain business from its advanced safety, electrical, and collision-avoidance technology. The latter is far more valuable in the world of driverless cars, and less dependent on annual vehicle sales. Aptiv is working with Intel's Mobileye and BMW to create a fully self-driving vehicle by 2021, and has already proven consumers are ready to adopt driverless vehicles with its Lyft partnership in Las Vegas.

Even now, investors have evidence that the business model is working well as it posted adjusted EPS of $1.33 during the second quarter, $0.19 per share higher than analysts' estimates. Management even raised profit guidance for the full year. Aptiv's business is good now -- not as reliant on sales of light-vehicles moving higher -- and remains well positioned to thrive as self-driving vehicles evolve and expand across the globe.

China's electric vehicle boom

While light-vehicle sales are slowing in the U.S., China's market has performed even worse recently. In fact, its automotive sales declined in 2018 for the first year in over two decades. Furthermore, June was the first month with year-over-year sales gains in 2019. But even as automakers struggle through the slowdown, NIO (NYSE: NIO), often referred to as China's Tesla, has seemed to be in a good spot because it sells electric vehicles (EVs). The Chinese government has been encouraging EV sales and has set lofty future sales targets.

According to a report from Research and Markets, 2022 could be when a battery-electric vehicle costs the same as a traditional vehicle, and that could send demand for EVs surging. The report also states that by 2025, China's EV sales could top 5 million units, roughly 20% of the nation's total auto sales; and by 2040, its EV sales could account for almost 70% of the world's auto sales. That potential addressable market should have NIO investors drooling.

Currently, NIO has struggled for a couple of reasons: a huge uptick in competition as many automakers scramble to get in on the EV gold rush, and the Chinese government dialing back subsidies to reduce the higher cost of many EVs. But as many young EV companies go bankrupt or merge, and as vehicle costs come down to offset the loss of subsidies, NIO's market could explode over the next couple of decades.

It's in the early stages of a potentially long and lucrative growth story, even if many investors haven't heard of the company because its vehicles are limited to China. It only sells two models right now, but plans to launch a new one annually for the foreseeable future, along with face-lifts for older models. That could help carve out a niche in the premium Chinese EV market.

With the government seeing EVs as a remedy to pollution, pushing demand higher, NIO is a savvy stock even as traditional vehicle sales stall.

Who needs more sales, anyway?

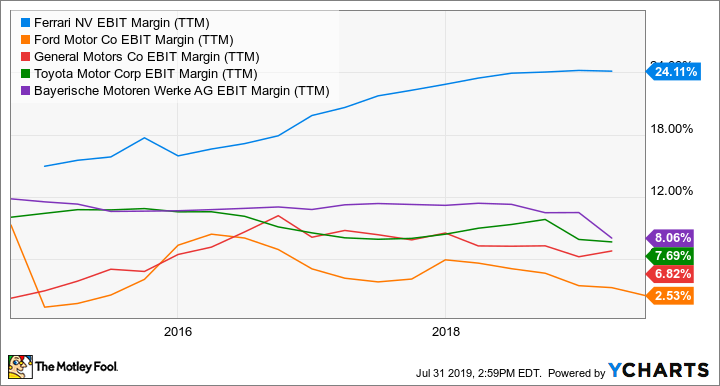

If you're looking for an automaker that can thrive in a sales plateau, start with one that actually doesn't want to sell too many cars -- yes, you read that correctly. A perfect example of an automaker with no pressure for sales increases is Ferrari (NYSE: RACE). The brand's extreme exclusivity maintains its prestigious image -- as well as its lucrative pricing. Ferrari should be considered a super-premium consumer brand rather than a traditional automaker. One look at its margin on earnings before interest and taxes (EBIT) shows how favorably it compares with bigger automakers.

RACE EBIT Margin data by YCharts. TTM = trailing 12 months.

Even as sales of light vehicles slow in the U.S., consider that the company plans to develop 15 new models that could roughly double its profits by the end of 2022. For an automaker over 70 years old, that's impressive.

Even more intriguing are its plans for its first SUV, which could boost margins even higher and appeal to more Chinese buyers, who crave SUVs. The number of wealthy consumers in China has grown large enough that Ferrari can expand its sales there without compromising its brand exclusivity or watering down its pricing.

What savvy investors should think

Sure, investors and Wall Street have shied away from auto stocks as the two largest markets, the U.S. and China, have slowed. But if you ignore all automotive stocks, you'll miss out on some incredible companies that don't rely on rising light-vehicle sales.

Aptiv, with its highly sought-after driverless vehicle technology, is set to thrive for decades if it can continue to innovate. NIO could have a bumpy couple of years but should be poised for long-term growth as the cost of EVs come down in China and the country pushes to solve its pollution and congestion problems. Ferrari's focus on exclusivity, sales growth in super-premium vehicles, and doubling profits makes for an intriguing growth story even as mainstream vehicle sales stall.

All three of these companies are compelling investments right now, and will remain so even if light-vehicle sales trend lower down the road.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Daniel Miller has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares) and Alphabet (C shares). The Motley Fool owns shares of Intel and has the following options: short September 2019 $50 calls on Intel. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance