3 Aerospace-Defense Stocks to Watch on Bright Jet Deliveries View

Impressive projections for aircraft deliveries in 2023, as stated by the International Air Transport Association (IATA), bode well for aerospace-defense stocks that are engaged in commercial aerospace-related operations. However, pandemic-induced supply-chain disruption in the U.S. defense electronics space remains a threat to the industry players. Nevertheless, the outlook remains bright for the defense side of the aerospace-defense industry, buoyed by a solid budget proposal, which should keep investors interested in this industry. The frontrunners in the aerospace-defense industry are Lockheed Martin LMT, Northrop Grumman NOC and General Dynamics GD.

About the Industry

The Zacks Aerospace-Defense industry comprises companies that primarily design and manufacture heavy-built products like commercial as well as military jets and helicopters, tankers and other combat vehicles, missiles, combatant ships as well as auxiliary ships, submarines, bombs, guns, space transportation vehicles, military satellites and a few more. The industry also includes cyber security players who offer information technology (IT) services and C4ISR (command, control, communications, computers, intelligence, surveillance and reconnaissance) solutions. A portion of revenues comes from defense contractors, offering spare parts, aircraft modification, ship repair and overhaul services and supply chain management services.

4 Trends Shaping the Future of the Aerospace-Defense Industry

Improved Air Traffic Outlook Boosts Prospects: Recovering global air traffic data in recent times has boosted the near-term growth prospects of the industry. As stated in a report published by the International Air Transport Association (IATA) in February 2023, industry-wide revenue per kilometer increased 55.5% year over year. IATA projects a solid recovery for aircraft deliveries in 2023, with a total of 1,540 aircraft scheduled to be delivered this year, up 24% from 2022. Such impressive projections bode well for commercial aerospace manufacturers, which have long borne the brunt of poor air travel in the form of delayed jet deliveries and, in some cases, cancellation of their orders altogether by airlines.

Expanding Defense Budget Remains a Growth Catalyst: While the commercial aerospace market has been recovering steadily over the past couple of quarters, the defense side of the industry stood its ground amid the COVID-19 crisis, cushioned by steady government support. To this end, it is imperative to mention the U.S. fiscal 2024 defense budget request of $842 billion for the Pentagon, which indicates a 3.2% improvement from fiscal 2023’s enacted amount. Such improved budgetary provisions set the stage for industry players focused on the defense business to win more contracts, which should enhance their top line.

Supply Chain Issues May Hurt: Significant supply-chain disruption has been observed in the Aerospace and Defense industry, of late, courtesy of pandemic-induced lower aircraft demand and restrictions on the movement of people and goods. This primarily affected smaller suppliers, like aircraft parts makers, especially those with heavy exposure to commercial aerospace and the aftermarket business. Although the global economy has started to improve, lingering market disequilibria will likely continue to keep prices high, including that of labor, as estimated by IATA. This, in turn, might keep the growth trajectory of the U.S. aerospace and defense industry constricted, to some extent, in the near term.

Strengthening Dollar Adds to Industry Woes: The recently appreciating U.S. dollar is adding another layer of cost to airlines’ operations, which are already burdened with high inflation and jet fuel prices. The Federal Reserve’s policy rate now stands at 4.75%, having started 2022 at 0.25%, and will likely peak in 2023 to the vicinity of 5%, as reported by IATA. All U.S. dollar-denominated costs are rising for airlines, which earn revenues in non-U.S. currency. Similarly, the debt burden has increased for all non-dollar-based entities that have borrowed in dollars. Such a burden on airlines might lead to lower aircraft delivery, thereby hurting aerospace-defense industry players that operate in commercial aerospace, in particular.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Aerospace-Defense industry is housed within the broader Zacks Aerospace sector. It currently carries a Zacks Industry Rank #52, which places it in the top 21% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few aerospace-defense stocks that you may want to add to your portfolio, let’s take a look at the industry’s recent stock market performance and valuation picture.

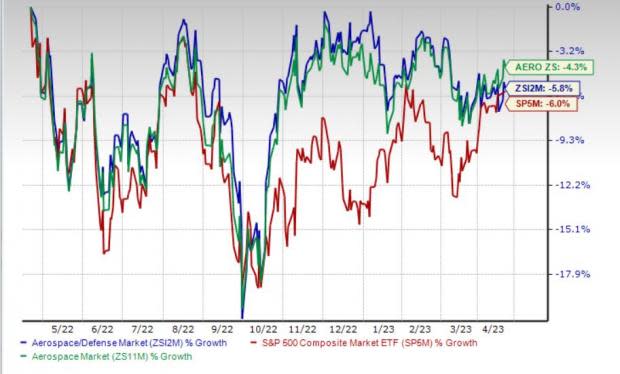

Industry Lags S&P 500 & Sector

The Aerospace-Defense industry has underperformed the Zacks S&P 500 composite as well as its own sector over the past year. The stocks in this industry have collectively lost 5.4% compared with the Aerospace sector’s decline of 3.5%. The Zacks S&P 500 composite has gone down 3.2% in the said timeframe.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month EV/Sales ratio, which is used for valuing capital-intensive stocks like aerospace-defense, the industry is currently trading at 1.85, compared with the S&P 500’s 3.43 and the sector’s 2.19.

Over the past five years, the industry has traded as high as 1.99X, as low as 1.64X, and at the median of 1.88X, as the charts show below.

EV-Sales Ratio TTM

3 Aerospace-Defense Stocks to Keep in Your Watchlist

Lockheed Martin: Based in Bethesda, MD, Lockheed is the largest defense contractor in the world, with its main areas of focus being defense, space, intelligence, homeland security and information technology, including cyber security. The company recently announced that its LM 400, a versatile, mid-sized satellite, which can be adapted for military, civil or commercial uses, has successfully completed Electromagnetic Interference/Electromagnetic Compatibility testing. This trial is crucial to ensuring that signals from the satellite bus components will not interfere with critical payloads during operations. This indicates Lockheed’s significance in the booming space market.

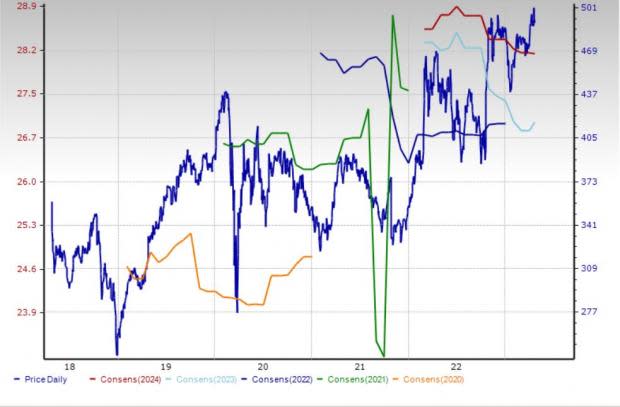

Lockheed currently boasts a long-term earnings growth rate of 6.9%. The company delivered an earnings surprise of 7.46% in the last four quarters, on average. LMT currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price & Consensus: LMT

Northrop Grumman: Based in Falls Church, VA, Northrop supplies a broad array of products and services to the U.S. Department of Defense, including electronic systems, information technology, aircraft, space technology and systems integration services. The company has completed a critical design review for its Tranche 1 Transport Layer (T1TL), part of Space Development Agency’s low-earth orbit network designed to communicate vital information to wherever it’s needed to support U.S. troops on the ground quickly and securely. T1TL communication satellites will provide resilient, low-latency, high-volume data transport, supporting U.S. military missions around the world. This reflects NOC’s significant position in the U.S. space market.

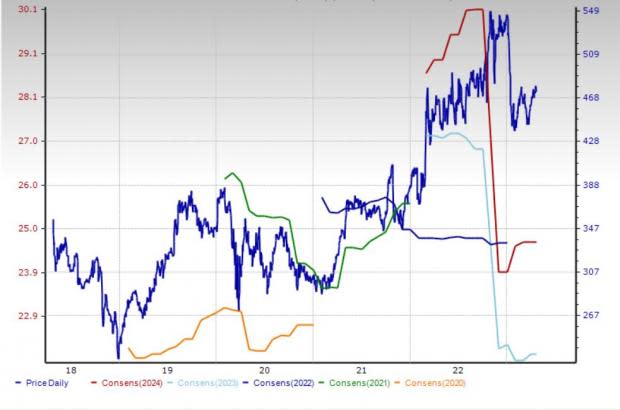

The Zacks Consensus Estimate for Northrop’s 2023 sales implies a solid improvement of 4.6% from the 2022 reported figure. The company delivered an average four-quarter earnings surprise of 3.35%. NOC currently carries a Zacks Rank #2.

Price & Consensus: NOC

General Dynamics: Based in Falls Church, VA, General Dynamics is the leading designer and builder of nuclear-powered submarines and a leader in surface combatants and auxiliary ship design and construction for the U.S. Navy. It is also a premier manufacturer and integrator of land combat solutions worldwide, along with renowned business jets. The company recently announced the continued expansion of its Gulfstream Customer Support Savannah-based maintenance, repair and overhaul (footprint at Savannah/Hilton Head International Airport. This should further bolster GD’s position in the business jet manufacturing market.

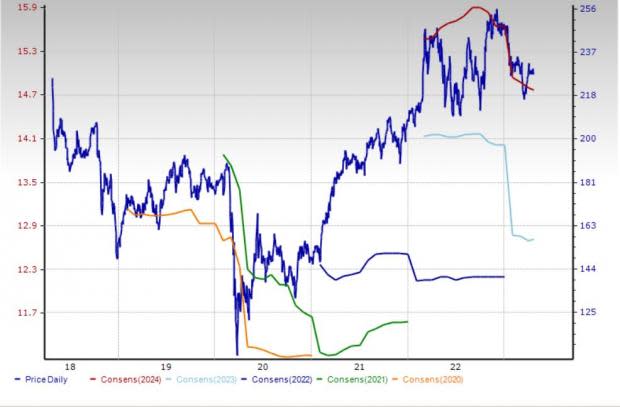

GD boasts a long-term earnings growth rate of 8.6%. The company delivered an average earnings surprise of 2.63% in the last four quarters. General Dynamics currently holds a Zacks Rank #3 (Hold).

Price & Consensus: GD

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance