Will 2022 Be a Better Year for Biotech Than 2021? 3 Big Picks

Despite the success of COVID vaccines and medicines, the biotech sector underperformed the broader market in 2021. The Medical-Biomedical and Genetics industry declined 21.6% in 2021 against the S&P 500 Index’s 29.4% increase.

Image Source: Zacks Investment Research

While companies like Moderna and BioNTech making antibodies/antivirals and vaccines for COVID-19 stole investor interest, other smaller biotech stocks fizzled out probably due to unattractive pipeline data, pipeline/regulatory setbacks, FDA delays, drug pricing pressure and a lack of M&A deals in the sector. In 2020 and 2021, there were numerous IPOs and a significant amount of money flowed into the biotech sector, with investors expecting huge overnight gains. However, given the levels of risk in the sector and the time required for drug discovery, the bubble burst in 2021.

Though 2021 was probably one of the worst years for the biotech sector for reasons unexplained, especially when the broader stock market hit all-time highs, we are quite optimistic for 2022 due to its strong fundamentals. M&A activity is expected to pick up in 2022, including possible mega-mergers. Some of the issues discussed above could reverse in 2022, which could set the sector up well.

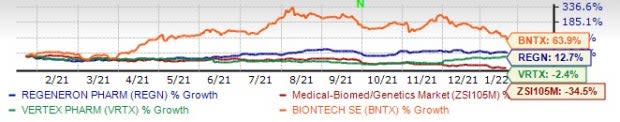

With the biotech sector expected to be in the spotlight in 2022, here we have highlighted three bigshot biotech companies, Regeneron REGN, Vertex Pharmaceuticals VRTX and BioNTech BNTX, which have a Zacks Rank #1 (Strong Buy) or #2 (Buy) and are good stocks to add to your portfolio. All three companies have seen positive estimate revisions in the past 60 days. A chart showing the share price movement of these companies this year so far is given below.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank stocks here.

BioNTech

BioNTech stock has risen 63.9% in the past year. Earnings estimates for 2022 have gone up from $31.14 to $32.52 over the past 60 days. BioNTech sports a Zacks Rank of 1.

BioNTech has been riding high on the success of its two-shot vaccine for COVID-19, Comirnaty, which it has developed with pharma giant Pfizer PFE, based on its proprietary mRNA technology. The vaccine was developed in record time and is now approved for emergency/temporary use in several countries worldwide and fully approved in the United States.

Pfizer and BioNTech’s vaccine was approved for younger patients (5-17 years) in the United States in 2021. A booster dose was also approved. Sales have skyrocketed owing to the vaccine sales. The momentum is expected to continue with the pandemic raging on, thanks to Omicron, which has created the need for a variant-specific booster dose.

In early 2022, BioNTech and Pfizer signed a new collaboration to develop an mRNA-based vaccine for the prevention of shingles, a painful and disfiguring disease.

Apart from this, BioNTech aims to develop an mRNA-based malaria vaccine, and the initiation of a clinical study is expected by the end of 2022. BioNTech is also advancing the development of a broad oncology pipeline, which spans multiple anti-tumor and immune-modulating approaches. The company now has four oncology programs in phase II development.

Regeneron

Regeneron’s stock has risen 12.7% in the past year. Estimates for Regeneron’s 2022 earnings have increased from $46.98 to $47.77 per share in the past 60 days.Regeneron has a Zacks Rank #2.

Regeneron’s performance was outstanding in 2021. Strong demand for eye drug, Eylea and immunology medicine, Dupixent drove sales. Incremental contribution from Regeneron’s antibody cocktail, REGEN-COV (casirivimab and imdevimab, administered together), has boosted the top line significantly and should propel sales as the pandemic continues. Regeneron is in discussions with the FDA to expand the current emergency authorization for REGEN-COV to other populations, including prevention and hospitalized patient settings.

We are encouraged by Regeneron’s strategy of signing deals to boost its portfolio and pipeline. The company is collaborating with Bayer for the global development and commercialization of Eylea outside the United States. Regeneron has a collaboration with Sanofi for promoting Dupixent, Kevzara and Libtayo in the United States.

Continued growth in Eylea and Dupixent through further penetration in existing indications and a promising late-stage pipeline set the momentum for growth.

Vertex Pharmaceuticals

Though Vertex’s stock has declined 2.4% in the past year, its earnings estimate for 2022 has gone up from $13.26 to $13.29 over the past 60 days. Vertex has a Zacks Rank #2.

Vertex’s main area of focus is cystic fibrosis (CF). The CF market represents huge commercial potential. With its four CF medicines, Vertex is treating around half of the 83,000 patients living with CF in the United States, Europe, Canada,and Australia. Meanwhile, the company is making progress toward reaching 30,000 additional patients in these regions through label expansions of its medicines.

Vertex’s CF sales continue to grow despite the impact of the pandemic. Vertex faces only minimal competition in its core CF franchise.

Trikafta’s (triple combo CF medicine) early approval and launch in 2019 in the United States was the most significant milestone for Vertex. In the EU, Kaftrio was approved in August 2020. New reimbursement agreements in ex-U.S. markets and label expansions in younger age groups in the United States are driving Trikafta/Kaftrio sales higher.

Trikafta/Kaftrio is crucial for Vertex’s long-term growth as it has the potential to treat up to 90% of CF patients. Meanwhile, Vertex is pursuing genetic therapies to address the remaining 10% of CF patients, including an mRNA approach in partnership with Moderna. Vertex and Moderna plan to begin clinical development of their CFTR mRNA therapy in 2022.

While Vertex’s main focus is on the development and strengthening of its CF franchise, the company also has a rapidly advancing early-stage portfolio in five additional diseases beyond CF like pain, sickle cell disease, beta-thalassemia, APOL1-mediated kidney diseases and cell therapy for type I diabetes. Data from multiple programs are expected in the next six to nine months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance