2 Tech Stocks to Buy for Strong EPS Growth

As investor optimism continues to grow toward tech stocks seeking out companies that are reconfirming anticipated growth is important as inflationary concerns begin to ease.

Cloud computing provider ServiceNow (NOW) and internet infrastructure services provider Verisign (VRSN) are two worthy candidates in terms of growth. To that point, both stocks have an “A” Zacks Style Scores grade for Growth and now may be a good time to buy as their earnings outlook is very intriguing at the moment.

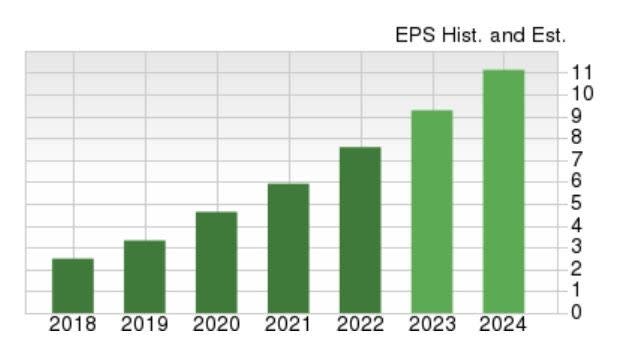

ServiceNow EPS

Starting with ServiceNow which boasts a Zacks Rank #1 (Strong Buy), demand continues to grow for the company’s cloud services that automate digital workflows to accelerate enterprise IT operations.

With sales expected to be up 21% this year to $8.81 billion, ServiceNow’s earnings are projected to climb 26% at $9.59 per share compared to EPS of $7.59 in 2022. Even better, ServiceNow’s bottom line is expected to expand another 24% in fiscal 2024 at $11.95 per share.

Image Source: Zacks Investment Research

Plus, as shown in the above chart earnings estimate revisions have continued to trend higher over the last 60 days. Furthermore, fiscal 2024 EPS projections would represent a mind-blowing 996% growth over the last five years with 2020 earnings at $1.09 per share.

Image Source: Zacks Investment Research

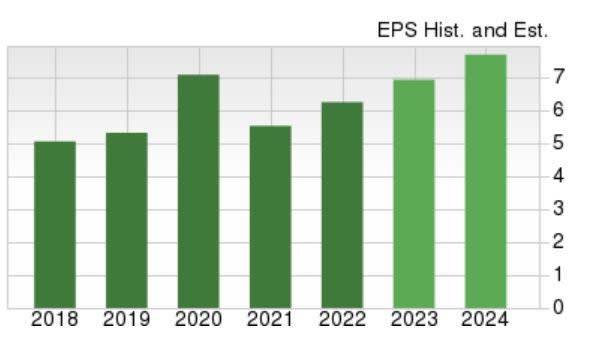

Verisign EPS

Sporting a Zacks Rank #2 (Buy) Verisign is worthy of consideration in regard to EPS growth as well.

Providing infrastructure services including domain name registry and infrastructure assurance, Verisign's sales are now forecasted to be up 5% in FY23 to $1.49 billion and earnings are expected to jump 11% at $6.92 per share.

Better still, FY24 EPS is expected to rise another 11% at $7.68 per share. Notably, Fiscal 2024 EPS projections would represent 49% growth from pre-pandemic levels with 2019 earnings at $5.15 per share. It is also noteworthy that earnings estimate revisions have remained higher over the last 30 days.

Image Source: Zacks Investment Research

Takeaway

ServiceNow and Verisign’s post-pandemic growth has been stellar and as inflationary concerns ease this should continue. On that note, both companies have massive earnings potential in regard to the technology services they offer and have become strong options to invest in among tech stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance