2 Stocks to Buy If Interest Rates Surge Again in 2023

It’s no secret that interest rates have increased over the last year. To combat high inflation, the Federal Reserve and other central banks have been forced to raise interest rates at a rapid pace. After an extended period of rock bottom interest rates this has been difficult for asset markets to digest. Discounting this change caused bonds to have their worst drawdown in recent history and a historically challenging year for stocks.

The popular Treasury Bond ETF TLT experienced a brutal -45% drawdown in 2022.

What’s Next for Interest Rates?

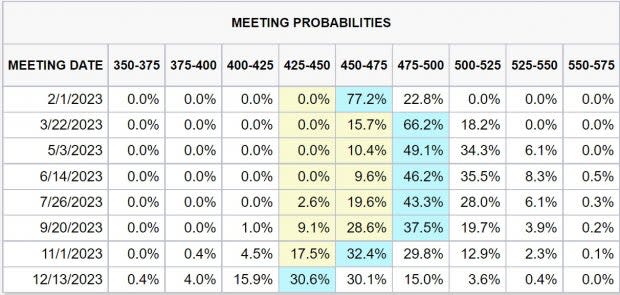

One way to get insight into the future is the CME FedWatch tool. FedWatch is a web-based tool that allows users to view the market’s expectations for future changes to the Federal Funds Rate. The tool displays a graph representing the probability of future rate hikes or cuts based on the curve of CME’s Fed Funds futures contracts. These contracts are financial instruments that allow traders to speculate or hedge against the future level of interest rates.

In the table below, we can see the forecasted probabilities of a range of interest rate hikes or cuts. According to the chart, the Federal Funds Rate is likely to peak at ~5% sometime between the March and September FOMC meeting. For reference, the current target rate is 4.25-4.5%, which means the market is forecasting just another 75 basis points of further hikes and only a 0.5% chance of the FFR trading above 5.5% at any point in 2023.

Image Source: CME FedWatch

There is a lot to take in from this chart, but simply put, based on Fed Funds futures, the market does not expect interest rates to go significantly higher. Predicting interest rates is bold, but I think this forecast is wrong. Last year this same tool forecasted just 0.75% of total hiking in 2022… so its possible for the market to miss.

Image Source: Tradingview

How High can Interest Rates Go?

One investor whose opinion I am always keen on is Stanley Druckenmiller. He is a legendary macro trader who averaged a 30% annual return in his fund from 1986-2010. Druckenmiller was one of the first investors to turn bearish on markets in late 2021 and his call was prescient.

In an interview several months ago, he gave an extremely valuable insight into inflation and the Federal Funds rate. He said that “once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI.”

CPI is currently at 7%, and Core CPI is 6%. The Fed has also stated that the rate of normalization for inflation has been slower than expected. Based on this information, I think a more realistic target for the Federal Funds Rate should be at least 6% this year, higher than is expected by the market.

Stocks to Buy in High Interest Rate Regimes

Even if interest rates don’t go as high as I expect this is still a challenging market environment to invest in. Higher interest rates mean slower growth, lower earnings, and lower earnings multiples. So where is safe?

BIL is an ETF that holds a portfolio of 1-3 month Treasury Bills. It is very low volatility and pays out 3.5% interest annually. It functions like a high yield savings account. It is not an exciting investment, but it is very safe, and if interest rates continue to climb so will the rate of interest the product distributes.

Another safe place is the world-famous Warren Buffett’s Berkshire Hathaway BRK.B. While it offers no dividend payment, you can be sure the excess cash flow is going to be reinvested in a savvy and conservative way.

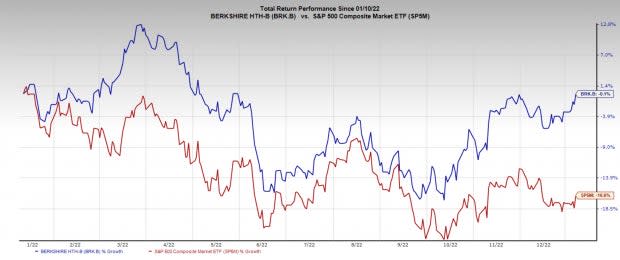

In 2022 Buffett put on a clinic, dramatically outperforming the market during the worst year since the financial crisis. Additionally, BRK.B sports a Zacks Rank #1 (Strong Buy) demonstrating Berkshire Hathaway’s earning outlook has improved even in a challenged economic environment.

Image Source: Zacks Investment Research

Another Zacks Rank #1 (Strong Buy) stock is Imperial Brands IMBBY. Based in the UK, Imperial Brands manufactures and sells tobacco and tobacco products internationally. Tobacco companies tend to also perform quite well during economic recessions. According to He and Yano’s 2009 research, “Tobacco companies are booming despite an economic recession,” in 2008 all major tobacco companies showed sales growth greater than expectations.

Along with its high Zacks Rank, IMBBY also boasts a below industry average P/E ratio, making it an investment with a strong margin of safety. To top it all off, Imperial Brands pays out a very nice 5.6% dividend yield, allowing investors to further build up their cash pile during the tough times.

Image Source: Zacks Investment Research

Conclusion

Higher interest rates undoubtedly make for a more challenging investing environment, but that doesn't mean you have to opt out completely. With a discerning eye, and a willingness to dive into the data, finding a way to make investment returns isn’t impossible. The main concern currently is capital preservation. This is not the time to be venturing into highly speculative investments, but rather into conservative, cash flow generating businesses and investment products. Building up dry powder and losing as little as possible is key to preparing for more investor friendly times.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

iShares 20 Year Treasury Bond ETF (TLT): ETF Research Reports

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

Imperial Tobacco Group PLC (IMBBY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance