2 startups are combining to fix a problem with Wall Street stock research

www.media.tumblr.com

t

Visible Alpha, a startup backed by five banks, is acquiring ONEaccess.

The two firms help investors answer two key questions in the equity research world.

What is your investment recommendation based on? And how valuable is your research?

Wall Street research analysts have lots of ways to communicate their opinions to investor clients.

They can say that a stock is a buy, or a sell. They can be overweight, or underweight. They can be above consensus, or below. They can be neutral, or have a hold rating. But what are those opinions based on?

Visible Alpha, a Wall Street startup backed by banks including UBS and Morgan Stanley, is set up to help investors understand exactly that. Now, the firm is acquiring ONEaccess, another startup that helps firms find corporate access events and track their consumption of research.

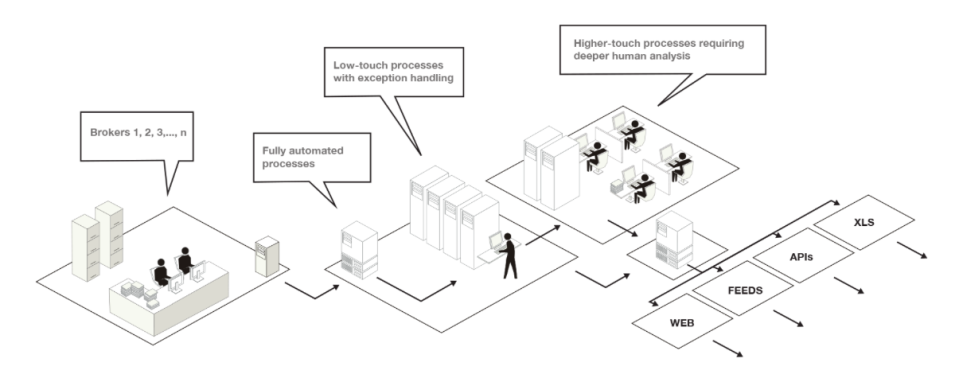

Visible Alpha aims to standardize the analyst models and forecast data that underpin those analyst recommendations like buy, sell, or hold. In effect, it allows analysts to show their working, and for investors to see it and compare it.

“Research analysts spend a lot of time analyzing data, and they put that into their research, but for clients, they want to see that quantified,” Scott Rosen, CEO at Visible Alpha, told Business Insider. “They’re saying: ‘Show me your underlying assumptions.’”

Visible Alpha

ONEaccess meanwhile helps investors track their research consumption, a key requirement with European regulations coming in to force that will require investors to put a monetary value on the research they consume.

“Both companies have focused on optimizing the investment management workflow, but we’ve tackled different aspects of it,” Mike Stepanovich, CEO of ONEaccess said. “By coming together, we are able to solve both sides of the equation for our clients, and we are already receiving positive feedback from them.”

NOW WATCH: A Harvard business professor explains a legal form of ‘insider trading’ in America

The post 2 startups are combining to fix a problem with Wall Street stock research appeared first on Business Insider.

Yahoo Finance

Yahoo Finance