2 Dividend-Paying Shipping Stocks That Ensure Steady income

The Zacks Transportation - Shipping industry is benefiting from the solid demand for goods and commodities. This favorable environment is likely to aid industry participants for the remainder of the year. The buoyancy in the industry is further confirmed by its Zacks Industry Rank #47, which places it in the top 19% of more than 250 Zacks industries.

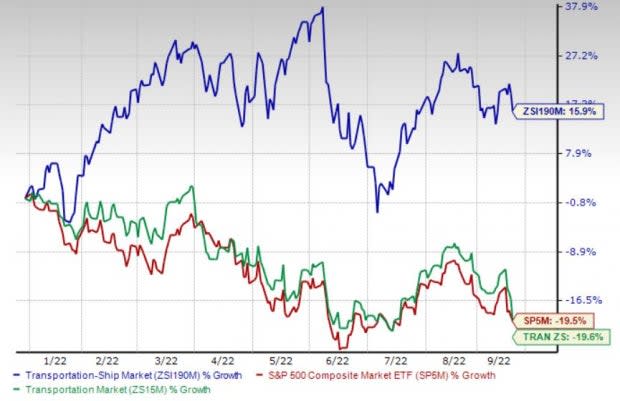

Driven by the tailwinds, the industry has gained 15.9% so far this year in contrast to the S&P 500 Index’s 19.5% decline and 19.6% drop of the broader Zacks Transportation sector.

Image Source: Zacks Investment Research

Given this encouraging backdrop, it would be a wise decision to count on shipping stocks like Costamare Inc. CMRE and Genco Shipping & Trading Limited GNK. Moreover, the fact that they pay attractive dividends adds to the stocks’ appeal, especially in the current uncertain scenario, which is characterized by a great degree of market volatility due to sky-high inflation and increasing interest rates.

Why Dividend Growth Stocks?

Stocks that have a strong history of dividend growth belong to mature companies, which are less susceptible to large swings in the market, and act as a hedge against economic or political uncertainty as well as stock market volatility. At the same time, these offer downside protection with their consistent increase in payouts.

Additionally, these stocks have superior fundamentals. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics.

In view of the tailwinds mentioned, it can be safely said that dividend-paying stocks appear as a preferred option compared to non-dividend-paying stocks in periods of a high degree of market volatility as the present situation.

2 Transportation Shipping Stocks to Embrace Now

We have run the Zacks Stock Screener to identify stocks from the aforementioned industry with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%.

Costamare: This Zacks Rank #2 (Buy) company owns and charters containerships to liner companies worldwide. CMRE’s young fleet size is praiseworthy. We are also impressed by CMRE’s strong cash flow-generating ability. Strong free cash flow generation supports its shareholder-friendly activities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Costamare pays out an annualized dividend of 46 cents per share, which gives it a 4.45% yield at the current stock price. This company’s payout ratio is 14% of its earnings at present. The five-year dividend growth rate is 2.73%. (Check Costamare’s dividend history here).

Costamare Inc. Dividend Yield (TTM)

Costamare Inc. dividend-yield-ttm | Costamare Inc. Quote

Genco Shipping & Trading: Headquartered in New York, this Zacks Rank #3 (Hold) engages in the ocean transportation of dry bulk cargoes worldwide. GNK is being aided by the optimism surrounding the dry bulk market. Increased fleet utilization with the gradual reopening of the economy and an upside in world trade are also aiding GNK.

Genco Shipping pays out an annualized dividend of $2.00 per share, which gives it a 15.06% yield at the current stock price. This company’s payout ratio is 57% of its earnings at present. The five-year dividend growth rate is 131.52%. (Check Genco Shipping’s dividend history here).

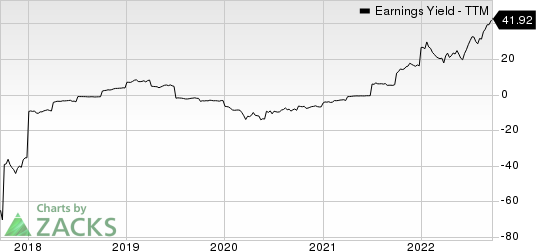

Genco Shipping & Trading Limited Earnings Yield (TTM)

Genco Shipping & Trading Limited earnings-yield-ttm | Genco Shipping & Trading Limited Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genco Shipping & Trading Limited (GNK) : Free Stock Analysis Report

Costamare Inc. (CMRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance