The 10 States Where You Need the Most Amount of Income to Buy a Home in 2024

Owning a home used to be a rite of passage for the middle class. The years immediately following the end of WWII were particularly booming for homebuyers. Thanks to new construction, government insured loans that had relatively low down payment requirements, millions of veterans returning to civilian life were able to purchase homes.

But those days are long gone. Today, mortgage interest rates are sky high, inventory isn’t keeping up with demand and a steep 20% down payment is the norm. That’s quite a pretty penny when considering that the median home price, U.S. Census Bureau and U.S. Department of Housing and Urban Development, the median sales price of houses sold in the U.S was $420,800 as of May 23, 2024.

Check Out: In Less Than a Year, You’ll Regret Not Having Bought Property in These 20 Housing Markets

Try This: Become a Real Estate Investor for Just $1K Using This Bezos-Backed Startup

Home prices vary widely based on location. Some states are infamously more expensive than others. To work out whether you can afford a home in any state this year, it’s important to know how much income is needed.

In a recent study, GOBankingRates found each state’s average 2024 home value and average monthly mortgage assuming buyers would choose a 30-year fixed-rate mortgage and make a 20% down payment with a 6.82% interest rate. From there, assuming housing costs could not exceed 30% of gross income, GOBankingRates found the minimum salary needed to comfortably afford a home in each state.

These are the 10 states where the most amount of income is required to buy a home in 2024.

1. Montana

2024 average home value: $449,576

20% down payment: $89,915.15

Loan amount: $359,660.62

Monthly mortgage: $2,349.51

Annual mortgage: $28,194.14

Minimum salary needed to comfortably afford a home: $93,980.47

Expert Advice: I’m an Economist: Here’s My Prediction for the Housing Market If Trump Wins the Election

For You: 50 Safest and Most Affordable US Cities To Live In

Wealthy people know the best money secrets. Learn how to copy them.

2. New Hampshire

2024 average home value: $474,549

20% down payment: $94,909.87

Loan amount: $379,639.47

Monthly mortgage: $2,480.03

Annual mortgage: $29,760.30

Minimum salary needed to comfortably afford a home: $99,201.00

Trending Now: 5 Worst California Cities To Buy Property Over the Next 5 Years, per Real Estate Agents

3. Oregon

2024 average home value: $494,672

20% down payment: $98,934.35

Loan amount: $395,737.41

Monthly mortgage: $2,585.19

Annual mortgage: $31,022.23

Minimum salary needed to comfortably afford a home: $103,407.45

4. New Jersey

2024 average home value: $518,053

20% down payment: $103,610.60

Loan amount: $414,442.38

Monthly mortgage: $2,707.38

Annual mortgage: $32,488.53

Minimum salary needed to comfortably afford a home: $108,295.12

5. Utah

2024 average home value: $519,376

20% down payment: $103,875.13

Loan amount: $415,500.51

Monthly mortgage: $2,714.29

Annual mortgage: $32,571.48

Minimum salary needed to comfortably afford a home: $108,571.61

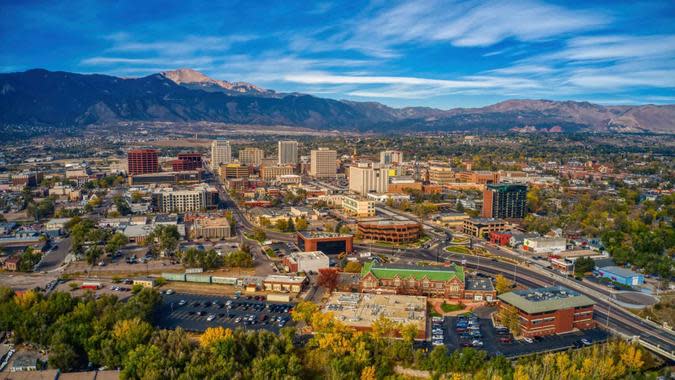

6. Colorado

2024 average home value: $550,945

20% down payment: $110,188.90

Loan amount: $440,755.61

Monthly mortgage: $2,879.27

Annual mortgage: $34,551.25

Minimum salary needed to comfortably afford a home: $115,170.84

Be Aware: Why Many Regret Moving to Texas Post-Pandemic

7. Washington

2024 average home value: $589,240

20% down payment: $117,847.99

Loan amount: $471,391.97

Monthly mortgage: $3,079.41

Annual mortgage: $36,952.87

Minimum salary needed to comfortably afford a home: $123,176.22

8. Massachusetts

2024 average home value: $615,963

20% down payment: $123,192.52

Loan amount: $492,770.08

Monthly mortgage: $3,219.06

Annual mortgage: $38,628.72

Minimum salary needed to comfortably afford a home: $128,762.39

9. California

2024 average home value: $785,333

20% down payment: $157,066.65

Loan amount: $628,266.60

Monthly mortgage: $4,104.20

Annual mortgage: $49,250.42

Minimum salary needed to comfortably afford a home: $164,168.07

10. Hawaii

2024 average home value: $967,270

20% down payment: $193,454.00

Loan amount: $773,816.01

Monthly mortgage: $5,055.01

Annual mortgage: $60,660.18

Minimum salary needed to comfortably afford a home: $202,200.59

More From GOBankingRates

This article originally appeared on GOBankingRates.com: The 10 States Where You Need the Most Amount of Income to Buy a Home in 2024