The 10 Biggest Housing Stocks

There are three main ways you can invest in housing stocks. The most obvious is to buy stock in a homebuilder. But there are also real estate investment trusts (REITs) focused on residential properties and a number of housing-related businesses to consider as well.

As you begin to narrow your list of potential choices, it can be a smart idea to take a closer look at the largest companies in a particular industry. These tend to be more mature players with distinct advantages when it comes to scale and financial flexibility.

Image source: Getty Images.

In housing, the 10 largest companies consist of two homebuilders, six REITs, and two retailers who benefit tremendously when housing is strong. Here's a quick look at the top 10, followed by an overview of each company's business.

To be clear, these companies are ranked in order of market capitalization, which is the total value of all of a company's outstanding shares, as this is a widely used metric of a company's size. There are other ways to rank companies, such as by sales volume, but that isn't a great fit here since these companies operate in several different housing-related businesses.

Rank/Company | 10-Year Total Return* | |

|---|---|---|

1. Home Depot (NYSE: HD) | $233.3 billion | 992% |

2. Lowe's (NYSE: LOW) | $82.1 billion | 490% |

3. AvalonBay Communities (NYSE: AVB) | $29.5 billion | 425% |

4. Equity Residential (NYSE: EQR) | $29.4 billion | 499% |

5. Essex Property Trust (NYSE: ESS) | $20.1 billion | 565% |

6. D.R. Horton (NYSE: DHI) | $16.4 billion | 383% |

7. Invitation Homes (NYSE: INVH) | $14.7 billion | N/A |

8. Mid-America Apartments (NYSE: MAA) | $14.0 billion | 389% |

9. Lennar (NYSE: LEN) | $13.5 billion | 364% |

10. UDR (NYSE: UDR) | $13.1 billion | 575% |

Data source: CNBC. Market capitalization data as of July 10, 2019. Note that these figures and rankings are likely to change over time. Invitation Homes has only been operating for seven years. *through July 23, 2019.

1. Home Depot: The biggest housing stock -- by far

Home Depot is the largest housing stock, by a wide margin. Since it was founded in 1978, Home Depot has grown into the world's largest home-improvement retailer with 2,290 stores in North America with an average of 105,000 square feet of indoor space each. Do this math -- this means that Home Depot has over 240 million square feet of retail space in its stores. In 2018, this space generated $108.2 billion in revenue. You get the point: Home Depot is a massive retailer.

The company is a nice play on the housing market, as it is a major source of hardware, lumber, and other homebuilding supplies for contractors, in addition to its consumer-facing business. And although it's a retailer, it's well insulated from e-commerce headwinds simply because of the nature of its products.

Despite its size, Home Depot continues to grow nicely, thanks to smart investments in e-commerce and other areas of the business. And Home Depot could be a good choice for income-seeking investors, as the company has an excellent track record of increasing its dividend over time.

HD dividend data by YCharts.

2. Lowe's: The "smaller" home retailer

With a market capitalization about one-third of Home Depot's, it might come as a surprise that Lowe's isn't all that much smaller. In 2018, Lowe's had sales of $71.3 billion, and the company operates more than 2,000 stores. And Lowe's is by far the older company -- founded in 1946, 32 years before Home Depot.

However, there are some good reasons for Lowe's cheaper valuation. For starters, the company has struggled to grow the online side of its business. In a recent earnings report, Lowe's said its online sales grew by 11% in the fourth quarter of 2018. This sounds pretty good until you hear that Home Depot's online sales grew by 24% in the same period. Furthermore, Lowe's isn't doing as great of a job when it comes to inventory control, logistics infrastructure, and delivery capabilities, as my colleague Matt Cochrane recently pointed out. And Home Depot consistently wins more market share when it comes to high-spending professional customers.

These are among the reasons why Lowe's operating margins are much lower than Home Depot's. In the first quarter of 2019, Lowe's ran a 9% operating margin -- far below the 15% figure Home Depot managed. This makes a big difference and is why Lowe's commands a cheap valuation relative to the industry leader.

In short, while Home Depot's business is firing on all cylinders, Lowe's is trying to play catch-up in many key areas of its business. It is worth mentioning, however, that Lowe's does have an excellent dividend growth track record, with 56 years in a row of annual dividend raises.

3. AvalonBay Communities: Higher-end apartments with room to grow

AvalonBay Communities is the largest real estate investment trust, or REIT, that focuses on residential properties. The company primarily invests in larger apartment communities located in six core markets -- New England, New York Metro, Mid-Atlantic, the Pacific Northwest, Northern California, and Southern California. In all, the company owns 291 apartment communities in the U.S. The portfolio includes all types of apartments, from suburban garden apartments to urban high-rise buildings.

AvalonBay also has ambitious expansion plans into new markets, particularly Southeast Florida and Denver, where it sees significant growth potential. The current Florida portfolio of three properties and the seven-property Denver portfolio (three of which are under development) could be just a starting point for the company, which has the financial flexibility to pursue growth opportunities where it sees them.

While AvalonBay does acquire properties, its preferred method of growth is development. When executed properly, development has the potential to create shareholder value and deliver superior returns when compared with acquisitions, since properties can be built for less than their completed market value. In fact, AvalonBay estimates that development activity alone has created $26 per share in net asset value since 2011.

From its 1993 IPO through the end of the first quarter of 2019, AvalonBay has generated 13.3% annualized total returns for shareholders and has increased its dividend at a 5.2% average pace. These are extremely impressive numbers to sustain for more than 25 years, and there's still quite a lot of untapped growth potential. And with strong job and wage growth, and the millennial generation continuing to enter its household-forming years, the fundamentals for the rental housing market appear quite strong.

4. Equity Residential: A time-tested business model

Equity Residential is virtually identical in size to AvalonBay, so it wouldn't be surprising if the third and fourth positions on this list swapped back and forth from time to time. In addition to being close in size, Equity also has a similar business model to AvalonBay, in that it focuses its efforts on high-cost housing markets in coastal areas.

The company owns 307 properties totaling nearly 80,000 apartment units, and is the third-largest owner of apartments in the U.S. The company was founded by legendary real estate investor Sam Zell in 1969, making it one of the oldest real estate investment companies in the U.S.

There are a couple of big differences between the two, when it comes to business models. First, AvalonBay is more development-oriented than Equity, at least in recent history. Over the two-year period from 2017 through the end of 2018, AvalonBay spent more than 10 times what Equity did on development.

Second, Equity Residential's portfolio is far more concentrated in urban and high-density suburban markets. Ninety-nine percent of its properties are in the Boston, New York City, Washington, D.C., Seattle, San Francisco, and Southern California metro areas. However, like AvalonBay, Equity is tiptoeing into the Denver market, with one recent acquisition and a total of three properties in the metro area (if you're curious, this is the other 1% of the portfolio).

5. Essex Property Trust: A stock to invest in the booming West Coast apartment markets

Essex Property Trust is the fifth most valuable housing stock in the market and has also been the best-performing publicly traded REIT in the period following its 1994 IPO through the first quarter of 2019. During that time, Essex generated an astounding 4,681% total return (16.9% annualized) for its investors.

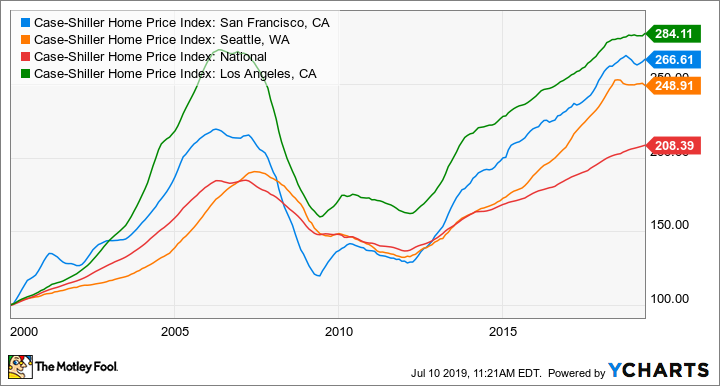

Once you understand Essex's business model, it's not hard to see why it's done so well. Essex owns and operates apartment communities in three West Coast markets -- Seattle, Northern California (San Francisco, Oakland, and Santa Clara), and Southern California (Los Angeles, Orange County, San Diego, and Ventura). If you follow the U.S. real estate markets at all, you know that these have been some of the hottest housing markets in the world. Just look at how home price growth in some of these areas has outpaced the national average.

Case-Shiller Home Price Index: San Francisco, CA data by YCharts.

Now, there's no guarantee that real estate values will continue to rise as rapidly in the future in these markets, but the demographics are certainly favorable for Essex. Here are a few of the trends that could be positive catalysts for Essex going forward:

Homeownership is prohibitively expensive in many of Essex's target markets, making it difficult for renters to become homeowners. In fact, the cost premium to own a home in these markets is estimated at 80% more expensive than renting. And that's after the tax benefits of owning a home.

All of Essex's markets have housing shortages, meaning that not enough new housing units have been built to keep up with demand, with California alone representing almost 50% of the U.S. housing shortfall from 2000-2015.

Essex's markets have seen more than five times as many jobs created as new housing units during the current economic cycle.

Income growth in Essex's markets has outpaced rent growth, so even though these markets are relatively expensive, affordability is improving.

6. D.R. Horton: America's largest homebuilder

D.R. Horton is America's largest homebuilder with the No. 1 volume of new homes delivered every year from 2002 through 2018, and no reason to think the streak will come to an end anytime soon. Over the 12-month period from April 2018 through March 2019, D.R. Horton sold 53,768 new homes, which generated $16.6 billion in revenue.

The company has operations throughout the United States, with particularly large amounts of revenue coming from the Southeast and South Central (Texas, Oklahoma, and Louisiana) states. And, D.R. Horton builds homes at a variety of price points -- the company offers everything from entry-level homes selling for less than $200,000 to luxury homes selling for $500,000 or more.

Recently, D.R. Horton has been using its size and financial flexibility to take advantage of the relatively slow housing market by acquiring smaller competitors. The company has also been focusing more of its efforts on the lower end of the housing market through its entry-level Express Homes brand, as this is where the most demand has been. D.R. Horton expects sales volume to increase, and if it can manage to generate strong margins from its lower-end homes (which has historically been more of a challenge than with luxury homes), the company could see profits rise significantly.

7. Invitation Homes: Some residential REITs aren't just apartments

The overwhelming majority of residential REITs focus on apartment properties of one kind or another, but this isn't true in all cases. There are a few that invest in single-family homes, and none are larger than Invitation Homes.

Invitation Homes owns and operates more than 80,000 single-family rental homes to take advantage of the strong rental market and the fact that apartments simply don't meet the needs of every renter household. The company focuses on markets with strong rates of household formation, as millennials are gradually getting into their peak family forming years. In 15 out of the 17 markets Invitation Homes operates in, it is cheaper to rent a home than to buy one, which helps with demand.

The majority (70%) of Invitation Homes' rental revenue comes from the Western U.S. and Florida, and household formation growth in these markets is twice the national average. And single-family home production is simply not keeping up with demand. Take a look at the graphic below. On the left, you'll see that in Invitation Homes' target markets, household formations are taking place at a rate that's 90% faster than the U.S. average. However, the right side of the graphic shows that new single-family homes are being built at a rate that's 54% slower than average. That's a big imbalance.

Furthermore, the company's scale gives it an inherent efficiency advantage over the competition, most of which consists of local property managers and independent landlords.

Image source: Invitation Homes investor presentation.

It appears that Invitation Homes' location-driven strategy is paying off -- the lowest occupancy rate in one of its markets is 95.8%, and the company's tenant turnover rate is just 31% (last 12 months ending March 31, 2019).

8. Mid-America Apartments: Lower-cost, high-growth apartment markets

Mid-America Apartment Communities was founded in 1977 and has been a publicly traded apartment REIT since 1994. As of March 2019, the company owns nearly 102,000 apartment homes in 305 communities and is based in Germantown, Tennessee.

Unlike the other apartment REITs we've discussed so far, Mid-America Apartments focuses on lower-cost markets that have higher-than-average growth rates. Half of the company's apartments rent for less than $1,275 per month, and to put this into perspective, the average rent of an AvalonBay apartment is roughly twice this amount.

Just to give you an idea of where the company invests, its top three markets by rental income are Atlanta, Dallas-Fort Worth, and Charlotte, North Carolina. The majority of the portfolio is located in the "Sunbelt" region, which generally means the Southeast and Southwestern United States.

The focus on the fastest-growing Sunbelt markets has paid off for investors, as Mid-America Apartments has generated 15.1% annualized returns over the two-decade period through 2019.

9. Lennar: The other biggest homebuilder in the U.S.

D.R. Horton is the largest U.S. homebuilder by number of homes produced, but Lennar is the largest by revenue after its 2018 acquisition of major homebuilder CalAtlantic. Lennar is headquartered in Miami, Florida, has been building homes in the United States since 1954 (under its current name since 1971), and operates in 21 U.S. states.

While D.R. Horton focuses more on the lower to mid-range of the housing market, Lennar is more of an upscale homebuilder. About two-thirds of the homes D.R. Horton sells are priced below $300,000 while the average Lennar home delivered in 2018 sold for $413,000. So, although the 45,627 homes it delivered in 2018 wasn't the largest, the higher average selling price gives it the most revenue.

For both homebuilders on this list, as well as for most others, the housing market has been rather slow lately. Materials costs have been high, mortgage rates rose to an eight-year high in 2018, and the housing market was tight in general. If these trends continue to reverse, it could be a major catalyst for all of the homebuilders going forward.

10. UDR: Geographic diversity and creative management

UDR develops, owns, and operates apartment communities throughout the United States. The company has a presence in 20 major markets throughout the U.S., with 83% of revenue coming from the West Coast, Northeast, and Mid-Atlantic regions. As of March 31, 2019, UDR owns just under 50,000 apartment homes in its portfolio.

In terms of price point, with an average rent of about $2,150, UDR's apartments are somewhat in the middle of the higher-end apartment REITs like AvalonBay and the affordability-focused REITs like Mid-America Apartments.

Over the past several years, UDR has done an excellent job of maximizing efficiency in its portfolio and generating revenue in creative ways. For example, by installing smart devices in its homes, UDR has made its maintenance costs far more efficient. As an example on the revenue side, by providing short-term furnished rentals, the company estimates that it has boosted net operating income by nearly $5 million.

UDR's geographical diversity while still maintaining a presence in some of the hottest housing markets is a key differentiator. This allows it to capitalize on the rapid growth of markets like San Francisco, but its diversification means that it won't get crushed if one of its target markets takes a downward turn.

Should you invest in the big players or look to smaller companies?

Here's the million-dollar question: Larger housing stocks tend to have efficiency advantages, more financial flexibility, and more recognizable brand names than their competition, and also tend to be more mature companies with proven business models as compared to their smaller counterparts.

On the other hand, there's no denying that smaller players in a space have the potential for huge amounts of growth if they can execute their business strategies well.

Generally speaking, if you're looking to get initial exposure to a business in your portfolio, it's a good idea to start with one or more of the larger names in the space. Then, once you've established a "base," it can be a good plan to add some well-run smaller companies with sky's-the-limit growth potential into the mix.

More From The Motley Fool

Matthew Frankel, CFP has no position in any of the stocks mentioned. The Motley Fool recommends Home Depot and Lowe's. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance