1 Great Stock for Your Roth IRA That You've Likely Overlooked

Individual retirement accounts, or IRAs, are a great investing tool for Americans. The Roth variety of IRAs is a particularly good choice for those who qualify, because gains earned in the account can be withdrawn in retirement tax-free (so long as the rules are followed). That tax benefit makes a Roth a great place to hold stocks that promise long-term upside potential.

One company in that category that I'm quite fond of is Paycom Software (NYSE: PAYC). This fast-growing business has been shaking up the payroll processing industry since its founding, and it shows no sign of slowing down. Here's why it's a great stock consider owning, particularly in a tax-advantaged account.

Image source: Getty Images.

Out-innovating that old guard

The payroll industry has been dominated by Automatic Data Processing and Paychex for decades. That fact bothered Chad Richison when he started his career in the industry, because he saw that the legacy solutions could be frustrating to use, and were devoid of innovation. Sensing opportunity, the budding entrepreneur set out on his own to develop a better solution.

He named his startup Paycom Software, and began to build out a suite of tools for employers. The company got its foot in the proverbial door by offering payroll processing solutions that were hosted in the cloud, but quickly expanded into helping employers with modules addressing other mission-critical HR functions -- time management, training, benefits management, scheduling, retirement, and more.

Fast-forward to today, and Paycom's tools have been embraced by thousands of businesses of all sizes.

Mouth-watering financials

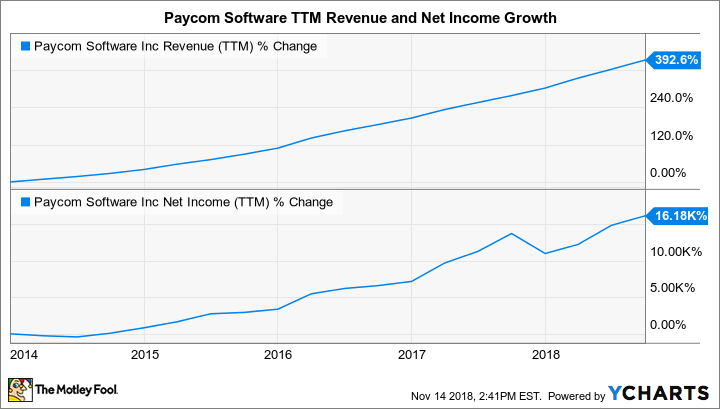

The vast majority of Paycom's revenue is earned through subscription fees, which makes its income statement highly predictable. That's wonderful news for investors, because the company has grown large enough to take advantage of the natural operating leverage that exists in scalable business models. Since Paycom has had no problems steadily winning market share, the company's financials have flourished.

PAYC Revenue (TTM) data by YCharts

More recently, the company decided to invest in a national marketing campaign to drive increased brand awareness. Despite the elevated spending levels, its revenue and adjusted earnings both expanded at 32% in the most recent quarter.

Moving upstream

Switching payroll providers in an arduous process for any business. That fact had historically been why Paycom focused its attention on small and medium-sized businesses, since they tend to be more open to making such a change. However, the company has had so much success within those markets that Paycom has started to target larger customers. As CEO Richinson stated on a recent conference call with investors:

[W]e are pleased to announce that we are expanding our proactive sales efforts from targeting firms with 50 employees to 2,000 employees to targeting firms with 50 employees to 5,000 employees. We have had great success selling to organizations above the 2,000-employee level, as word-of-mouth about the Paycom solution frequently pulls in larger company leads to our sales group.

This expansion of Paycom's target market is great news for shareholders, but the company also sees opportunities for growth within its current list of clients. Right now, the average Paycom customer only utilizes about one-third of its available software modules. If the company can cross-sell its existing clients on more of those additional services, then they become even sticker -- and more profitable.

So how big is the potential pie? Management estimated that its total market opportunity was over $20 billion. For context, the company is expected to pull in about $560 million in total revenue this year.

A premium price

High-quality businesses rarely come cheap, and that's certainly the case today with Paycom: Its stock trades for around 38 times forward earnings and north of 13 times sales -- lofty valuations, for sure.

Investors who can look past the premium price, however, will see a founder-run business with a stellar track record of outperformance, 98% recurring revenue, and a large and growing market opportunity. That's a rare combination, and is a big reason why I've already decided to become a Paycom shareholder. If you like to invest in companies that are in great financial shape and hold lots of long-term growth potential, then you should considering buying Paycom stock too.

More From The Motley Fool

Brian Feroldi owns shares of Paycom Software. The Motley Fool owns shares of and recommends Paycom Software. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance