1 Great Dividend Stock to Benefit From E-Commerce

The rise of e-commerce has hurt many real estate investment trusts. Those focused on certain types of retail properties are obviously under pressure, and even REITs focused on properties like hospitals, hotels, and more are affected by various online-related headwinds.

On the other hand, logistics REIT ProLogis (NYSE: PLD) could be a major beneficiary of e-commerce growth. This stock, which pays a 3% dividend yield and has increased its payout significantly in recent years, could have lots of growth opportunities to capitalize on in the coming decades.

Image source: Getty Images. Image does not necessarily depict a ProLogis facility.

What is logistics real estate, and Prologis in particular?

ProLogis is a real estate investment trust, or REIT, specializing in logistics real estate. Essentially, this means properties such as distribution centers and warehouses used by companies to get products from point A to point B.

As ProLogis says in a recent investor presentation, "we build, lease, and operate distribution space to facilitate the flow of goods around the world."

There has always been a need for logistics properties, but e-commerce is a big driver of recent growth in logistics real estate, as you might expect. Not surprisingly, Amazon.com is one of ProLogis' largest tenants, and other major customers include Walmart, DHL, The Home Depot, and Best Buy, just to name a few.

ProLogis is a massive REIT, with 3,282 properties featuring 684 million square feet of space in 19 countries. In all, there is $1.3 trillion worth of products flowing through ProLogis-owned distribution centers each year.

The company is also one of the financially strongest REITs in the market, with a high credit rating (A3/A-) and a solid balance sheet. This allows ProLogis the flexibility to pursue attractive growth opportunities as they arise, such as ground-up development of new facilities, which creates roughly $450 million in value per year for the company.

Excellent results that could keep getting better

Over the past five years as e-commerce has grown rapidly, ProLogis has grown its core FFO and dividend at a 9% annualized rate, handily beating the REIT average. The company is expecting industry-leading performance in 2018, and there's no reason to believe that things are going to slow down anytime soon.

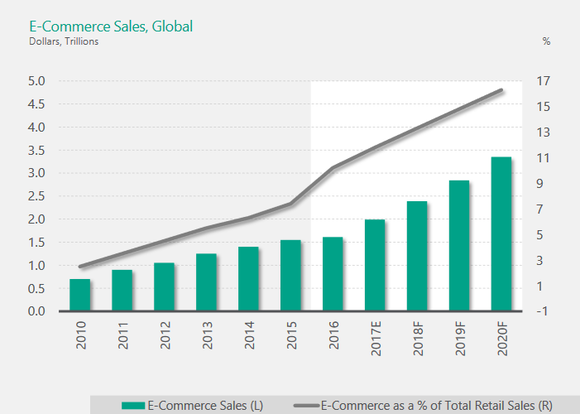

With strong e-commerce growth expected over the coming years, logistics real estate is expected to deliver superior total returns (income plus appreciation) to several other types of commercial properties such as apartment and retail. In fact, e-commerce sales are expected to grow from approximately $2 trillion worldwide in 2017 to nearly $3.5 trillion by 2020.

Image source: ProLogis investor presentation.

After reading all this, you may be thinking, "So what? Whether people are buying items online or in store, products still need to go through warehouses and distribution centers, right?"

Yes, but here's the important takeaway. E-commerce fulfillment requires three times the floor space of brick-and-mortar retailers, on average, because of the broader product lines, high inventory turnover, and parcel-focused shipping strategy. Currently, only about 12% of all retail sales are online, and as this percentage increases, there will be a growing need for logistics real estate. And a market leader like ProLogis has a big advantage when it comes to efficiency and financial flexibility.

As a result, ProLogis sees strong long-term growth potential, both through its existing properties and through expansion. The company sees same-store NOI growing at a 4%-5% annualized rate for the next few years, and has nearly $3 billion in available funding to fuel growth -- such as lucrative development, which I mentioned earlier. And it's important to point out that the company doesn't like to dilute its investors -- in fact, it's one of the few REITs that has not issued any new equity in the past three years.

A great combination of income and growth

Dividends are nice, but dividends combined with growth can make you rich over time. ProLogis offers a solid, growing income stream, as well as the long-term price appreciation potential that comes with a growing type of real estate. If you were looking for a way to play the rise in e-commerce without investing directly in an online retailer, ProLogis could be a smart addition to your portfolio for decades to come.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Matthew Frankel has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon. The Motley Fool has the following options: short May 2018 $175 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance