Will 2018 Mean Déjà Vu for US Steelmakers?

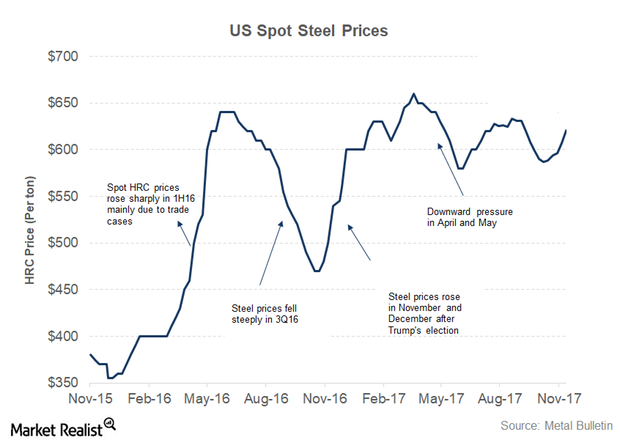

Steel prices are the key driver of steel companies’ profitability. For instance, steel prices tend to be strong in the first half of the year on strong domestic demand and inventory restocking. For instance, in 2015, steel prices were weak throughout the year.

Yahoo Finance

Yahoo Finance