A big environmental infrastructure investment fund aims to raise £50m with a new placement

UK environmental infrastructure investment fund John Laing Environmental Assets Group (JLEN.L) is looking to raise £50m from a fund placement, Yahoo Finance UK can exclusively reveal.

The company, which listed on the main market of the London Stock Exchange, with a market cap of just over £425m ($552m), is aiming to use the cash to pay down its Revolving Credit Facility (RCF), so it can further invest in a raft of projects that it has already locked down.

“We have a very strong pipeline of projects in sectors we are becoming more prominent in, such as anaerobic digestion (AD), that we are looking to capture and put ourselves in the best possible position for those projects,” said Chris Holmes, joint-lead adviser of JLEN, to Yahoo Finance UK.

He added that when JLEN approaches the limit of its RCF, which it is doing at the moment, “it makes sense to come to the market and raise capital and repay the RCF and leave head room to acquire more projects as and when.”

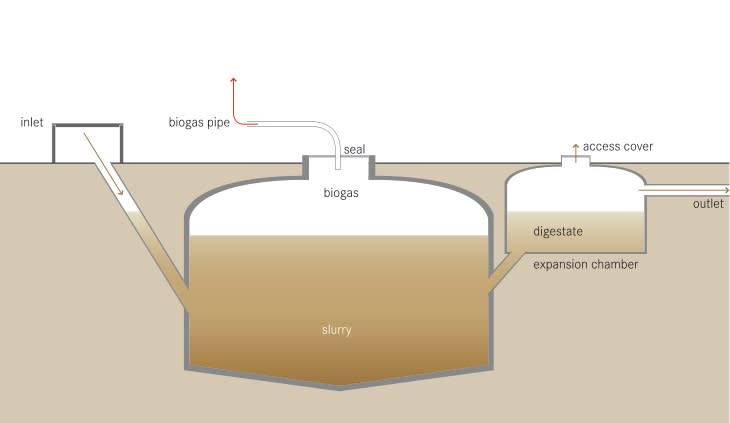

JLEN invests in projects such as wind, solar, waste and water management, and anaerobic digestion (AD). The latter is a way of creating renewable green energy, created from organic materials, including manures or from crops specifically grown for AD. When biodegradable material is broken down by microorganisms in the absence of oxygen, the method of AD takes place. When this happens, it releases biogas which can be turned into heat and electricity.

In August this year, JLEN acquired a fifth AD plant in Hibaldstow, north Lincolnshire, in the UK.

Holmes highlighted how the company views AD as one of the key growth areas, which is supported by Anaerobic Digestion and Bioresources Association data that expects 50 new biomethane-to-grid plants to be built in in the UK within the next 18 months.

JLEN’s current portfolio is mainly in the UK as investment restrictions mean at least 50% of the portfolio (by value) will be based in Britain and the fund will only invest in projects that are located in OECD countries.

However, in the background, there is the lurking question over how Brexit will present potential problems. But Holmes points out that unlike many sectors that have concerns over how a post-Brexit landscape could hit subsidies, AD plants, which JLEN is heavily invested in are not subsidised by the bloc.

Yahoo Finance

Yahoo Finance