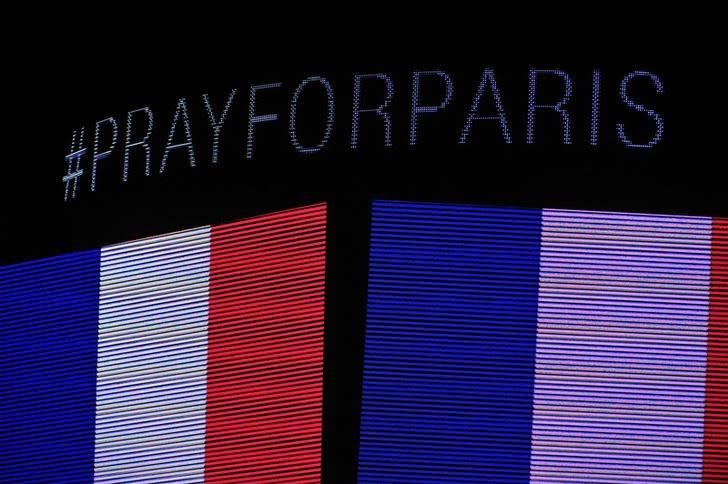

Oil prices rise as tensions mount after Paris attacks

NEW YORK (Reuters) - Oil prices rose on Monday after strong losses last week, as Friday's deadly attacks in Paris raised geopolitical tensions that some said could threaten global oil supply.

France carried out air strikes overnight in Syria against Islamic State, which claimed responsibility for the Paris attacks, and on Monday called on the United States and Russia to join a global coalition to overcome the group.

Oil price gains were limited, however, in a day that saw prices switch from positive to negative and back again, as traders sought to make sense of what the attacks and their aftermath might mean for oil supply and demand.

While geopolitical tensions in the oil-producing Middle East tend to be a bullish factor for oil because of potential disruptions to supply, many expected that the Paris attacks would crimp economic activity in Europe, in part by reducing travel on the continent. Brent crude rose less than U.S. crude on Monday.

"The market is flip-flopping about what the French attacks mean," said Phil Flynn, analyst at Price Futures Group in Chicago. "It is really torn about how to react."

An OPEC delegate from a Gulf oil-producing nation said he believed that oil prices could gain some support in the medium term from rising tensions, particularly if the international community steps up measures to reduce oil smuggling and hits oil facilities under Islamic State's control in Syria and Iraq.

Front-month Brent crude rose 9 cents to settle at $44.56 a barrel, after earlier falling to as low as $43.15.

U.S. futures rose $1 to settle at $41.74 a barrel, after earlier falling to $40.06. The failure to fall below $40 for the first time since late August led to some technical buying in U.S. crude, traders said, bolstered by stock increases on Wall Street.

The spread between Brent and U.S. crude, at $1.68, was at its narrowest level since mid September.

Some expect gains to be limited longer term, however.

"The Paris tragedy may warrant some uptick in geopolitical premia but this is likely trumped by near-term negative impacts on European oil demand," said Ed Morse, global commodities strategist at Citi in New York.

Oil prices last week racked up their biggest weekly losses in eight months, pressured by swelling storage of crude on both land and sea.

Oil prices have dropped more than 60 percent since June last year as high production and inventories have coincided with an economic slowdown in Asia, particularly in China but also Japan, which slipped back into recession in the third quarter.

The International Energy Agency said on Friday there were a record 3 billion barrels of crude and oil products in tanks worldwide, comparable to a month's global oil consumption.

(Reporting by Edward McAllister in New York and Karolin Schaps in London; Additional reporting by Henning Gloystein in Singapore; Editing by Cynthia Osterman and Chizu Nomiyama)

Yahoo Finance

Yahoo Finance