Income gap in Singapore narrows in 2011

The income gap in Singapore narrowed slightly last year after taking into account government schemes to help lower-income households, according to a report by the Department of Statistics (DOS) on Tuesday.

On average, resident households -- households with at least one working person and headed by Singaporeans or permanent residents -- received S$1,660 worth of government transfers per household member from various government schemes last year.

The Gini coefficient, which is a measure of income inequality, inched up last year to 0.473 from 0.472 the year before. However, after adjusting for government transfers and taxes, it fell to 0.452 from 0.455 over the same period.

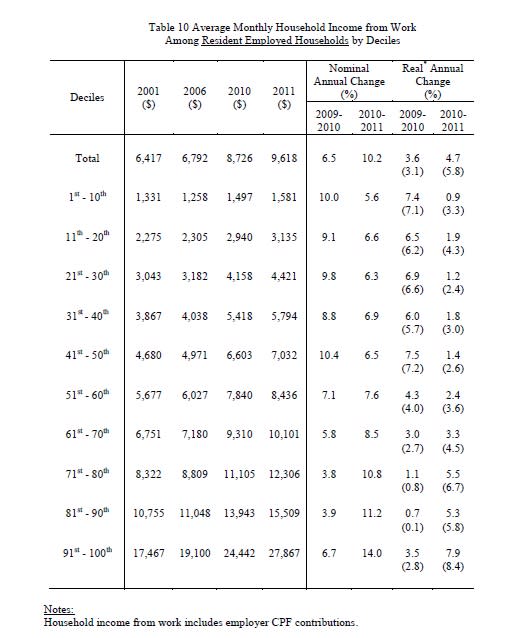

Also, according to the report, the rise in average monthly household income per household member was the sharpest for the lowest-income resident household group at 5.8 per cent in real terms over the one-year period.

Meanwhile, the median monthly household income from work rose by 11 per cent to S$7,040 last year from S$6,340 the year before. After adjusting for inflation, the increase was 5.6 per cent.

Impact of policies

When asked on the figures of the household incomes, particularly of the lower income earners, Manu Bhaskaran, adjunct senior research fellow at Institute of Policy Studies (IPS), said that the only way to look at the issue is to look at it with a long-term perspective.

"It's not just the bottom 20 per cent of the population which have seen too little progress [in income growth], but even up to the bottom 60 per cent, the growth in real income has significantly lagged [in terms of] overall GDP growth".

However, Chua Hak Bin, director of global research at Bank of America Merill Lynch thinks that "the government's effort to help poorer households via workfare and special transfers is reducing income inequality. Tighter foreign worker policy is [also] leading to higher wages across all segments".

Chua also noted that household income grew far higher over the past five years (2006 to 2011) compared to the previous five years (2001 to 2006), when wages had largely stagnated. He attributed this change to a shift in government policies from companies to workers.

Bhaskaran acknowledged that, in recent years, the government has started to recognise the problem of income inequality and stagnant median wages.

"The introduction and expansion of the Workfare Income Supplement was a major move forward. Since the May 2011 elections, the government has indicated a willingness to go beyond its current policies and expand the measures to reduce inequality. I expect that there will be many more new measures taken by government in coming years," he said.

Households and the Budget

The Department of Statistics also said in its report that the profile of households remained relatively stable.

The number of resident households was relatively unchanged at 1.15 million in 2011 as compared to the previous year. The average household size has also remained stable at 3.5 person since 2006.

The distribution of resident households by type of dwelling also remained steady, with the HDB four-room flats being the most common type of dwelling.

However, the proportion of resident households with at least one working person increased to 91 per cent last year from 90 per cent the previous year.

When asked on what changes the Budget announcement on Friday will bring, Chua said: "We expect the upcoming Budget to maintain the tight foreign worker policy stance, increase employer CPF contributions -- especially for the elderly -- and expand the social safety net for the lower income households."

However, over the past few years, there have been more negative than positive policy surprises for companies as the government transforms and restructures towards the economy become more productivity-driven and inclusive.

He expects the upcoming Budget to focus on three broad themes -- (1) the shift toward productivity-driven (from population-driven) growth (2) greater differentiation on privileges and rights of Singaporeans, residents and foreigners and (3) greater attention and financial support for lower-income and middle class households.

Yahoo Finance

Yahoo Finance