Forex: Euro Slips on Italian Election Polls, Fitch Warning on Spain

ASIA/EUROPE FOREX NEWS WRAP

Political headlines out of the Euro-zone are beginning to heat back up, putting further downside pressure on the Euro. Needless to say, the implicit endless support of the ECB’s balance sheet assuaged fears among bond holders, which has helped push Italian and Spanish borrowing costs to their lowest levels in two years. While the lower yields have bought the Italian and Spanish government time, one major problem that both countries to face is worsening structural unemployment. Like in the case of Greece, social unrest is rooted in diminished standards of living, declining purchasing power, and lower incomes. And after months of smooth sailing, these concerns have finally reignited with current governments nearing the point of collapse/turnover.

In Italy, opinion polls show that Silvio Berlusconi, the former Italian Prime Minister who helped drive Italy to the brink of economic destruction, has narrowed the gap with Pier Luigi Bersani, the front-runner to continue Mario Monti’s reform path, within the +/-4% margin of error. This is a significant swing in perception regarding the Italian elections, which were dismissed by many as a non-event; the same polling agency had Mr. Berlusconi trailing Mr. Bersani by -14% on January 2. The elections are slated for February 24.

With respect to Spain, Fitch Ratings’ Managing Director Ed Parker warned that “there is still a large budget deficit that will take several more years of austerity to close, to stabilize and then reduce government debt from high levels…the crisis won’t be over until we see a sustained economic recovery, which is crucial in terms of helping to reduce government debt ratios, easing problems of bank asset quality and in terms of the political situation.”

Taking a look at European credit, peripheral yields have eased further, although they’ve done little to help the Euro. The Italian 2-year note yield has decreased to 1.585% (-2.8-bps) while the Spanish 2-year note yield has decreased to 2.683% (-5.4-bps). Likewise, the Italian 10-year note yield has increased to 4.455% (+0.7-bps) while the Spanish 10-year note yield has decreased to 5.317% (-2.9-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:50 GMT

GBP: +0.01%

JPY: -0.04%

CAD: -0.22%

EUR:-0.40%

NZD:-0.43%

CHF:-0.58%

AUD:-0.75%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.32% (+1.17 % past 5-days)

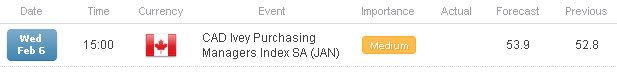

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

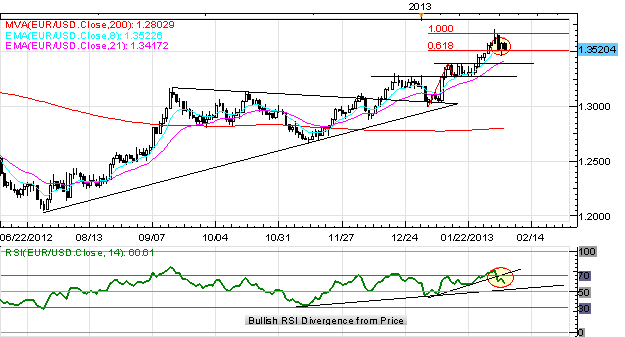

EURUSD: No change: “Consolidation occurring after overshoot towards 1.3700; with the daily RSI uptrend breaking, a pullback towards 1.3500 should not be ruled out. I maintain: with the daily RSI well into overbought territory, a pullback would be deemed healthy. Dips into 1.3500 are deemed constructive. Support is 1.3615/20 (weekly R2), 1.3540 (weekly R1), and 1.3500. Resistance is 1.3635/60 and 1.3755/85 (weekly R3, monthly R1).”

USDJPY: No change: “Further bullish price action as US Treasury yields strengthen and speculation over BoJ policy arises again. Resistance comes in at 92.00/05 (breaking now) (weekly R1), 93.15/20 (weekly R2), and 93.45/50 (monthly R3). Support comes in at 91.00 and 90.00/10 (weekly pivot, monthly R2).”

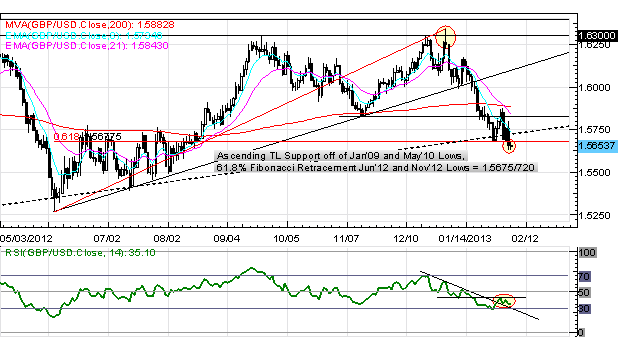

GBPUSD: The pair is holding below the 61.8% Fibonacci retracement from the June low to January high, vindicating the “cover on dips, sell rallies” perspective. I continue to look to sell rallies in the pair as significant RSI divergence exists. A hold below 1.5675 eyes a move towards 1.5500, and ultimately, 1.5265/70, the June low. Resistance comes in at 1.5825 and 1.5885/90. Support is 1.5675 and 1.5580 (monthly S1).

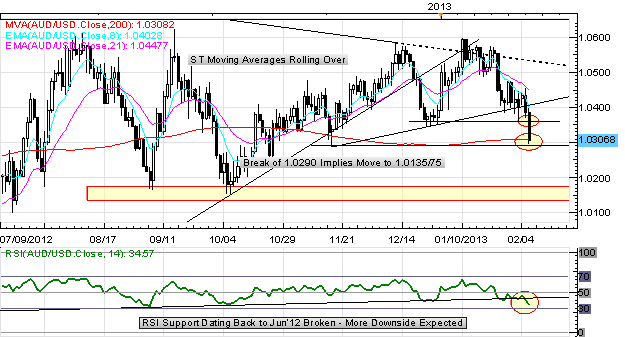

AUDUSD:A break below 1.0360 has given way to a move into the November swing low and 200-DMA at 1.0285/310, which could prove to be an area to look for a bounce. However, the daily RSI support dating back to June 2012 is breaking, suggesting that further downside should be sought. Resistance comes in at 1.0360 and 1.0425. Support is 1.0290 and 1.0150.

S&P 500: Tuesday I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1512/15; the December 2007 highs of 1520/24 could be reached on an overshoot. Bottom line: I’m expecting a crash in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

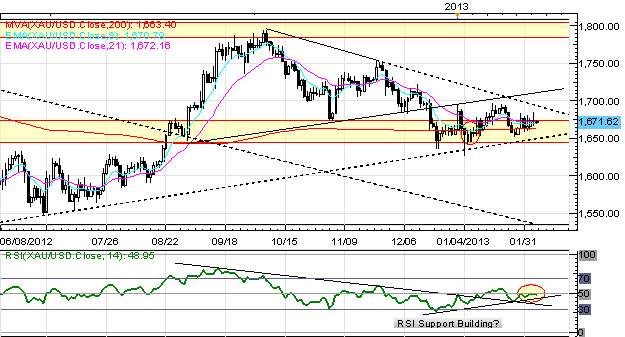

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance